Previously better known for its focus on anime, comics and gaming-related content, fast-growing video platform Bilibili has since built up a strong user base with varied content types. How can luxury brands crack the code for this platform?

Growing traffic volumes on video platforms have been prompting brands to reconsider their traditional digital marketing efforts and turn their focus on this communications medium. In China, most brands have already taken to ByteDance’s Douyin and WeChat’s Channels – but there is still an untapped video platform that luxury brands can look to leverage: Bilibili, the video platform favoured by millions of young, Generation Z Chinese.

According to Bilibili’s FORM 20-F Annual Report filed with the SEC on 27 March, Chinese tech titans Tencent and Alibaba hold 13.3 per cent and 7.2 per cent of Bilibili’s shares respectively. In April this year, Sony also invested approximately $400 million to secure a 4.98 per cent stake in Bilibili through its wholly-owned subsidiary, Sony Corporation of America. The strategic investments from these digital giants will reportedly be used to optimise and further develop Bilibili’s content ecosystem on three fronts: Commercialisation (Alibaba), intellectual property (Sony), copyright and channels (Tencent).

Empowered by these large conglomerates, Bilibili has since proved itself over the past few years to be more than an ACG (anime, comics, games) video site. Driven by an original content incentive program launched in 2018, its diversified content base is gradually taking shape. Five main content pillars – lifestyle, games, entertainment, anime and tech & knowledge – have replaced the previous ACG-focused content structure. Lifestyle content covering fashion, beauty and food has since become the most viewed content type on Bilibili.

According to the “Bilibili Fashion Big Data” study released this January along with the second phase of its “Fashion Star Project”, Bilibili has published over 1.63 million fashion-related videos and generated over 700 million interactions. At the same time, the growth of the fashion community on the platform has been spurred on by young, fashion-forward users largely from first and second-tier cities. As a result, brands across a range of consumer goods categories have started to venture onto Bilibili. Most luxury brands, however, are still opting to watch from the sidelines.

The Challenges Behind Quality Content

With the launch of the third phase of its “Fashion Star Project”, Bilibili will provide exclusive traffic support, as well as cash rewards and commercial resources dedicated not only to an incubation programme for its fashion-related content creators, but also bringing external talents to the site. NikkieTutorials, a make-up artist with 13.4 million followers on YouTube, has amassed 180,000 followers after eight months with Bilibili.

Bilibili’s incentive mechanism for quality content on the site includes not only the typical engagement model of liking, sharing, commenting, but also an interesting “monetary” system. Known as “Coin Vote”, the first model in this system has users voting for their favourite videos with coins that are automatically added to their accounts (one per daily login). The more coins a piece of content has, the more the recommendation algorithm will swing in its favour. The second model is that of “Charging”, which allows users to directly donate cash to content creators. Over time, these elements have contributed in building an ecosystem that nurtures quality content on Bilibili.

Unlike Douyin’s recommendation model which is based on total video views, Bilibili’s model is based on follower preferences and is more creator-centric. This means that the viral marketing video tactic is much harder to replicate on Bilibili as opposed to other short video platforms – whether created by a brand or through a collaboration. If brands do not develop rich content that meets the mark, traffic is bound to be squeezed, resulting in lower returns on investment.

While Douyin is also based on professional user generated content (PUGC) content, its user base is seeking snappier video content, while on Bilibili they are looking for richer, more immersive video content, says Iris Chan, Partner and Head of International Client Development at DLG (Digital Luxury Group). “On this platform, brands must make the extra effort to invest in creating the right opportunity and develop well-thought-out content for this niche audience,” she adds.

Collaboration Opportunities For Luxury Brands

In terms of advertising on Bilibili, resources are only available on the discovery feed, personal feed, video page, as well on the opening screen. Compared to video platforms such as Tencent Video or iQiyi, advertising resources and opportunities on Bilibili may seem more restrictive, but this has not stopped brands. Big names like as Estee Lauder, Chanel Beauty and Gucci are already serving their ads on the opening screen. Fendi also dropped a promotion campaign about its Peekaboo Bar across the personal and discovery feeds, as well as on the video page (with a redirect to the official Fendi site). Despite the seeming advertising limitation, there are still significant content opportunities for brands to explore on the platform.

Image: BiliBili

Videos are the best medium for promoting beauty products, as they rely heavily on the visual experience. Since 2016, the popularity of beauty content on Bilibil has been growing. Content formats including product seeding, product testing and tutorials have gradually become mainstays. Over time, the platform has also helped groom a new stable of beauty KOLs including QianHuChangSheng (千户长生) and DangMei (党妹).

As further testament of its growing clout, Shiseido held a livestreaming event on Bilibili earlier in April. The session generated over 1.23 million views. Lancôme and Elizabeth Arden have also collaborated with creators to promote their new products via campaigns on the platform.

Despite the fad of “unboxing” and “OOTD” videos on Bilibili, as well as its diversified content feed that creates more spaces for brands to explore, it is still challenging for luxury products with high unit prices to stimulate purchasing through video exposure, compared to beauty products that are famous for their low price points and high consumption frequency.

Therefore, luxury brands also have to consider making their stand on Bilibili. Some of the more forward-thinking brands have already set up official accounts on Xiaohongshu (RED) and Douyin – but not Bilibili. In contrast, another high value category, automobiles, already has brands like Mini on the platform. The British marque has since accumulated over 10,000 followers on Bilibili.

Do As The Romans Do

Last year, Riot Games announced a partnership with Louis Vuitton for the League of Legends World Championship in September 2019. This move also came after the luxury label featured the popular game’s protagonist Lightning in its Spring/Summer 2016 campaign. In November last year, Louis Vuitton launched an AR filter of League of Legends character on Bilibili, allowing users to upload videos with this filter.

Bilibili is certainly the choice video partner in China for brands who want to explore the ACG concept. It started with ACG content and its League of Legends channel already contains over 1.47 million videos with 22.3 billion views. With Tencent and Sony on board, more licensed IPs will be available to Bilibili in the future. As Generation Z (that grew up in the era of video games and other forms of digital entertainment) continues to grow as a prominent luxury consumer group, using an anime or game angle to ease into the platform could be an interesting place for luxury brands to start.

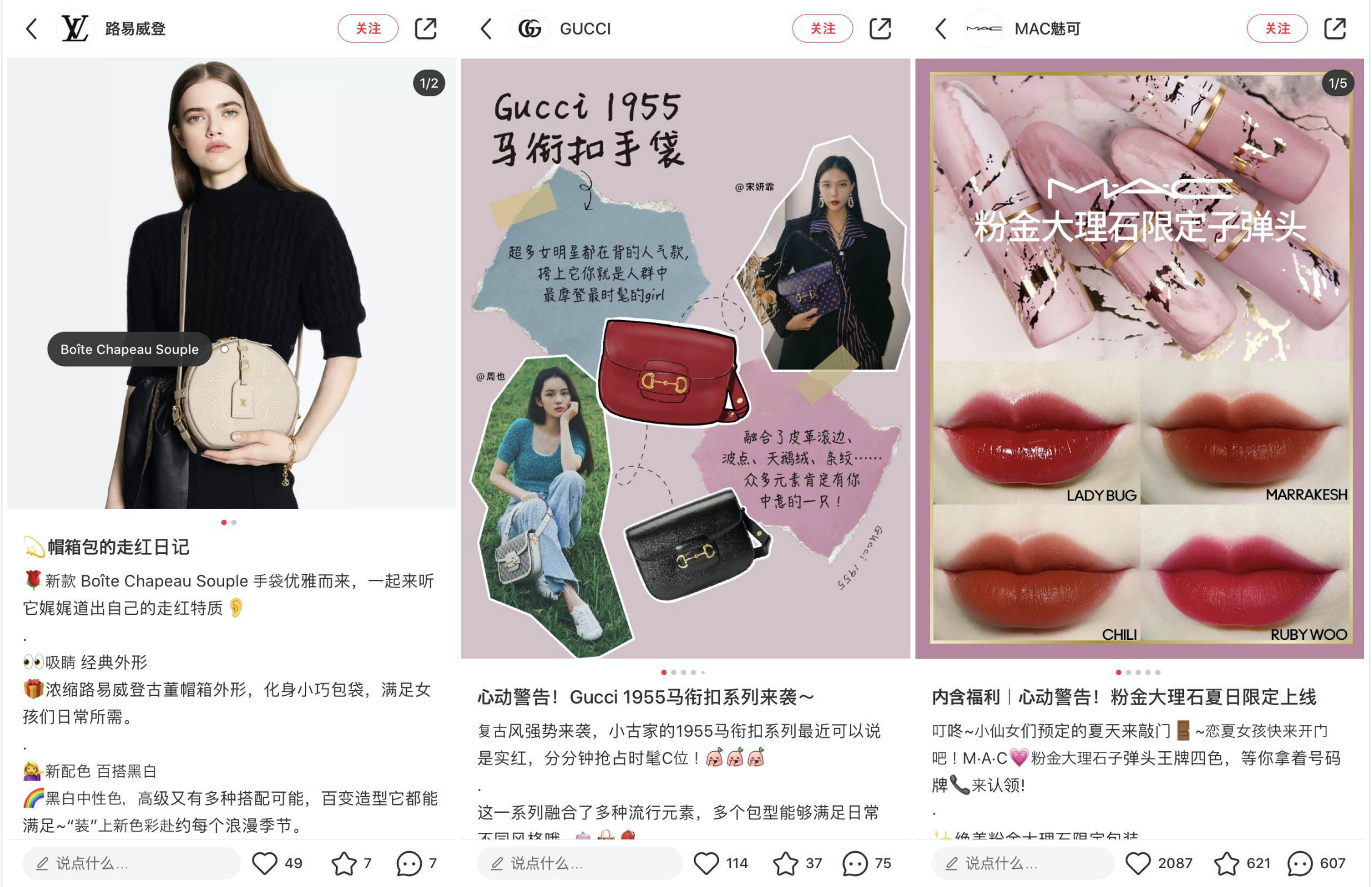

Brands also need to think vertically – not only in terms of content, but also in terms of format. Take for instance, on social commerce platform RED. Louis Vuitton and Gucci have adapted their content styles to fit in with that of the platform’s “Notes” format, and are promoting their new products and marketing activations in that manner. This has proven to help with user engagement and stickiness. Likewise, for brands on Bilibili, making use of popular content formats like unboxing, store visits or vlogs would be key in ensuring their success.

Image: Xiaohongshu (RED)

The Commercialisation Worth Waiting For

According to first quarter 2020 financial results released by Biblibili on May 18, the platform has reached 172 million MAU (monthly active users), indicating a 70 per cent year-on-year increase. Total net revenues were 2.32 billion RMB, representing an increase of 69 per cent year-on-year, with its non-gaming revenue accounting for 50 per cent. Revenues from value-added services including live broadcasting and premium membership program were 790 million RMB, while revenues from advertising were 210 million RMB.

For luxury brands, expanding one’s consumer base largely through print advertising is no longer relevant. Instead, many brands are looking to diversifying their ad placements, as well as channels for content dissemination. This is especially so in China, with its plethora of platforms and huge population of luxury consumers.

That said, luxury brands still tend to be hesitant about entering new platforms, often citing concerns about brand perception. In the post-pandemic era, when every move taken by brands need to drive conversions, this decision becomes harder than ever. “‘Now’ is not always the right time, but it is always the right time to be monitoring and running test-and-learn exercises to see if it is a fit for your brand,” says Chan. “In some cases, the ROI only makes more sense when the brand isn’t the originator of content or the primary focus of the content. In other cases, especially when all the dots are connected to e-commerce, the huge investment in creating something for one platform is worth every penny.”

Perhaps what is missing on Bilibili for luxury brands is the commercialisation angle – allowing traffic generated on videos to be driven directly to a third-party e-commerce site for purchase. With the strategic partnership between Bilibili and Taobao, a few KOLs have since launched online stores on their personal Bilibili profiles, with some product listings being redirected to Taobao. While this is not exactly at the level of in-video e-commerce integration, it is a positive step towards that – and maybe the one thing that brands are holding out for.

Cover Image: BiliBili