With retail on the rebound, how can brands ride the momentum and fine-tune their digital strategies in China? The latest WeChat Luxury Index report from DLG (Digital Luxury Group) and JINGdigital examines the performance of luxury brands on WeChat and the opportunities that come with livestreaming and social selling within this ecosystem.

With retail on the rebound, how can brands ride the momentum and fine-tune their digital strategies in China? The latest WeChat Luxury Index report from DLG (Digital Luxury Group) and JINGdigital examines the performance of luxury brands on WeChat and the opportunities that come with livestreaming and social selling within this ecosystem.

Although the global COVID-19 pandemic is far from over, retail has been on the rebound in countries like China where the epidemic is now under control. Offline traffic is slowly approaching pre-pandemic levels, while social media and e-commerce marketplaces that catered to consumption needs during the lockdown continue to complement the consumer journey in a variety of ways.

According to a recent study, 43 per cent of Internet users aged 16 to 64 in China spent more time on social media due to COVID-19. In addition, 55 per cent of survey respondents in China expect to shop online more frequently even after the pandemic ends.

As such, seizing the China digital opportunity is becoming increasingly important for brands. This is made that much harder by the ever-evolving, sophisticated Chinese consumer. While content-focused marketing strategies on WeChat – the most ubiquitous social platform in China – were previously sufficient, they are no longer enough. New tactics as livestreaming and social selling have risen to the fore, and brands are rushing to adapt to these new models and consumer expectations.

According to DLG (Digital Luxury Group) and JINGdigital's latest WeChat Luxury Index (Jan-Jun 2020) report, community growth on large WeChat accounts (averaging more than 100,000 followers) is slowing. While growth was at 18 per cent in the first half of 2019, these brands only saw their follower bases increasing by 12 per cent over the same period this year.

At the same time, the average engagement per WeChat push is decreasing, having fallen from 10.45 per cent (January to December 2019) to 6.59 per cent in the first half of 2020. Brands that have been benchmarking their WeChat performance against engagement or community growth might find themselves hitting a plateau – but significant opportunities remain on WeChat as the platform continues to evolve.

The Impact Of COVID-19

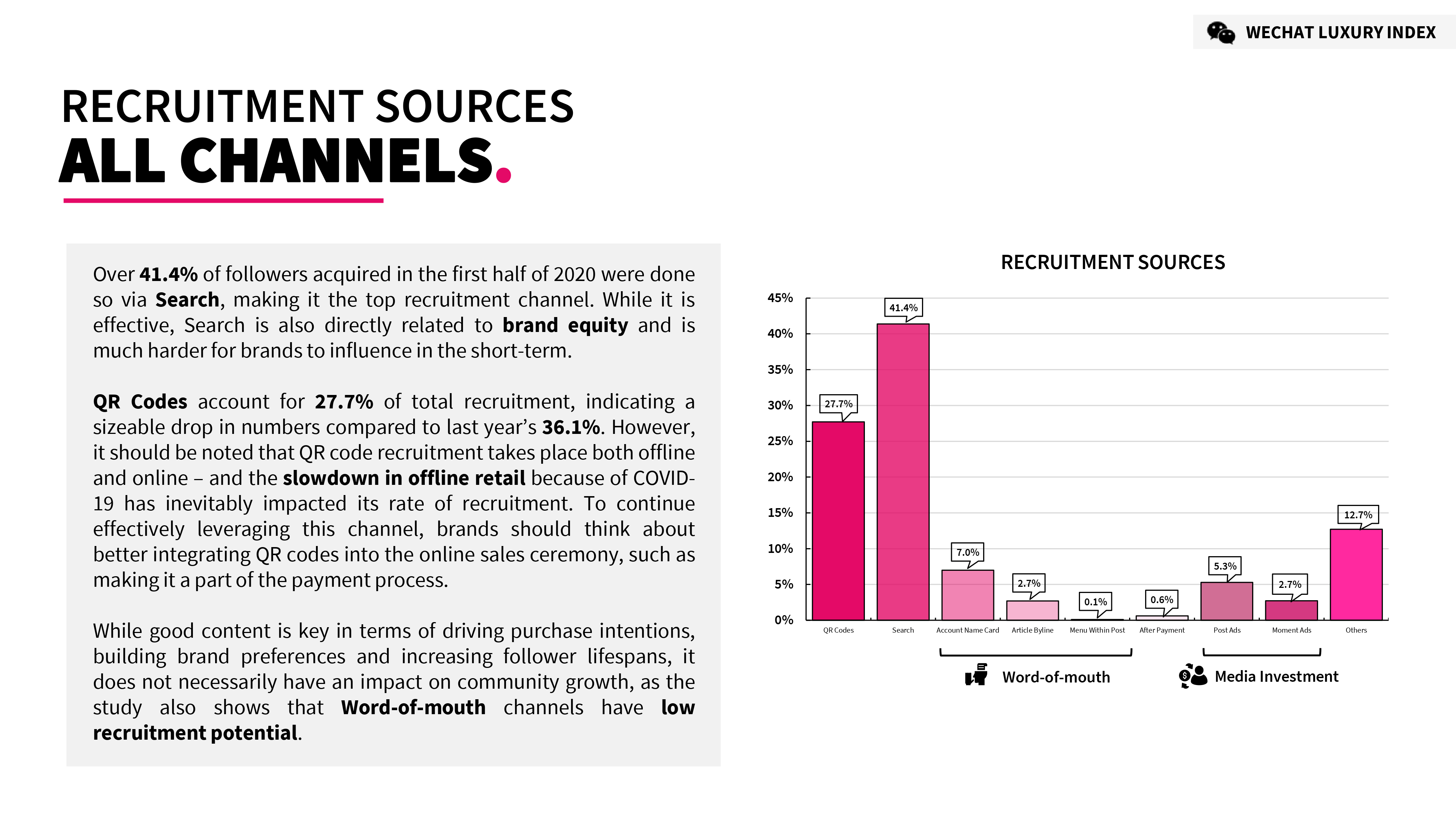

The pandemic’s impact on offline touchpoints is not only reflected in terms of sales performance, but also in the spread of its WeChat follower acquisition channels. The report reveals that the current top fan acquisition channel is Search, accounting for 41.4 per cent of recruitment. QR codes – previously the top acquisition channel at 36.1 percent in 2019 – only contributed to 27.7 per cent of growth in the first half of 2020.

QR codes placed in offline stores have traditionally been one of the most direct ways to onboard qualified clients and prospects. Now with this avenue affected, brands can consider integrating QR codes into their online sales ceremony (such as making it part of the payment process) to ensure that the channel continues to be well leveraged.

While COVID-19 has put a dampener on community growth and follower activity, it has also helped spur on the development of social media as an alternative sales channel. Based on data collected from January to June, 45 per cent of engagement actions now circle around e-commerce functions, representing a significant increase from the 36 per cent reported in 2019.

"In the past, brands were pursuing an ever-growing community of followers on their WeChat Official Accounts. But now, more brands are focused on the conversion of followers,” says Aaron Chang, Founder and Chief Experience Officer at JINGdigital. “Brands are building their e-commerce platforms and searching for opportunities to redirect their followers to e-commerce, driving conversions through their Official Accounts."

Targeted Livestreaming Strategy

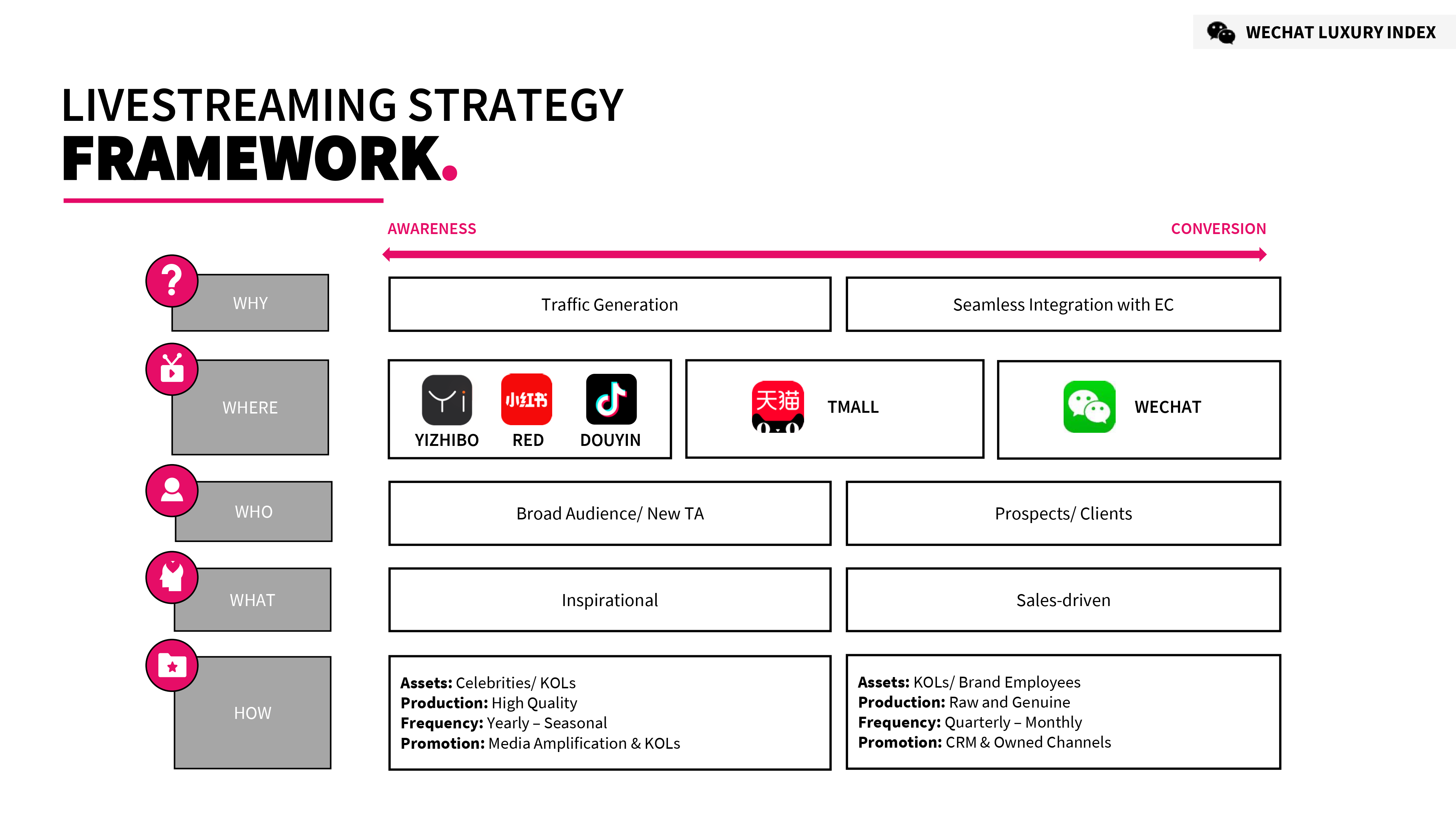

The report also delves into livestreaming, a channel that brands have been increasingly tapping into over the past few months – especially in China. Long regarded as an effective strategy to drive exposure and engagement, livestreaming is now also viewed as a strong conversion tool given the growing number of platforms offering e-commerce integration. Brands need to consider their objectives and select an appropriate method of delivery in order to achieve maximum returns of investment.

By showcasing case studies of livestreaming on different platforms (including YiZhibo, Taobao Live and WeChat Mini Program), this report explores different livestreaming strategies in terms of target audience, production tone and conversion rates. It should be noted that there is a strong negative correlation between reach and conversions – when a livestream session has a wide target audience, its conversion rates are bound to be lower than one that is focused on a specific audience type.

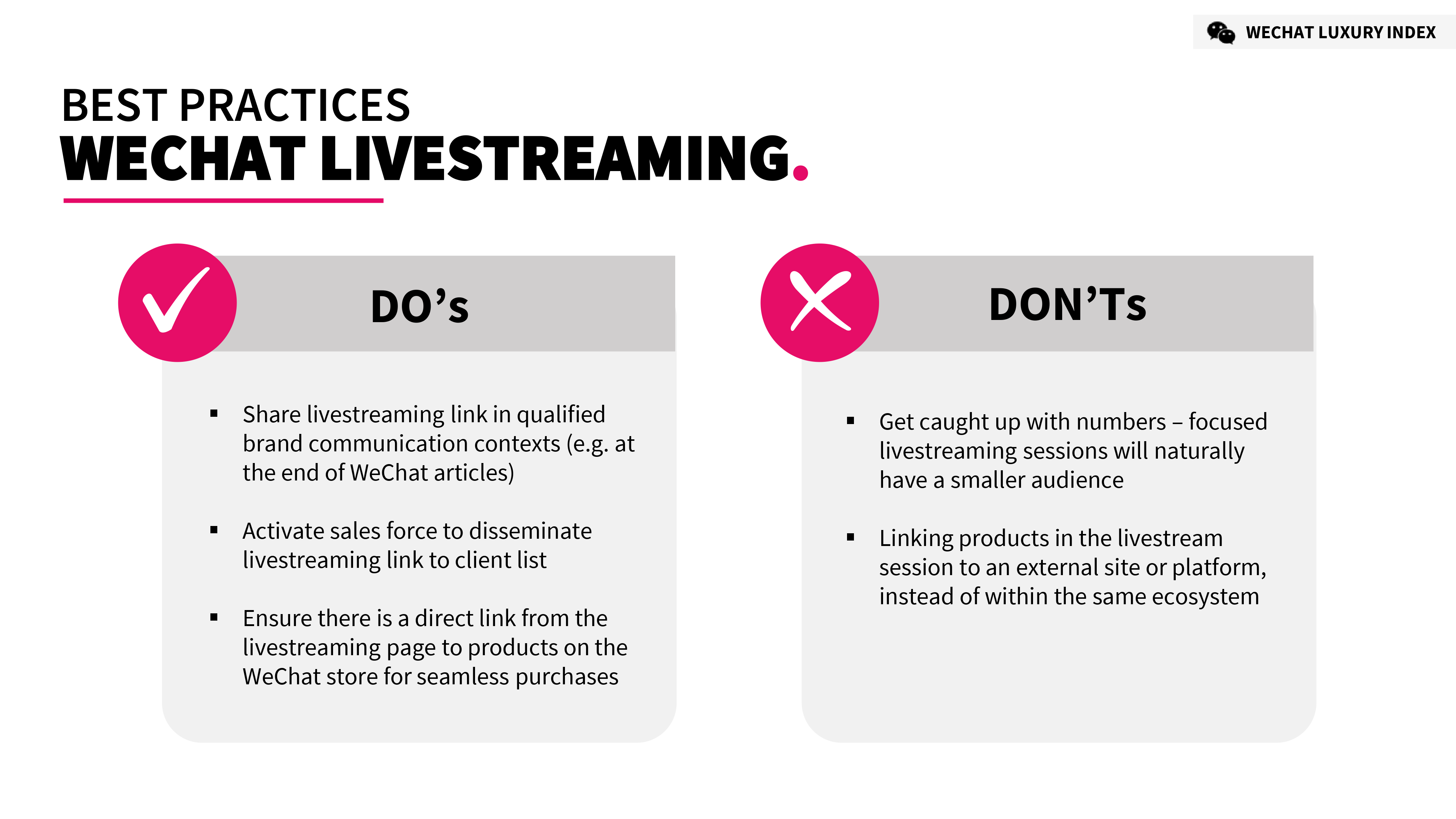

Brands in pursuit of higher conversion rates can consider targeting existing clients and prospects and leveraging WeChat Mini Programs for a more precise reach. Livestreaming links can be distributed by sales associates via WeChat to clients, directly reaching out to individuals who are already familiar with the brand. By default, these viewers are more qualified than audiences on Taobao or XiaoHongShu (RED) and targeted consumers always translate to higher conversion rates.

"The WeChat ecosystem rebuilds the seamless consumer journey that has been fragmented by COVID-19. Livestreaming on Mini Programs based on the brand’s CRM infrastructure enables them to boost sales with a limited budget and re-engage with existing clients,” explains Pablo Mauron, Partner & Managing Director China at DLG.

Social Selling At Scale

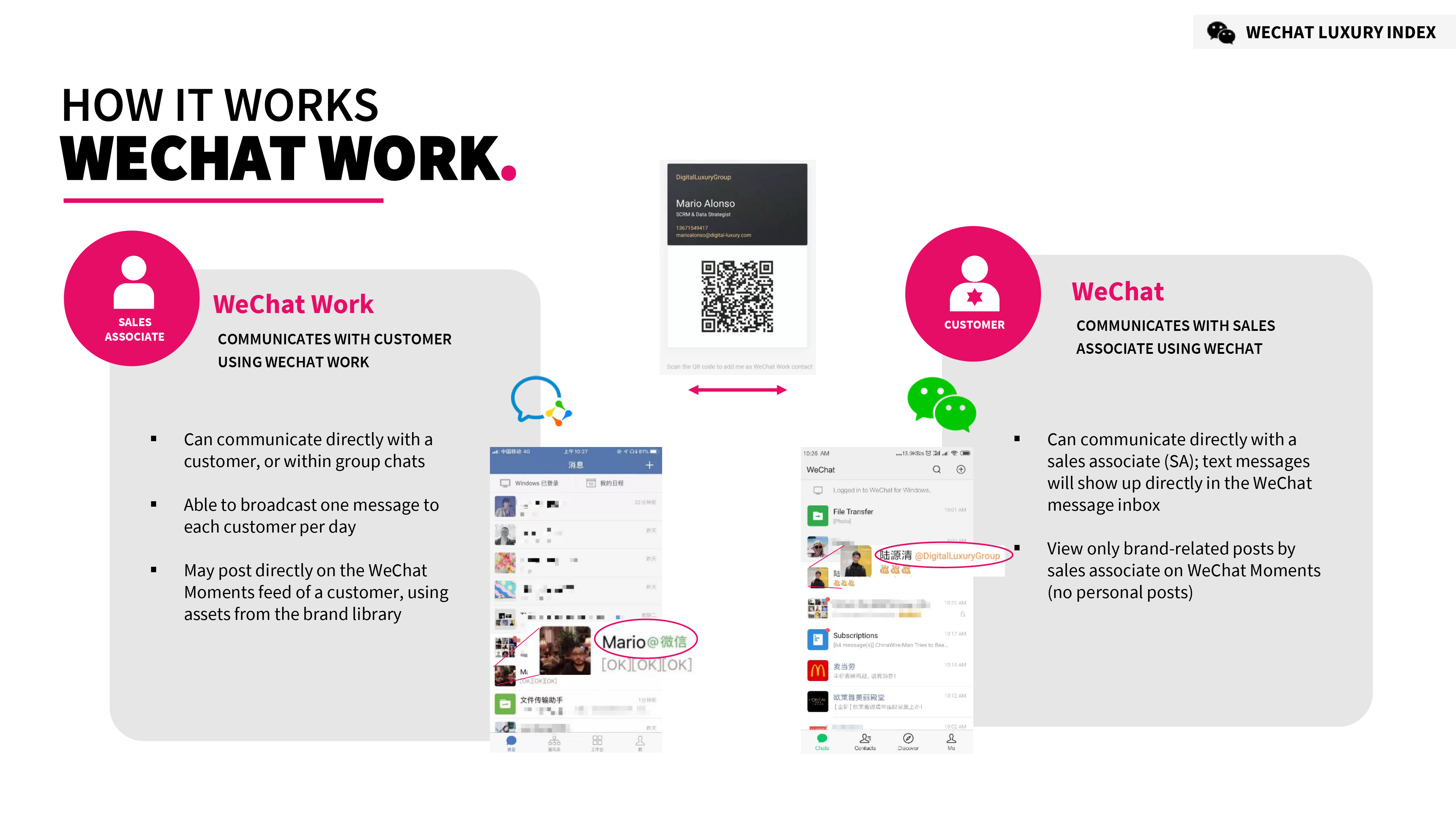

In addition, the report also sheds light on how brands can scale up their social selling efforts with the help of WeChat Work. Making sure that sales associates stay in touch personally with consumers via social tools has become an important sales tactic as the pandemic continues to impact offline foot traffic. With the adoption of WeChat Work, brands can better manage communications with clients, build richer consumer profiles, and leverage marketing automation to drive conversions.

WeChat Work gives brands a leg up in terms of content with an in-built Asset Centre that gives sales associates access to a curated library of images and communications content for sharing with clients. Brands will also be able to enrich their customer profiles by tracking client interactions with sales associates, WeChat behaviours, as well as transactional data.

"By implementing an integrated clienteling solution, sales associates will be able to maximise the number of people they contact while maintaining a high level of relevance," adds Mario Juarez, Social CRM & Data Strategist at DLG. Sales associates can be alerted to specific user behaviours and opportunities to initiate conversations with clients, making their exchanges more meaningful.

For more insights and data on follower acquisition, engagement and content, as well as case studies and analytical frameworks on livestreaming and social selling, watch a replay of the WeChat Luxury Index (Jan-Jun 2020)’s livestreamed launch or download the full report below.

Cover Image: Bloomberg