Have brands shifted their approach to China’s two major milestones – 520 and 618 – in the face of ongoing challenges? The newly released COMPASS Index report reveals who led the conversation and who fell behind during these key moments.

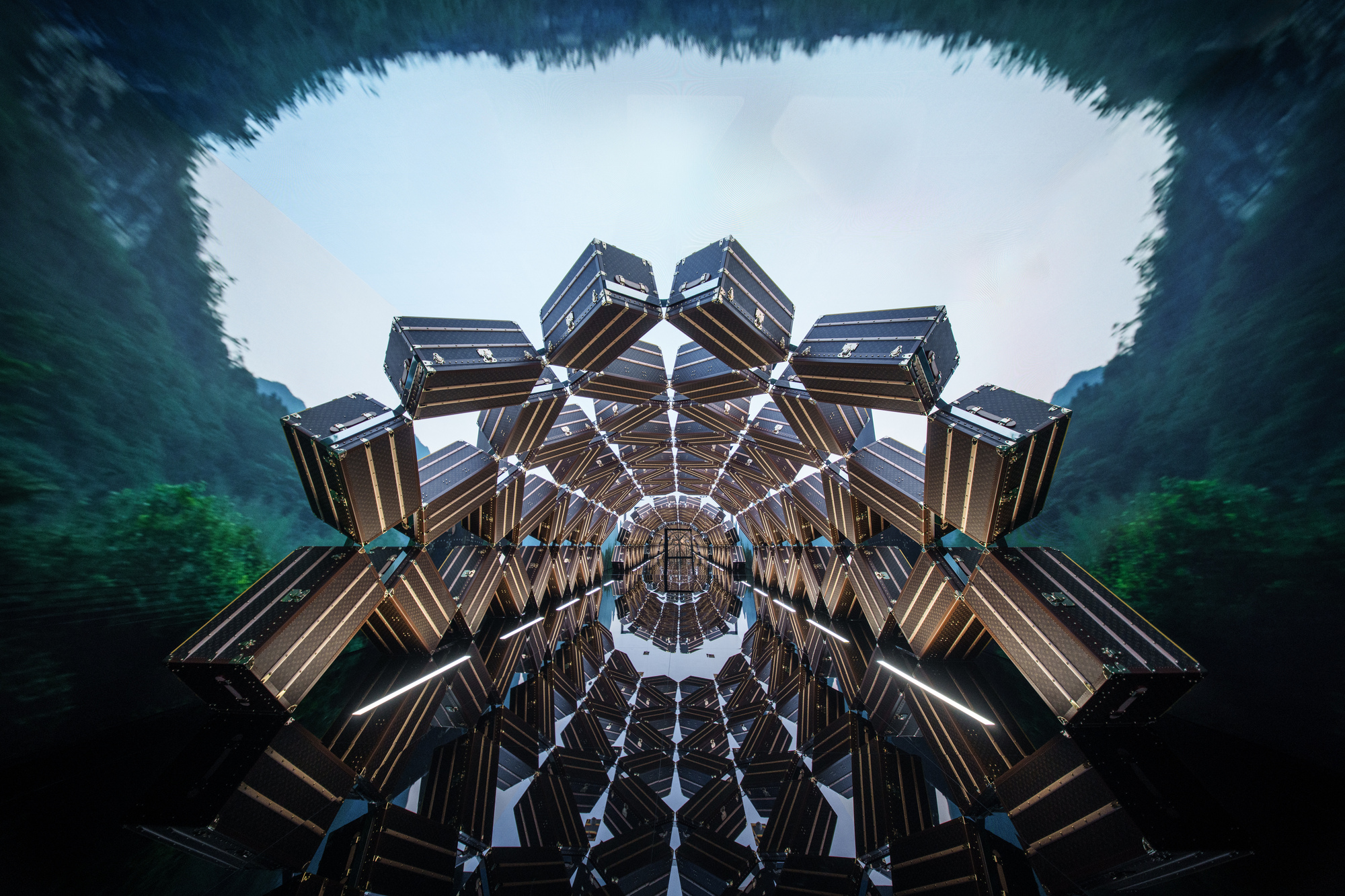

On a midsummer night in June, a striking new landmark emerged on Shanghai’s prestigious Nanjing West Road. “The Louis,” an architectural marvel wrapped in metallic Louis Vuitton Monogram, made its debut in the heart of this luxury shopping district. Evoking memories of 19th-century transoceanic voyages and Shanghai’s rich maritime legacy, the installation is more than just a retail space—it combines boutique shopping, Le Café Louis Vuitton, and the Visionary Journeys exhibition into one cohesive cultural experience.

Attracting over 100,000 visitors on its opening day, The Louis is poised to become both a destination for tourists and a cultural icon for Shanghai locals. It is also a bold testament to Louis Vuitton’s long-term commitment to the Chinese market. This level of investment might appear counterintuitive following a difficult 2024, especially as Asia (excluding Japan) was the only region to report a decline in revenue of the previous year—largely due to cautious Chinese consumers. Yet, LVMH Chairman Bernard Arnault reminded investors at the beginning of the year, “What matters most is that in 10 years, our brands are as desirable as they are today. Profit is a consequence of what we do well; it should never become a goal.”

BUILDING DESIRE BEYOND COMMERCE

The Louis is a clear demonstration of LVMH’s long-termist mindset, rooted in cultural relevance, emotional connection, and immersive experience. Louis Vuitton isn’t alone: top brands including Audemars Piguet, Loro Piana, and Hermès are also investing in non-commercial activations to maintain their resonance with Chinese consumers.

Credit: Courtesy of Louis Vuitton

As brands search for the light at the end of the tunnel, the leaders are rethinking how they stay top-of-mind in a challenging environment. The second quarter is especially significant in China, marked by two major commercial festivals: 520 (China’s Internet Valentine’s Day) and 618 (E-commerce Shopping Festival). These events provide a timely barometer for brand performance and consumer sentiment.

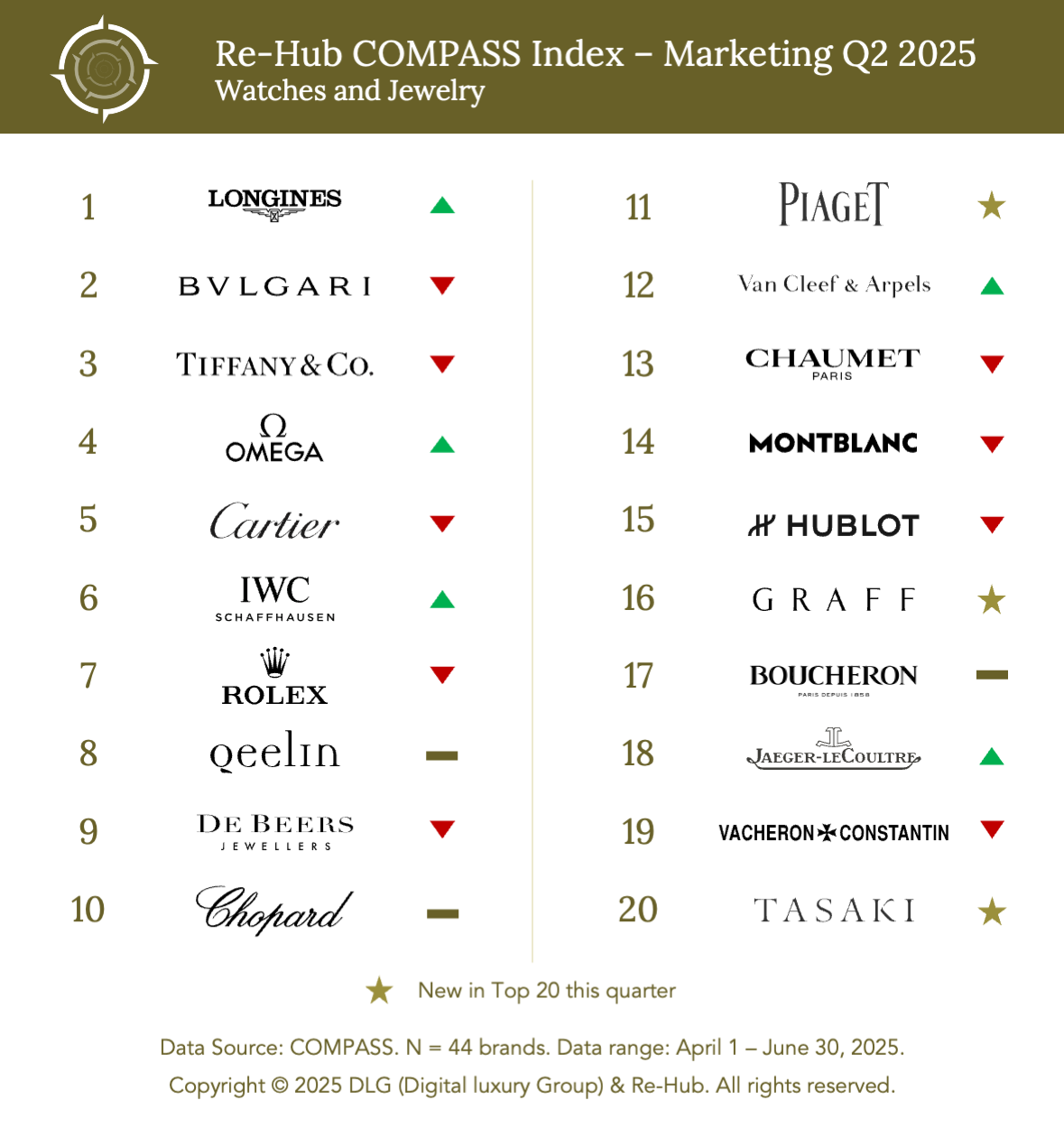

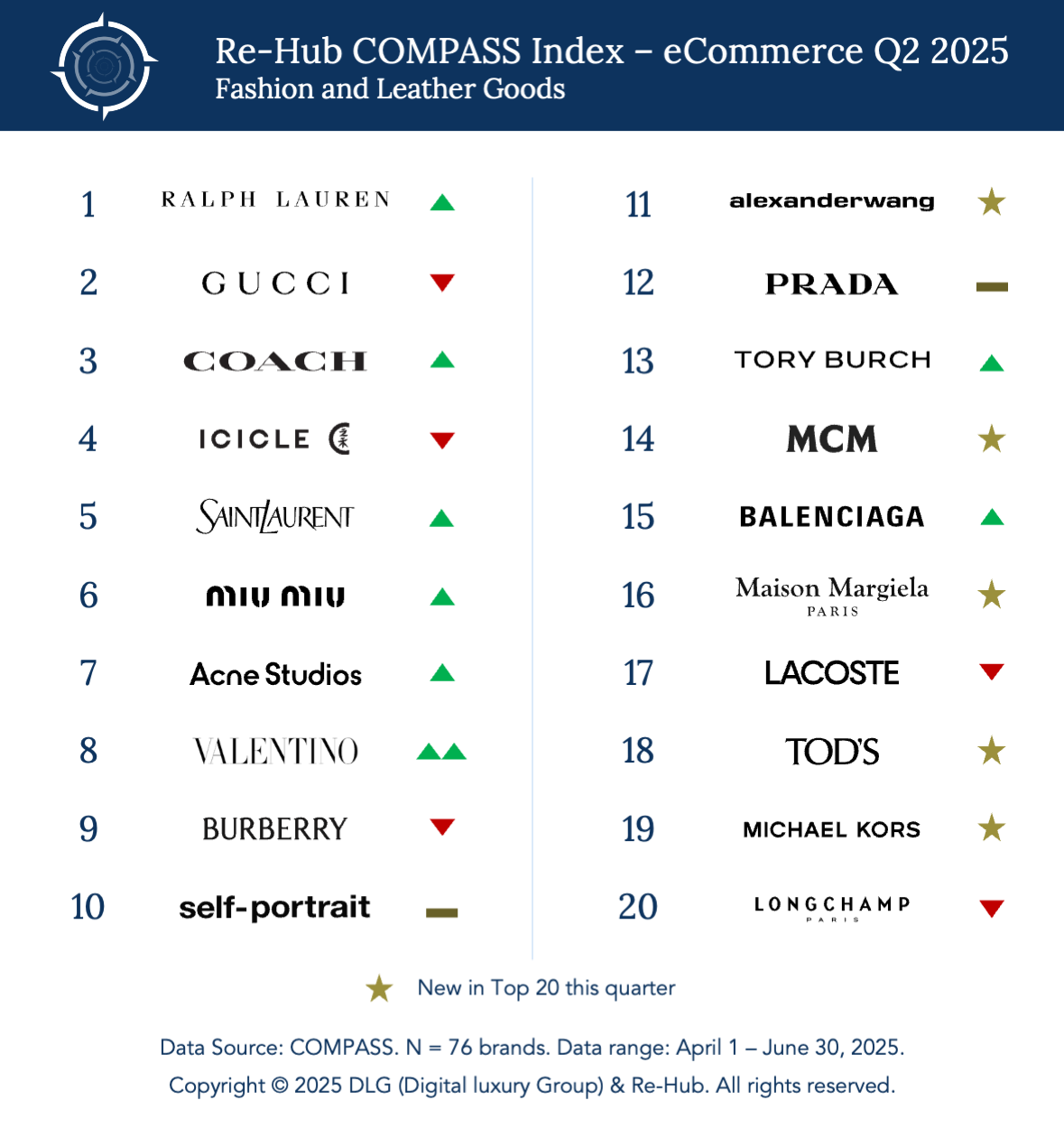

To track these shifts, the newly released COMPASS Index Q2 2025 by Re-Hub and DLG (Digital Luxury Group) analyses the marketing and e-commerce performance of over 100 luxury brands. Who led the conversation, and who fell behind during these key moments?

OWN YOUR NARRATIVE

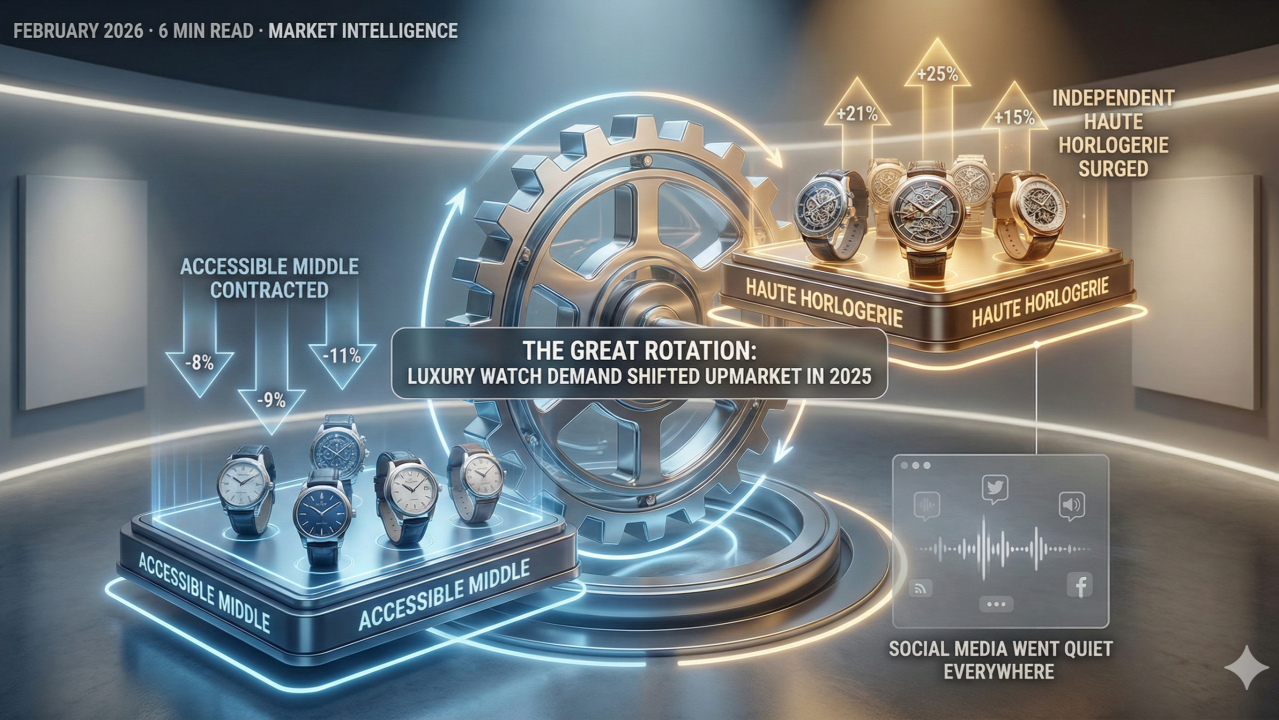

From a social media standpoint, the overall picture was muted. Engagement levels on brand-owned channels and UGC mentions showed less sign of year-on-year growth in Q2. In fact, most metrics declined. For example, Weibo—which is often driven by celebrity amplification—saw its engagement plummet by 40.8% this quarter, continuing a three-quarter downward trend. UGC volume on RedNote, a more accurate barometer of organic brand heat, also declined for the third consecutive quarter.

This slump reflects brands’ increasingly cautious marketing approach: smaller content budgets, fewer events, and a greater focus on conversion-driven social content. However, standout activations like “The Louis”, Miu Miu’s Literary Club, and Van Cleef & Arpels’ Perlée pop-ups show that some brands are actively rewriting the playbook to generate long-term desirability.

Credit: Courtesy

Take 520, for instance. Once a prime opportunity for romantic campaigns, this year’s top performers on the COMPASS Marketing Index largely moved away from formulaic themes. Coach appointed young Chinese singer Liu Yu as a fragrance ambassador just before 520, generating massive engagement and propelling the brand from 18th to 6th place. Ultra-luxury jeweller Graff also attracted attention, launching a series of initiatives around the date, including a new Beijing boutique opening and a 50th anniversary celebration of its Butterfly collection. Hermès, meanwhile, replicated its “Hermès in the Making” exhibition in Shenzhen, drawing significant buzz on RedNote for its craftsmanship and immersive brand storytelling.

Credit: DLG (Digital Luxury Group) & Re-Hub

These cases reflect a growing realisation: while consumer fatigue with repetitive, seasonal content is real, these festivals remain crucial communication moments. Brands looking to cut through the noise are learning to take ownership of the narrative—whether or not the activation aligns directly with the festive theme.

E-COMMERCE ON THE REBOUND

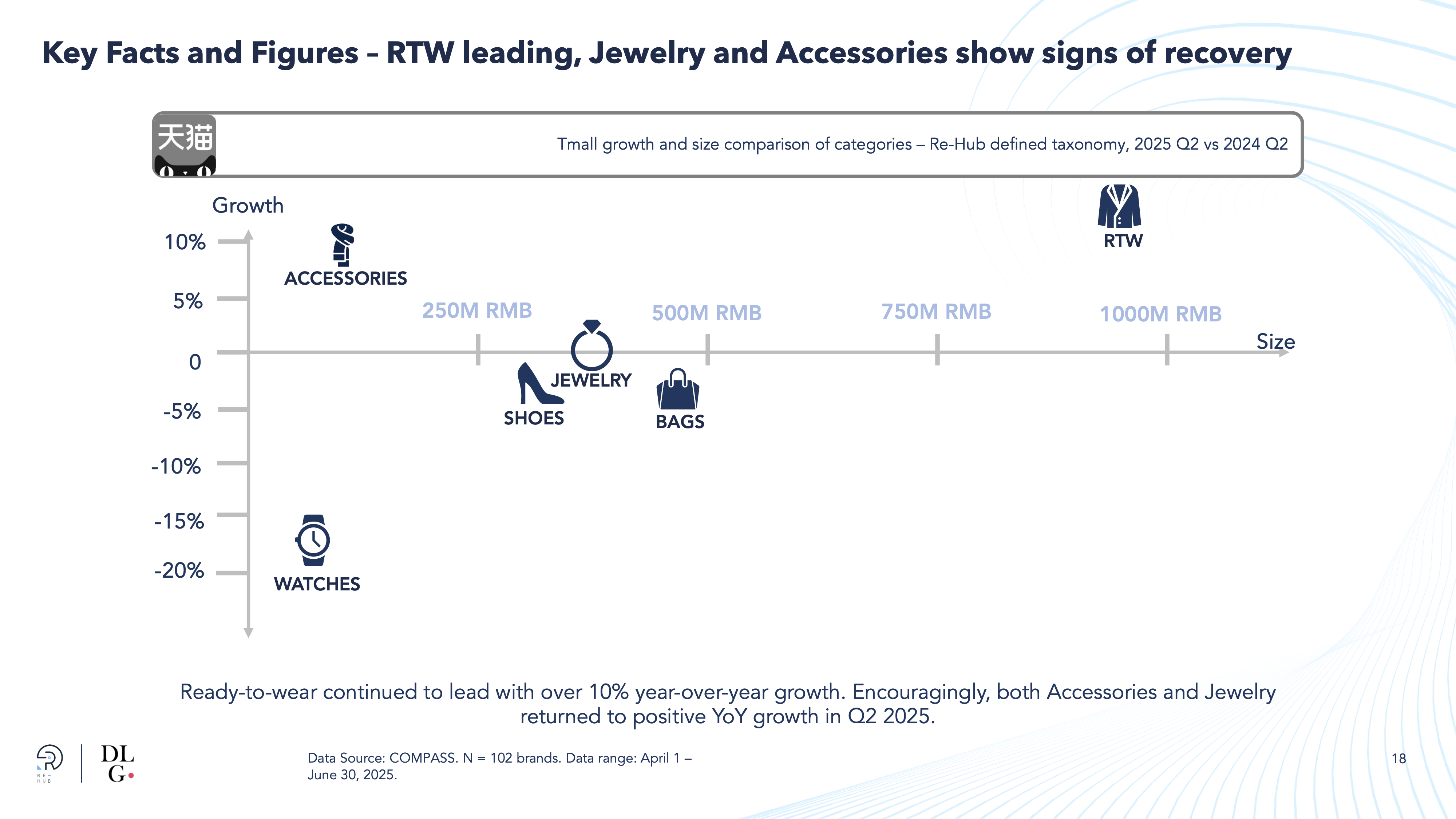

Compared to the social space, Q2 e-commerce performance painted a more optimistic picture. This year’s 618 was the longest in history, running from 13 May to 18 June—a full 37 days on Tmall. For many brands, this extended shopping period boosted performance, especially those able to stimulate short-term demand via promotions.

Ready-to-wear led the way, with sales up 10% YoY, largely driven by discounted products. Jewellery and Accessories also returned to growth, posting 1% and 7% increases respectively.

Credit: DLG (Digital Luxury Group) & Re-Hub

But the lengthened 618 comes with trade-offs. While premium brands benefit from waves of promotions as a tool for inventory management and revenue uplift, the flood of discounts risks overshadowing non-promotional events. For instance, 520—a gifting holiday traditionally untouched by price reductions—was partially cannibalised by overlapping sales campaigns.

This tension is visible in the COMPASS E-commerce Index, where brands like Acne Studios, Maison Margiela, and Alexander Wang achieved double-digit growth on Tmall thanks to discounts.

Credit: DLG (Digital Luxury Group) & Re-Hub

SHOULD WE EXPECT A BETTER H2?

Given the low base from H2 2024, analysts expect flat organic growth of the industry for the second half of 2025, though it remains too early to call it a full recovery.

In response to complex market dynamics and wavering consumer confidence, some brands are pulling back on investment and leaning into short-term revenue boosts to protect margins. But others remain firmly committed to China, actively optimising their retail networks, marketing activations, and product assortments.

This divergence is sharpening the polarisation of the luxury landscape. According to the latest Bain & Altagamma report, the performance gap between leaders and laggards—measured by relative revenue growth—has widened to 1.5 times the spread seen in Q1 2024.

“Brands can no longer afford passive optimism – this is a moment for decisive action,” says Max Peiro, CEO of Re-Hub. “Growth will not return equally: those who win now are recalibrating strategies, tightening portfolio discipline, and converting brand equity into measurable business outcomes.”

To explore the full rankings and deep dives on how brands fared during China’s Q2 milestones, download the full COMPASS Index Q2 2025 report below.

Cover image courtesy of Louis Vuitton.