Whilst major watch groups struggle with market uncertainty, Switzerland’s independent watchmakers are thriving – and H. Moser & Cie’s remarkable transformation reveals precisely why

When Edouard Meylan took the reins of H. Moser & Cie in 2013, the historic Swiss watchmaker was, by his own admission, “a mess financially” with quality issues and confused positioning. Twelve years after the Meylan family took over H. Moser & Cie, the company has increased production tenfold and turnover fifteenfold, emerging as one of independent watchmaking’s most compelling success stories. Speaking on a recent episode of The Luxury Society Podcast, Meylan offered candid insights into how his family-owned brand has not only survived but flourished during a period when many heritage watchmakers have struggled – revealing fundamental truths about what drives success in modern luxury.

The Human Connection

At the heart of Moser’s success lies what Meylan describes as the critical advantage independent brands maintain over their group-owned competitors: authenticity and human connection. “I think the strength of independent brands is that they don’t do much compromise,” he explains. “They have a very strong identity, they’re very opinionated, and they have this human factor that unfortunately the groups have lost.”

This distinction reflects structural realities within luxury conglomerates. According to Morgan Stanley’s analysis of the Swiss watch industry published in 2025, the “Big Four” independent brands – Rolex, Patek Philippe, Audemars Piguet, and Richard Mille – now command a combined market share of 47%, suggesting the premium consumers place on authentic brand narratives and uncompromised vision. Meylan observes that CEOs of major group-owned brands face constraints that independent operators simply don’t encounter: “When I talk to people working for the major groups, even at the brand level, if you’re CEO of a major brand in a major group and you cannot take decisions alone about product design, about orientations, you need to go through centralised design decision-making. First, it slows down, second it standardises a lot of things and dilutes the message.”

This freedom manifests tangibly in Moser’s willingness to take creative risks that group-owned brands simply cannot afford. The brand has built its reputation on disrupting watchmaking conventions through bold product decisions and audacious marketing campaigns. The Swiss Mad Watch (2017), with its case literally made from Swiss cheese combined with resin, protested lax “Swiss Made” regulations whilst achieving a symbolic price tag of CHF 1,081,291—referencing Switzerland’s founding date. The Swiss Alp Watch series (2016-2021) parodied the Apple Watch with mechanical watches housed in rounded rectangular cases, complete with Vantablack dials mimicking powered-off screens. Most controversially, the Swiss Icons Watch (2018) combined design elements from Rolex, Patek Philippe, Audemars Piguet, Hublot, and others into a mash-up piece – but backlash forced Meylan to retract it within 24 hours. When reflecting on the brand’s provocative campaigns, Meylan acknowledges he burnt his fingers on some of them. Yet this capacity to experiment, to surprise, and occasionally to provoke remains central to Moser’s identity.

Such bold positioning has cultivated an uncommonly loyal collector base. “What people like about the Moser fan base is the fact that we surprise them over and over again,” Meylan explains. The relationship transcends typical brand-consumer dynamics, built instead on creative courage and mutual understanding. “One of the best compliments, and for me that’s really the moment I realised we built what I believe is a real brand, is the day where one of my customers came to me and said, ‘This watch, I really didn’t like this product that you just launched, but I love the fact that you did it.'”

This kind of emotional resonance – where collectors appreciate a brand’s creative courage even when they don’t personally connect with every product – represents a relationship depth that transcends transactional luxury.

Credit: H. Moser & Cie

Profitability: The True Measure of Health

Meylan challenges one of luxury’s most persistent vanity metrics: revenue figures divorced from profitability. “It’s not because we make a hundred million that we are healthy,” he states bluntly. “I think we are healthy because we are very careful in the way we develop, produce, and sell our products, so we can generate margin. That’s where you are healthy. I think there’s a lot of brands larger than us, making significantly more revenue, that are not healthy.”

This philosophy guided Moser’s most painful early decisions. Upon taking the reins of the brand in 2014, Meylan reduced headcount from 75 to approximately 30 employees, sold machines, and even stopped producing movements that either did not work or were financially unsustainable. “What I learned is it’s easier to start from very small and grow as you need it, rather than being oversized and not taking the decision to downsize.”

The mathematics of Meylan’s approach prove compelling. His father, who spent years at Audemars Piguet, observes that Moser achieves profitability levels that Audemars Piguet never reached when operating at significantly larger scale. This efficiency stems partly from Moser’s size and focus, but primarily from strategic discipline around production, pricing, and distribution. The company now employs between 120 and 130 people – a manageable expansion that maintains operational agility whilst supporting ambitious growth targets.

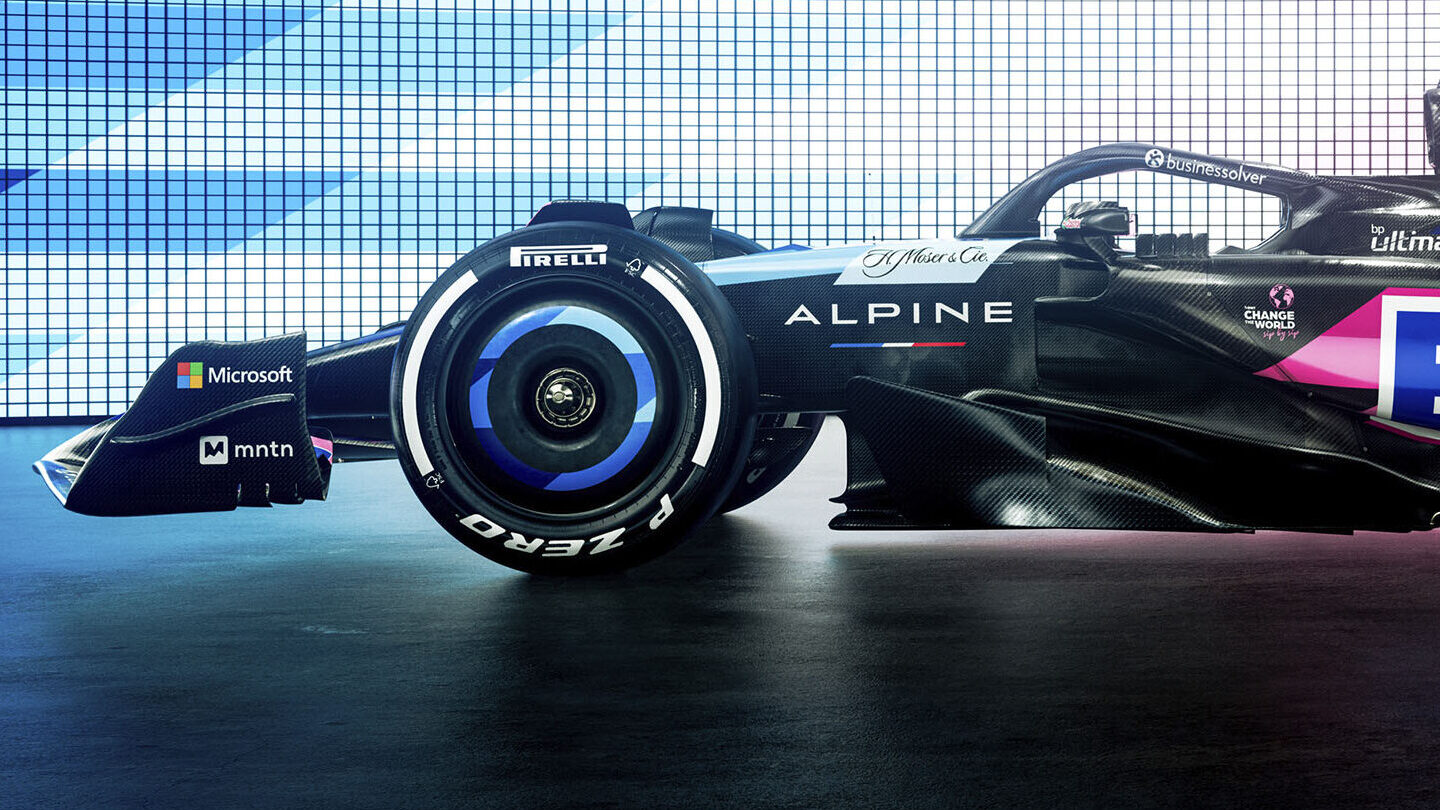

One of the reasons for the watchmaker’s sustained growth is its geographic diversification. According to Meylan, Moser achieved 55% sellout growth in the United States in 2025, driven in part by strategic activations including its partnership with Alpine Motorsports as Timekeeping Partner and the appointment of NFL star Saquon Barkley as a Friend of the Brand. Mexico delivered even more dramatic results, with over 200% growth last year. But Moser is not one to rest on its laurels, continuing to steadily expand its global storefront footprint. Meylan shared that the brand intends to open its third China store in Chengdu, with a second South Korea location to follow. Within days of recording this episode, Meylan was also in Singapore to unveil Moser’s first boutique in the country.

Credit: H. Moser & Cie

For all its successes, Moser is not immune to geopolitical headwinds. But the key is how they deal with them. When confronted with the challenge of US tariffs on Swiss watch imports, Meylan implemented a pragmatic three-way solution: “We absorbed part of the tariffs, reduced a little bit the margin of our partners, and increased the price for the consumer. So overall, everybody pays a little bit.” This flexibility – combined with currency management and strategic inventory positioning in Hong Kong – exemplifies the reactive decision-making that size enables. The company implemented two price increases totalling approximately 13% across 2025, acknowledging the difficulty of such adjustments whilst maintaining transparency with retail partners and end consumers.

Innovation 2.0: Beyond Gold and Into the Future

Whilst gold prices have surged to record highs, creating pricing pressures across luxury watchmaking, Meylan views the challenge as an opportunity for differentiation. “At the moment I’m pretty cautious. I think we’ve been very successful with other materials, but we’re also exploring new materials at the moment. To be honest, I took the decision to reduce the quantities on gold. I think we have enough ideas for crazy interesting products that don’t have to be in gold.”

For Meylan, it’s not a retreat – it’s a playbook borrowed from the industry’s biggest disruptors. “If you look at some of the most successful brands in the last 20 years – Audemars Piguet, Richard Mille – it’s not gold that made them successful,” he observes. “I think they are the powerhouse of innovation 1.0. I want Moser to be the powerhouse of innovation 2.0.”

The “Moser Innovation Lab” represents the brand’s most ambitious expression of this vision – a dedicated team thinking beyond traditional watchmaking boundaries. “I don’t want to make a new lighter, more accurate chronograph,” Meylan explains. “I want to think a different way of the chronograph or see what our industry can bring to some of the most advanced companies in the world on the tech side or in the car industry.

The scale of Moser’s ambitions becomes clear when examining current projects. The company is constructing a new 6,000-square-metre manufacture directly beside Europe’s largest waterfall – more than doubling current space from 2,500 square metres. The facility will house Precision Engineering (Moser’s sister company that specialises in escapement components) on a dedicated floor, alongside workshops, innovation departments, and significant client experience areas. “It should be like a temple of the brand,” Meylan says. “And it should be timeless because obviously it should outlive me.”

Credit: H. Moser & Cie

This focus on experiential spaces reflects broader industry recognition that physical environments drive emotional connection. As Julien Tornare, CEO of Zenith, observed in an earlier podcast episode, creating meaningful client experiences has become essential to luxury watch brand building – a philosophy Meylan is embedding into Moser’s architectural DNA.

Building for Generations, Not Quarters

As the luxury watch industry navigates tariff uncertainty and market volatility, Meylan maintains optimism grounded in long-term vision. “I think 2026 is going to be an amazing year for Moser,” he states. “We grew almost 10% last year, and we are going to grow this year also.”

Yet his confidence extends beyond Moser’s trajectory to encompass broader industry concerns. “I’m more concerned as an industry that we take the right decisions, that we support our suppliers because if they disappear and we lose craftsmanship and knowledge, that’s my concern,” he explains. “That’s where the big brands need to step in and support them and not disappear the day that their orders are down.”

Moser & Cie’s journey from a historic brand to thriving independent, innovative powerhouse offers instructive lessons. Success stems not from scale alone but from margin discipline, authentic connections, and decisive action. The golden age of independent watchmaking belongs to those willing to surprise their communities, support their ecosystems, and build for generations rather than quarters.

__________________________

Listen to the full interview with Edouard Meylan on The Luxury Society Podcast on Apple, Spotify, and other major podcast platforms.

To discover more about how independent watch brands are navigating today’s market challenges, read our interview with Peter Harrison, CEO EMEA of Richard Mille, or listen to the podcast episode on Apple, Spotify, and other major podcast platforms.

For insights on luxury market pricing pressures, read our interview with Luca Solca, Managing Director of Luxury Goods at Bernstein, or listen to the podcast episode on Apple, Spotify, and other major podcast platforms.

Subscribe to The Luxury Society Podcast to receive notifications about new episodes featuring luxury industry leaders. Never miss an episode as we continue exploring the themes shaping the future of luxury.