With a new chief executive taking the helm at e-commerce giant Amazon later this year, future changes at the company are likely to have ripple effects across the luxury and retail industries.

With a new chief executive taking the helm at e-commerce giant Amazon later this year, future changes at the company are likely to have ripple effects across the luxury and retail industries.

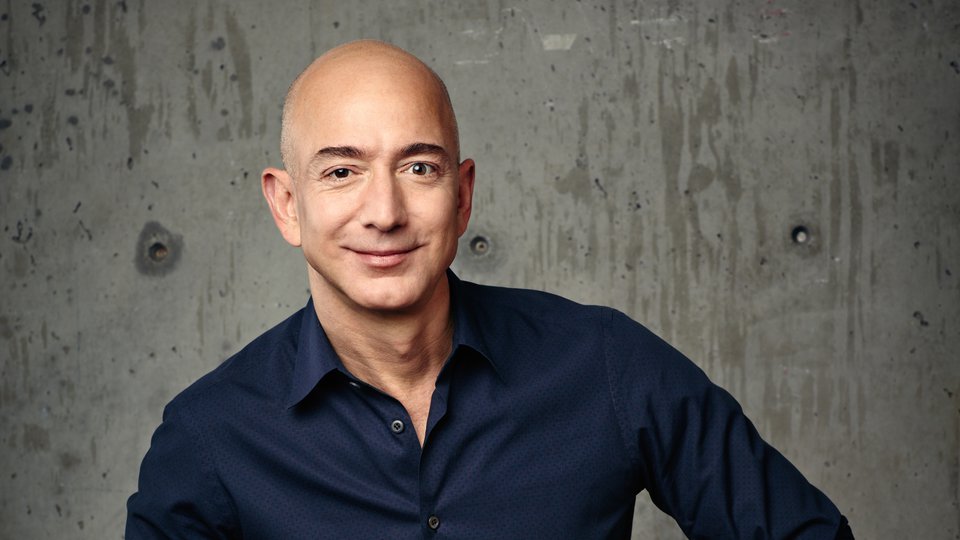

Last week, Amazon founder Jeff Bezos announced his decision to step down as CEO in the third quarter of this year, with Andy Jassy, the current CEO of Amazon Web Services revealed as his replacement. The move has been hailed by retail experts as an indication that the company may focus on further building out its cloud services, despite an outsised presence in e-commerce ranging from Luxury Stores to Prime Wardrobe and Style by Alexa.

“We all agree that Amazon has the most powerful search and recommendation engine out there, but the customer journey and buying experience is still not meant to fulfil a luxury buyer’s expectation,” said Mathieu Champigny, CEO of content agency Industrial Color, New York. “Amazon still has a long way to go to provide luxury brands with options they can embrace."

“In the meantime, brands will keep increasing content production dedicated to e-commerce, for their own e-commerce websites and third-party marketplaces,” he said. “A partnership between luxury brands and Amazon would go a long way to make sure Amazon develops the right platform for these brands, but the question is: are brands ready to share their knowledge of the space and open that door?”

Amazon and luxury

While Amazon is best known for its online marketplace, Amazon Web Services (AWS) is one of the world’s most popular cloud computing services, and is relied on by international corporations, major publications and government agencies.

Jassy, Amazon’s incoming CEO, has been at the company since 1997 and was involved with the development of AWS starting in 2003. He was named CEO of AWS in 2016. According to TechCrunch, AWS was developed out of the company’s desire to help third-party merchants to create their own shopping sites.

In the years since, Amazon’s dominance and the importance of e-commerce have only grown. The COVID-19 pandemic, which shuttered boutiques for months on end, further underscored the value of selling luxury goods online.

“With fewer IRL touch points to build the brand and maintain their elasticity, brands need to think about how they can create online experiences that are additive,” said Melissa Jackson Parsey, chief strategy officer at B-Reel, New York. “There’s clearly an imperative for brands to invest in experiences that are as distinct as their brand and in tune with luxury customer expectations — providing high tech, high touch interactions.”

Amazon has spent many years courting luxury brands, but the platform has failed to provide a high-end ecommerce experience despite its wealth of technological resources. Counterfeit goods and an outdated user experience have also been concerns for high-end brands.

“The overarching issue is that the whole proposition of Amazon is at its core antithetical to luxury,” Jackson Parsey said. “Convenience, price competitiveness and being able to shop around doesn’t support brand elasticity.”

Amazon’s most recent push to engage high-end brands is Luxury Stores, which launched last fall.

Luxury Stores is currently available by invitation-only to select Prime subscribers in the US. The new e-commerce destination allows luxury brands, including Oscar de la Renta, La Mer and Elie Saab, to leverage Amazon’s vast reach of customers and technological capabilities.

For instance, in-app shoppers can use Amazon’s “View in 360” technology to see a full-circle view of a garment’s details and better visualise fit. The online retailer already uses augmented reality features for millions of products, allowing consumers to digitally see how particular items fit into their homes.

“Currently, Amazon has all the substance to host luxury brands, however with an absence of style,” said Alasdair Lennox, group executive creative director of experience, Americas at Landor & Fitch, New York.

“While Amazon’s luxury fashion portal is high on the logic of convenience and logistics, it's low on the magic of theatre, drama and illusion,” he said. “When you are buying into the luxury world, the detail on the sole of a shoe, the clasp of a belt or the shape of a bag reflects the discerning, educated and affluent consumer you are.”

While more brands such as Mark Cross and Car Shoes have joined Luxury Stores since its launch, Amazon will have to continue to invest in the platform if it wants to continue attracting luxury brands during Jassy’s tenure.

“The fear of diluting the brand image or reducing the luxury appeal of a brand is still real, and that has been the biggest challenge for Amazon to build and expand its luxury business,” Champigny said. “Most, if not all, luxury brands will get there eventually if Amazon manages to improve the buyer’s experience and the ability for brands to build a unique customer journey on their platform.

“We can predict it will take years though,” he said.

Luxury opportunities

Even if Amazon continues to pour resources into Luxury Stores, luxury brands should continue building and improving their own e-commerce platforms. Specialty online retailers including Net-A-Porter, Matchesfashion and Farfetch are also part of the puzzle.

“Luxury brands seem to favour this approach, which will provide some high touch to the customer, and some protection for the brands,” said Champigny. “These e-commerce platforms offer some technology solutions while allowing labels to create a real customised customer experience via branded content.”

Last fall, it was announced that Farfetch is teaming with Chinese e-commerce giant Alibaba and Swiss luxury group Richemont with the hopes of expanding its global reach, particularly in the world’s largest luxury market.

Alibaba and Richemont each plan to invest $1.1 billion in London-based Farfetch, which will be launching on Alibaba platforms including Tmall Luxury Pavilion. The partnership will also further strengthen the e-commerce credentials of Richemont, which already owns online retailer Net-A-Porter.

While multibrand high-end retailers offer a range of benefits to luxury brands, there are also drawbacks.

“A number of organisations grew their online presence by co-opting others’ infrastructure and reach,” said Jackson Parsey. “With more consumers shopping online, brands realise they are also losing direct connection with customers and the relationships that sustained them.”

Additionally, the importance of owned e-commerce platforms will grow as changing consumer data and privacy regulations will impact the value of third-party data.

Technology giant Apple is expected to empower consumers to block identifiers for advertisers (IDFA) in the coming weeks, resulting in all mobile apps listed in the Apple Store, including Amazon, needing to request user permission to collect third-party information.

With marketers facing limitations on data insights from third-party apps and platforms, this is an opportunity for brands to reevaluate their use of other channels.

Owned e-commerce sites allow brands to build first-party data, particularly when synchronised with a customer relationship management platform.

“When a luxury brand develops their own platform, they become masters of their own destiny,” said Lennox. “They curate and change the look and feel at will, they can easily add and trial new products.

“However, brands need the backend infrastructure to support with logistics, studios, programmers and designers,” he said. “For big groups like LVMH and Kering, it makes sense to do it all.

“For smaller up-and-coming designers, it’s a huge investment and that’s where Farfetch and Net-A-Porter become a necessary stepping stone to a much larger audience.”

This article has been republished with permission from Luxury Daily. Adapted for clarity and style.

Cover Image: Amazon Founder Jeff Bezos. Photo: Courtesy.