The landscape of social media has gone through some significant changes over the past few years: TikTok’s meteoric rise and X’s recent transformation have meant that brands have had to reassess their strategies and budget allocations. However, a new report from Launchmetrics and Lyst has found that Instagram remains the top platform for brand amplification.

When a brand thinks of where to make a splash on social media today, it’s often thought that newer might be better. That’s where all the cool kids are looking at, right? Where you might get the most likes, shares, or interaction. And yet, when it comes to brand amplification, Instagram still remains the best platform for fashion, lifestyle and beauty brands.

Of the $16.9 billion generated in Media Impact Value (MIV) in the first half of this year, Instagram accounted for 57 percent of that share. To put that into perspective, Facebook, the second-highest achieving platform, generated $3.5 billion, and YouTube and RED both accounted for $2 billion, tied for third highest place, according to a new report by Launchmetrics and Lyst on Instagram’s impact on brand performance.

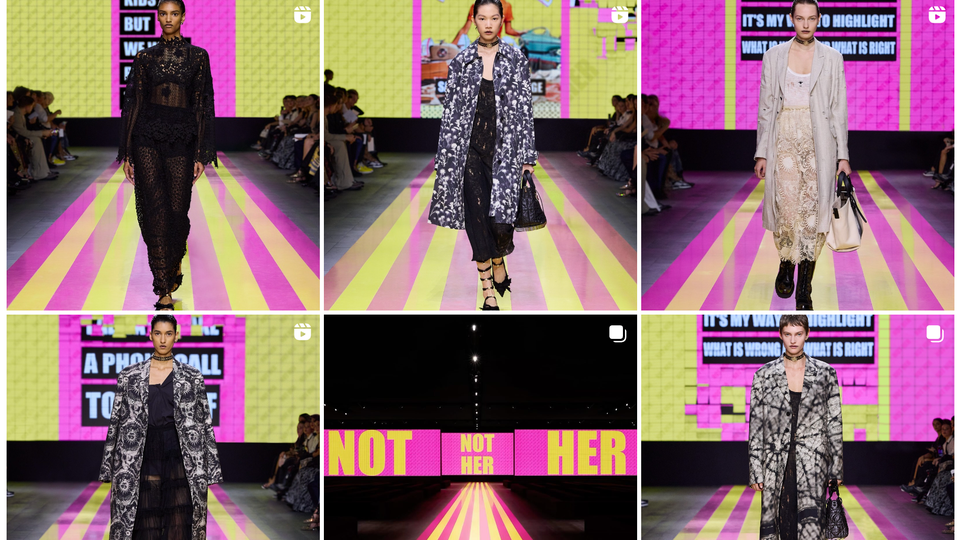

Of the brands making the highest impact on Instagram, Dior, Chanel, Prada, Gucci and Versace were ranked as the top five for luxury fashion, and Dior was ranked as the most powerful brand on Instagram with a MIV of $782.1M, followed by Louis Vuitton ($554.6M) and Chanel ($515.3M).

The report, which uses MIV to allow brands to assign a monetary value to every post, interaction or article to measure its impact and identity contributions to brand performance across voices, channels and regions, also found that Instagram sees the greatest penetration in fashion and sportswear, reporting the highest share value of more than 60 percent.

However, YouTube’s long video formats and the greater reach it has from its connections from its search engine, help it achieve a higher average MIV per placement of $10K compared to Instagram ($7.3K). TikTok comes behind very closely with an average of $7K MIV per placement, meaning that whilst Instagram led the way during the first half of this year, the tides could quickly change, and TikTok could steal its crown.

The study also found that fashion is the top-performing sector on Instagram, with brands collectively achieving $8.7 billion in MIV, more than double that of the second highest-achieving segment, beauty, meaning that for brands in these segments, there remains a lot of room for high-value opportunities, but at the same time, it means they will have to operate in a more competitive landscape for those specific segments.

Within fashion, luxury makes up 48 percent of its MIV share, indicating the strong demand from consumers for luxury fashion content. Fashion accounted for 1.1 million placements, resulting in an average MIV of $8.2K, followed by sports (158K placements, $8.8K Avg. MIV) and watches (189K placements, $7.4K Avg. MIV).

Beauty has the lowest average MIV, which the report’s authors attribute to current industry challenges across social media marketing. An increase in paid partnerships has made content seem less authentic and content saturation, which has resulted in audiences demanding more variety, such as more podcasts. Many beauty influencers have begun to explore adding podcast video clips to their feeds to mix up their content, and this rise of mixed media could mean a rise in the average value of beauty placements and new avenues for brand mentions.

While there are many considerations for brands to consider about their social media strategies, what remains clear is that companies must take the lead when it comes to creating their own content; branded content on Instagram has shown a growth in value generation ranging from 16 to 40 percent, compared to 4 percent of the value generated by influencers this year.

Another point to note is the different mix of voices that brands consider using. In some regions, content featuring celebrities is the primary driver of value in Asia Pacific, whereas influencers have a bigger impact in America or EMEA, meaning that content formats and types of stories will need to vary to adapt to the unique needs of consumers in each market, and brands will need to tailor their Instagram content accordingly.

For more information, please visit Launchmetrics to find the full report and more insights on brand performances on social media.

Welcome to Data Digest, our breakdown of the latest data releases and reports focused on the luxury industry.