The Luxury Maisons’ Tmall Imperative report release by DLG guides luxury brands in optimising their Tmall strategy amid China’s evolving luxury landscape.

China’s luxury market has outpaced Western markets significantly by establishing genuine B2C luxury online marketplaces, moving beyond traditional wholesale models.

In 2017, when luxury purchases online were still viewed sceptically due to potential impacts on brand image, Chinese tech giant Alibaba launched the Luxury Pavilion (now known as Tmall Luxury), a dedicated e-commerce platform specifically for luxury brands. Initially, 17 luxury brands joined.

Since then, particularly during the pandemic when physical store footfall sharply declined, e-commerce platforms have become crucial for brands to reconnect with existing customers and seamlessly attract new ones. However, as China’s luxury market normalises, online growth has encountered new challenges.

Tmall, still the largest online e-commerce channel for most luxury brands, is beginning to show signs of fatigue. To sustain growth, some brands have resorted to discounts and promotions, while others are exploring emerging platforms such as Douyin. But is this approach genuinely strategic?

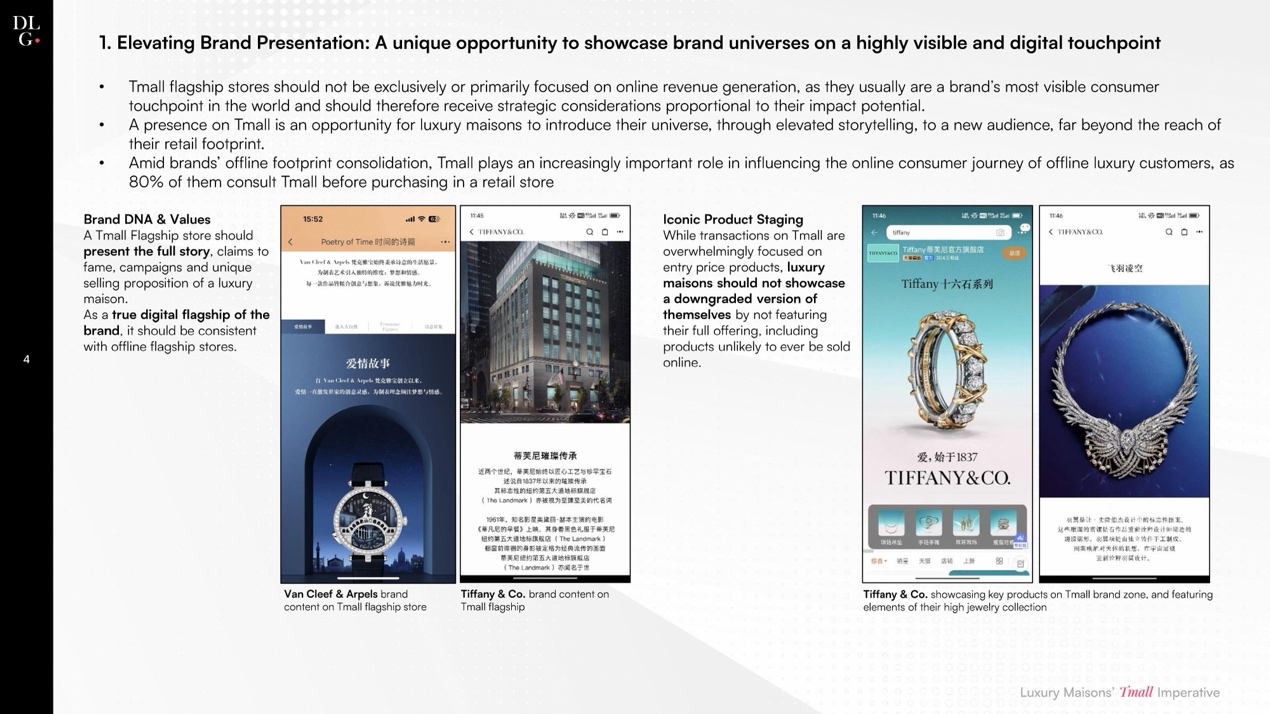

DLG’s latest report, Luxury Maisons’ Tmall Imperative, investigates how brands should reposition Tmall within their digital strategies. Tmall is not simply a sales channel—80% of consumers now consult Tmall before making offline luxury purchases. While brands adhere to traditional branding principles on social media and PR channels, they frequently overlook Tmall’s pivotal role in the consumer journey.

Maintaining an Elevated Image on Tmall

Major shopping festivals and local holidays in China typically account for 50-70% of a brand’s annual Tmall sales, making them critical strategic opportunities. Brands often introduce new products or leverage seasonal sales and platform-driven promotions (such as coupons) to stimulate demand.

However, heavy discounting during these events on Tmall can damage brand image, akin to placing a “sales rack” in China’s largest boutique window.

Luxury brands must ensure these activations align with their brand DNA and approach price-driven promotions cautiously. Tmall also offers valuable non-price promotion options, such as interest-free instalments and gifts with purchase (GWP), enabling brands to boost sales while preserving brand integrity.

Furthermore, brands should acknowledge Tmall’s influential role as a communication platform—its impact on top-of-funnel consumers rivals any local social media channel.

Tmall flagship stores provide much more than product listings. Brands can utilise extensive spaces like homepage features, Product Detail Pages (PDP), and interactive menus to showcase their brand universe through images, videos, and interactive experiences, ensuring brand consistency across touchpoints. For example, during Van Cleef & Arpels’ exhibition in Shanghai, users could book visits via Tmall, enriching brand storytelling without relying on conversion-driven initiatives.

Additionally, Tmall provides advanced tools to enhance consumer exploration and shopping experiences, such as 3D previews and personalisation features, helping brands offer innovative and immersive experiences that strengthen their presence.

Prioritising Tmall in the Strategic Mix

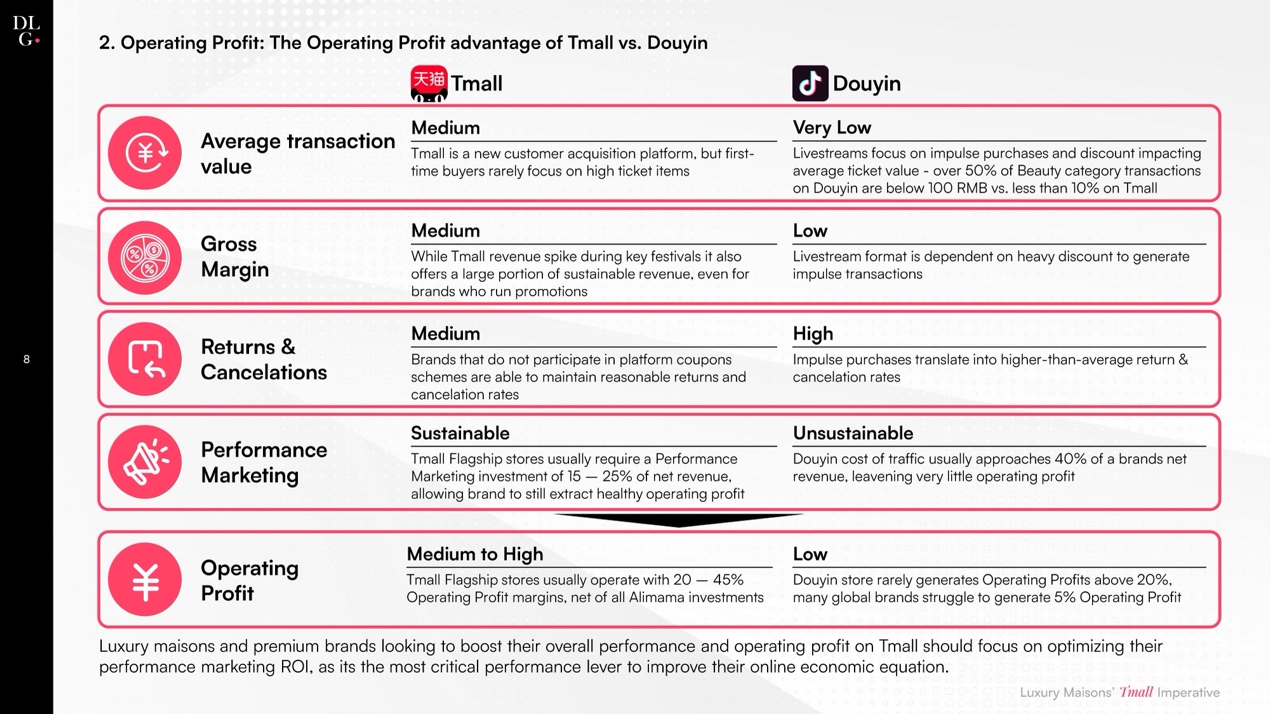

As traffic and revenue on Tmall normalise, brands—particularly beauty and premium fashion brands—are exploring emerging platforms like Douyin, which achieved a GMV of RMB 3.5 trillion in 2024, marking a 30% year-on-year growth. Should brands shift their primary focus away from Tmall?

Brands need to understand the fundamental differences between Tmall’s and Douyin’s operational models. Douyin’s revenue primarily depends on live-streaming (either managed by brands themselves or in partnership with KOLs) and content collaborations with numerous KOLs and KOCs, driving impulse purchases through short-form videos.

Therefore, stable revenue generation on Douyin demands substantial investment in live-streaming and influencer marketing, necessitating dedicated teams and vendor support. Purchases made via Douyin typically involve shorter decision cycles driven by impulse or promotional incentives.

These factors significantly influence profitability on Douyin. The report highlights that brands on Tmall can achieve profit margins between 20% and 40%, compared to Douyin’s margins typically ranging from -5% to 15%. Tmall provides luxury and premium brands with sustainable revenue streams and superior branding opportunities, a challenge on emerging platforms.

Tmall boasts one of China’s most developed e-commerce ecosystems, supported by mature tools from multiple vendors to optimise performance marketing on and off-platform. For example, consumer analytics tools like Deeplink precisely target brand advertising, significantly boosting revenue by 20-30% with minimal additional investment—a strategy frequently adopted by local brands but rarely utilised by global ones.

With the ongoing dismantling of China’s digital walled garden, brands can now integrate Tmall members with the WeChat ecosystem, significantly enhancing customer profiling capabilities. Currently, emerging platforms have yet to reach Tmall’s level of sophistication.

Given the significant shifts in China’s luxury consumption landscape, brands must reassess Tmall’s strategic role, fully harnessing its potential at various consumer journey touchpoints. By outlining key opportunities, requirements, and considerations, this report aims to support luxury and premium brands in optimising their presence, operations, and profitability on Tmall.

Click here to download the full report.