The newly released WeChat Luxury Index examines how high-end and luxury brands achieve marketing or business objectives on WeChat. The report also showcases a ranking of these brands, evaluating whether their offerings and services on WeChat are developed enough to meet the sophisticated demands of today’s consumers.

In 2012, WeChat launched the Official Account feature. This instant messaging app, which had been established for just a year, offered brands in China a new platform for online marketing. In November of that same year, Louis Vuitton became the first brand to launch an Official Account in China, marking WeChat’s entry into the social landscape and establishing it as a key private domain and communication channel for the luxury industry.

But WeChat did not stop there. With the introduction of functionalities such as WeChat Pay, Mini Programs, and Search, it has evolved into an essential all-in-one application in the Chinese market, with few counterparts. It now covers nearly every aspect of daily life, including shopping, entertainment, media, messaging, and more.

In 2018, DLG launched the first WeChat Luxury Index, which helped brands evaluate their performance within the WeChat ecosystem (particularly on the Official Accounts) in terms of recruitment, retention, and optimisation while benchmarking against industry standards.

Today, WeChat remains a critical component of brand digital marketing strategies in China. Even with the emergence of platforms like REDnote and Tmall, which attract more attention at certain stages of the consumer journey, WeChat remains the only platform in China capable of covering the entire consumer journey comprehensively.

In the newly revamped WeChat Luxury Index, the report focuses on the digital assets of over 150 high-end and luxury brands within the WeChat ecosystem, including Official Accounts, Mini Programs, Channels, Search, WeCom, and media buys. It explores how these features help brands achieve marketing goals at various stages of the consumer journey. Through industry benchmarks and case studies, this report will assist brands in identifying gaps and providing strategic recommendations.

Challenges in Content Strategy

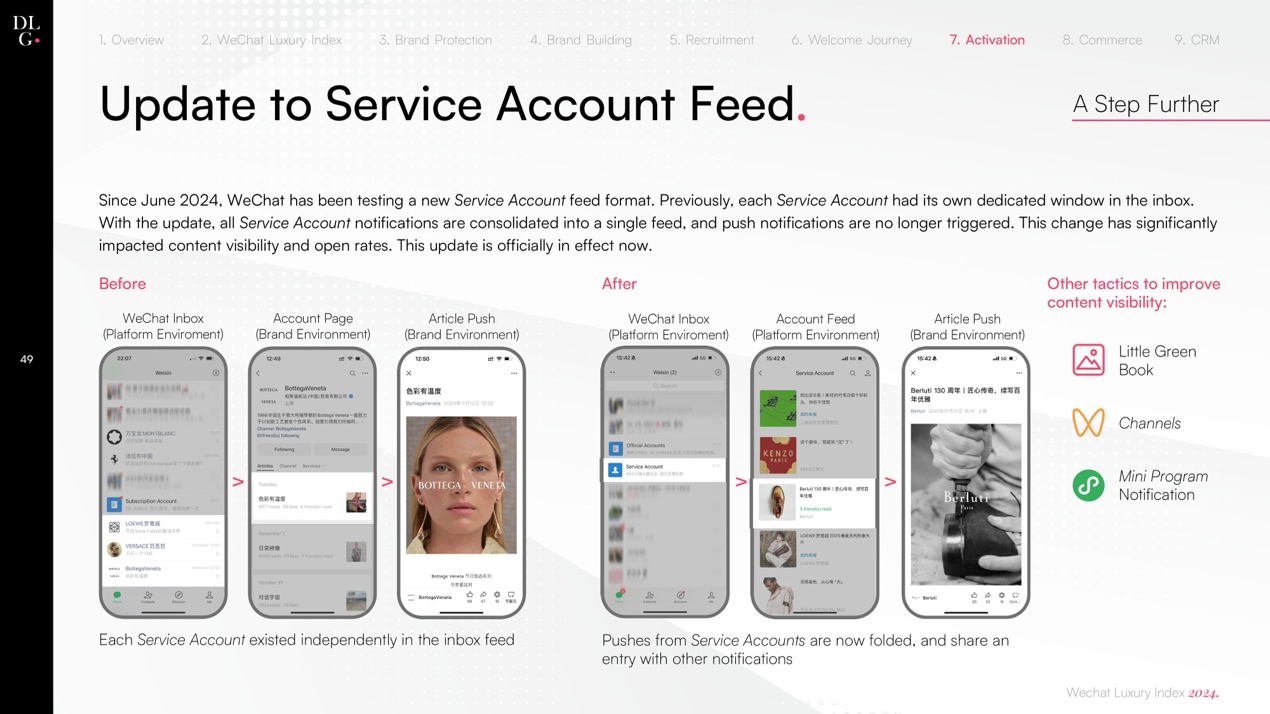

Among the brand samples, 99% of them operate their WeChat business through a Service Account. Previously, Service Account messages could be pushed directly to users’ WeChat homepages. However, in an update rolled out in late 2024, all pushes from Service Accounts are now folded, directly impacting readership and engagement levels. According to Re-Hub, total engagements of luxury brands’ accounts have declined by 8.3% in 2024 compared to 2023.

However, the Service Account is no longer the only content activation method available. Channels – an in-platform video feed similar to TikTok – helps brands reach a broader audience through videos and livestreaming, rather than just their followers. In the sample, 94% of brands have activated their Channel account.

Additionally, Mini Programs now can also activate a brand’s private domain via push notifications. These alerts can be related to key brand milestones (such as new product launches or event notifications) or custom reminders based on user behaviour, such as when a user is ready to check out items in their cart. 46% of brands now require consent for future notifications within their Mini Programs.

DTC Ambitions

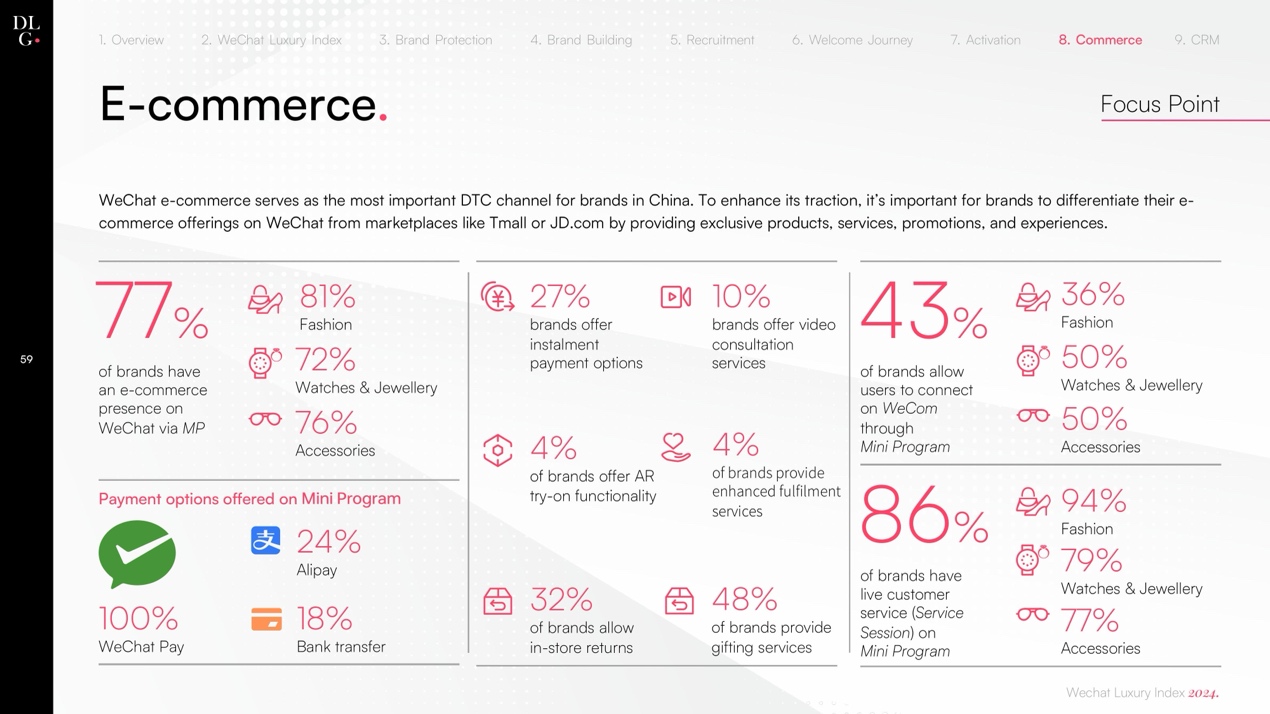

Within the Chinese market, WeChat is seen by luxury brands as the most important direct-to-consumer (DTC) channel (a role typically filled by brand websites in Western markets). Compared to online marketplaces, brands have greater control over pricing, promotions, and marketing milestones through WeChat Mini Programs. 77% of sampled brands are running e-commerce through Mini Programs.

Brands like Louis Vuitton and Dior only offer e-commerce on their WeChat Mini Programs and official websites, using exclusivity to secure revenue for DTC channels. However, for most brands, the majority of online sales still flow through Tmall and JD.com. To drive Mini Program e-commerce success, brands need to differentiate through unique products, experiences, and services.

However, many value-added functions offered by Mini Programs—such as AR try-ons and personalisation services—are also available on platforms like Tmall. For example, only 27% of brands on WeChat offer instalment payment options, while almost all Tmall merchants support Alipay instalments.

Nevertheless, some brands have attracted customers by offering differentiated products. For example, certain luxury jewellery and watch brands use WeChat to showcase ultra-luxury items. While these products are not available for online purchase, interested potential customers can communicate with the brand via online customer service or WeCom. This approach is seen as an effective way to identify high-potential prospects.

The Centralised Private Domain

China’s Personal Information Protection Law (PIPL) imposes strict regulations on cross-border data transmission, making it essential for brands to build robust local CRM systems to store, manage, and utilise consumer data within China. WeChat offers an ideal platform for brands to build and optimise their private domains in this market.

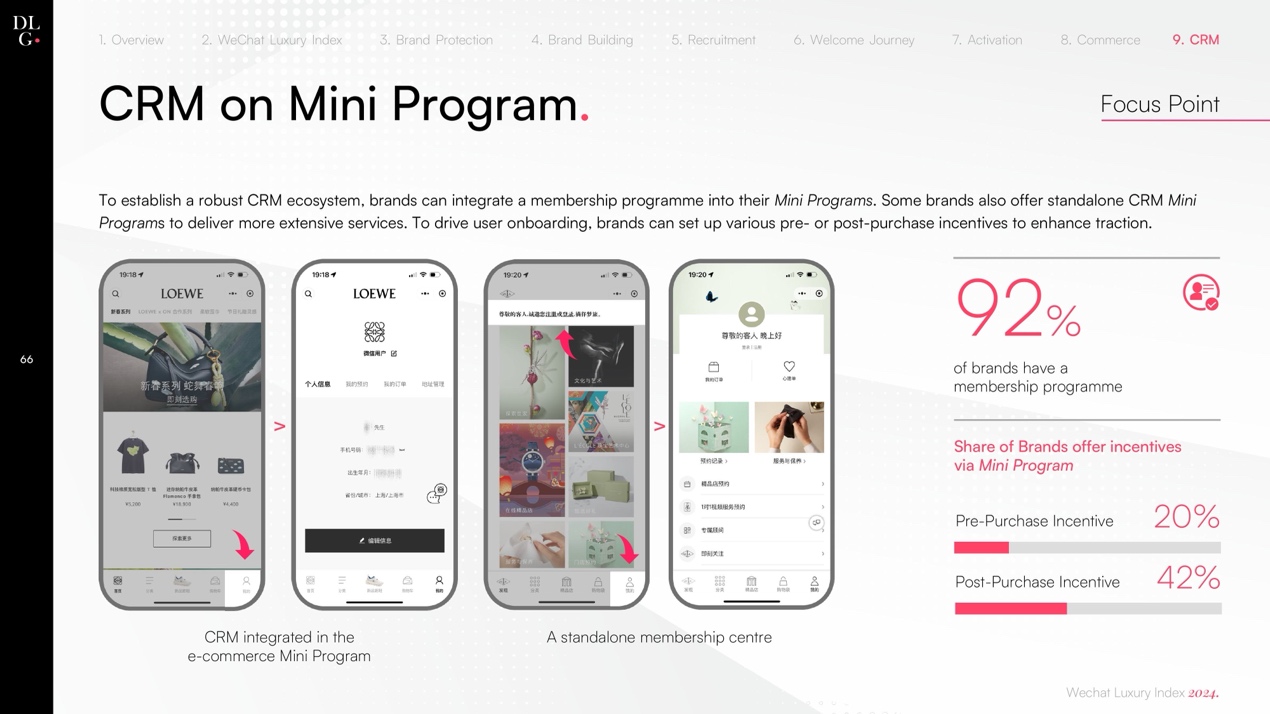

Currently, 92% of brands have established a membership programme via Mini Programs, though the sophistication of these programmes varies. A key difference between the WeChat membership ecosystem and traditional ones is that membership programme on WeChat is open not only to existing customers but also to prospects. For instance, A. Lange & Söhne’s membership centre offers extensive content about the brand and the watchmaking industry, allowing watchmaking enthusiasts to engage and develop a connection with the brand.

Furthermore, brands can establish effective customer journeys across Mini Programs, Official Accounts, and Brand Zone, allowing customers to connect with brand ambassadors via WeCom to push them further down the purchase funnel. 47% of brands allow consumers to connect with a brand ambassador’s WeCom within their WeChat ecosystem.

The All-new Index

To help brands better assess their WeChat business strengths and weaknesses, the report introduces a new index ranking system. This will assist brands in positioning their WeChat business across seven key dimensions: brand protection, brand building, recruitment, welcome journey, activation, commerce, and CRM.

For full access to the report or to receive a brand’s detailed WeChat Luxury Index score, along with a comprehensive diagnosis of the WeChat business, please visit this link.