Paurav Shukla, Senior Lecturer at the Brighton Business School, urges brands to think outside the diversification square, when looking for market share

“ often growth through brand extension looks very lucrative but quickly becomes a bottleneck for smaller luxury brands ”

In the case of smaller and boutique luxury brands, due to financial and marketing resource limitations, the idea of brand extension often appears lucrative but can become a bottleneck very quickly. Like in the case of Anna Sui, when the brand partnered with Mattel in 2005, to create Barbie-themed clothing and accessories and interpret Barbie’s wardrobe for grownups, the extension was a disaster that effected the image of the involved designers for much longer than the product was on the shelves.

Another example can be found in Audi’s entrance into the US market, where the brand still struggles to rise to success, because consumers remember sudden unintended acceleration issues and a series of product recalls associated with it nearly 3 decades ago.

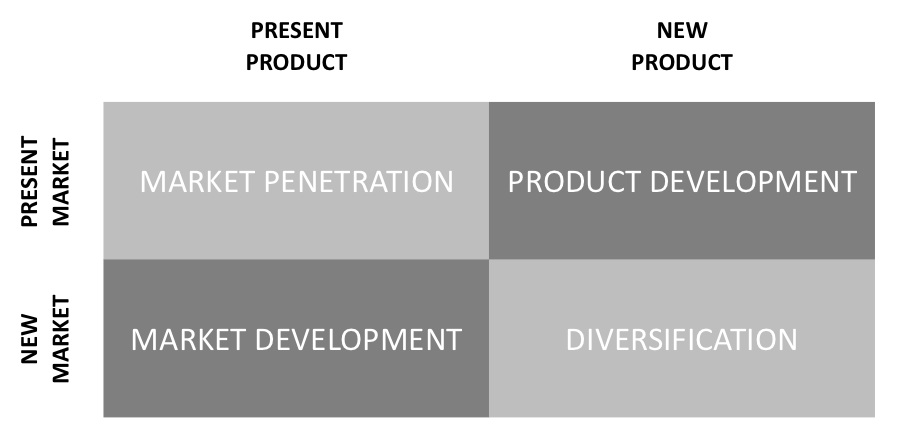

Luxury brand managers need to be cautious of brand extension and diversification, be it categorical or geographical. There are many other routes suggested by marketing experts, which can be taken into account. For example, Ansoff’s Product/Market matrix provides good few insights on what other options can be exploited without diversification.

The Ansoff model provides luxury brands alternative options for growth, when brand expansion may not be the most appropriate. Quadrant 1, where a company wishes to expand itself in a market it is already present, could focus on various ‘market penetration’ strategies by seeking to increase the frequency of product usage, increase the quantity consumed or identify new applications for the product. In the case of luxury brands, where usage can often be occasional, such strategies could lead to higher market share and stronger customer loyalty.

Quadrant 2 focuses on developing new products for the current markets, not in the form of diversification but instead looks at ‘product development’ strategies. In this case, luxury brands can focus on product improvements (highlight them in communications carefully) and line extensions (after careful market research).

“ brand extension and irrelevant diversification is particularly delicate issue for luxury, with the strong origin and image associations brands have in consumer minds ”

Quadrant 3 focuses on ‘market development’ strategies. In this case, luxury brands could focus on geographic expansion or targeting new segments. For each of these options, specific strategic initiatives are required. In the case of geographic expansion, cultural proximity and market understanding are a must, and when targeting new segments, it would be desirable to identify peripheral groups which take the current luxury brand consumers as their aspirational leaders.

Whilst quadrant 4 highlights the potential of diversification, as the fourth of four options, it should be thought of somewhat as a last result. If growth has not been possible using the first three series of strategies, only then should a brand focus on extending themselves beyond their traditional mould – not focusing on such extension as a first option, as I have noticed in my research to be common.

My aim in this article is to explore and offer some alternatives for growth and branding, looking outside the sphere of diversification. Going back to basics can be helpful with any luxury branding effort and I hope it will ignite that thought in Luxury Society readers.