For luxury brands that are involved in the wedding industry, there are boundless opportunities to broaden their product offerings and client bases, but first, they need to attain a clear understanding of the bridal market.

For luxury brands that are involved in the wedding industry, there are boundless opportunities to broaden their product offerings and client bases, but first, they need to attain a clear understanding of the bridal market.

The wedding industry is flourishing, propelled by the growing population of millennials reaching marriageable age.

About one in five couples’ wedding budgets top $1 million, with spend on luxury apparel and accessories part of their plans for their big days.

“For luxury brands entering the bridal market can mean an extension of the product offering and the client base or an increase in the 'lifetime value' and the spendings of the existing customers,” said Yana Bushmeleva, chief operating officer at Fashionbi, Milan. "However, it's important to understand the market and the local clients first."

Join Luxury Society to have more articles like this delivered directly to your inbox

Tying the knot

Worldwide, the wedding industry is a $300 billion business. While most of these celebrations are economical, some have big budgets that stretch into the millions.

Most of the couples planning ultra-luxury affairs pay for at least part of their wedding. While millennials are the prime consumer group for these ceremonies and receptions, those who spend upwards of $1 million tend to be more mature than those who spend less.

Image credit: Four Seasons – 8 per cent of wedding budgets exceed $3 million

These clients are also the most educated and do significant research before making a bridal purchase.

The legalization of same-sex marriage in 26 countries has boosted the bridal market, opening up the industry to more couples. Many of those planning gay weddings are older and have more to spend on their big days.

Homosexual couples often choose to spend more due to the broader significance of their nuptials, justifying a more lavish affair as a celebration of their right to marry.

Selfridges has seen a 25 per cent lift in sales of wedding bands to same-sex couples.

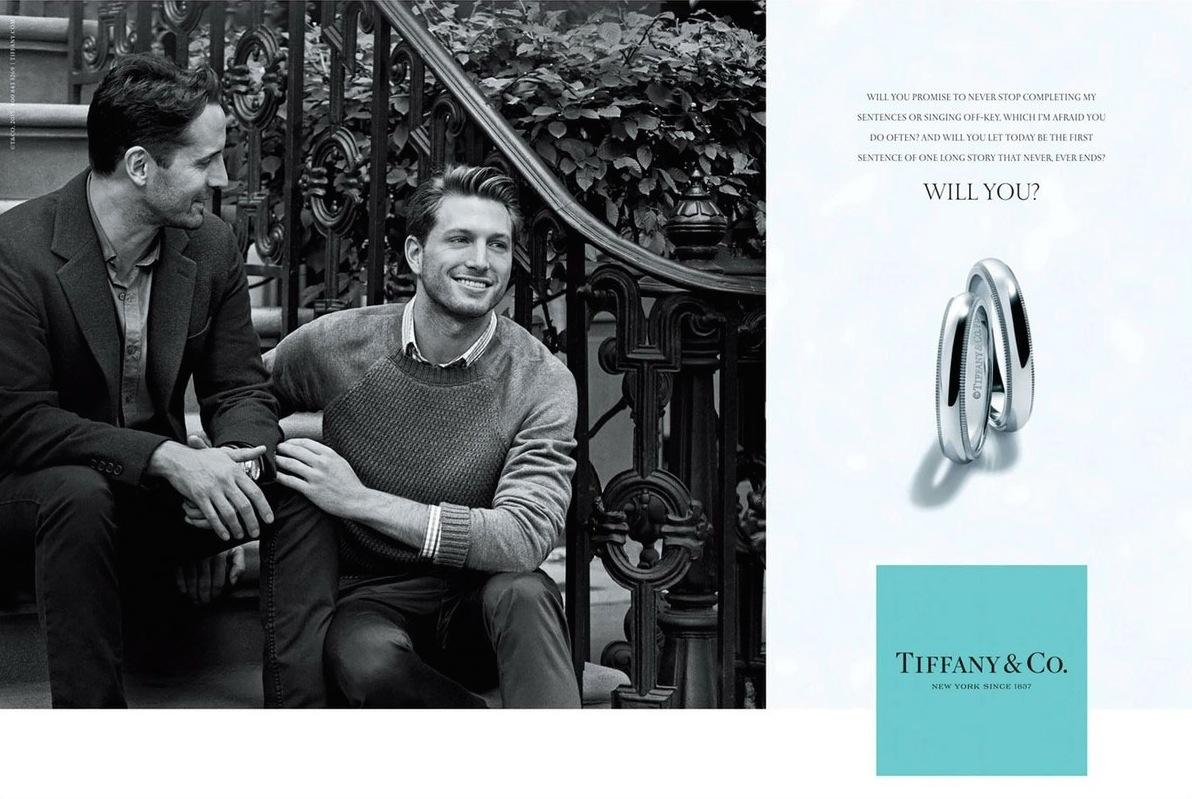

Some luxury brands have responded to this growing need for same-sex wedding options. Chanel sent two brides down the runway together after marriage equality was passed in France, and Tiffany & Co. featured a gay couple in an advertising campaign for engagement rings.

Image credit: Tiffany & Co.'s "Will You?" print and television ad campaign in 2015 made history when it featured a gay couple for the first time in its advertising

Statistics from Stategyr estimate that the bridal wear market in particular is set to grow to $73 billion by 2024.

Several designer labels such as Oscar de la Renta and Carolina Herrera have bridal lines in addition to their ready-to-wear collections. Vera Wang is perhaps most well-known for her bridal creations, having dressed personalities as diverse as Kim Kardashian and Chelsea Clinton for their weddings.

While high-end labels play in the bridal space, there are also labels that specialize primarily in wedding gowns, such as Reem Acra.

Image credit: Couture wedding gowns by Reem Acra

Bridal dressing is a big market, however, a Lyst survey found that brides have been decreasing the amount they spend on their outfits for the big day, with an average cost of about $1,000 for their attire. Brides are increasingly opting for less traditional options, such as jumpsuits.

Completing the outfit are accessories, including footwear and jewelry.

Jimmy Choo plays into the bridal experience with its #IDoInChoo user-generated content intiative, asking brides to share images of themselves getting married in its shoes.

Stuart Weitzman’s bridal collection features details such as Swarovski crystals. After expanding the line, the brand extended the collection’s points of sale by bringing it in-stores.

Many jewelers have looked to be part of consumers’ big days through marketing. Campaigns featuring depictions of the wedding experience have put houses such as Harry Winston and Bulgari at the center of love stories.

Video: Bulgari Bridal – The only answer is yes

Cartier similarly focused its promotions on engagement rings, encouraging consumers to pick its diamonds to pop the question.

"Nowadays many weddings start from the Internet search for dress ideas, decoration inspirations and so on," Ms. Bushmeleva said. "The storytelling can be the best solution for targeting the potential clients. Even if a person doesn't have a partner he or she can already start to dream about this special brand on your Web site."

Weddings around the world

Bridal traditions vary from culture to culture, and many brides and grooms adhere to their local customs of dress and ceremony for their weddings.

For instance, Chinese brides traditionally wear a red dress and veil. Today, many opt to change multiple times throughout their big day into styles such as modern white dresses and ball gowns.

Japanese brides may make five changes as they seek to balance tradition with contemporary styles.

Interested in strengthening your brand’s positioning for specific markets and consumers?

With an increasingly globalized fashion market, should luxury attempt to cater to these traditional styles?

"The young generation are not in a hurry when it comes to the marriage and have a more global point of view on the bride and groom outfits, so the number of those couples who choose the traditional wedding outfits in line with the local culture is decreasing year on year," Ms. Bushmeleva said.

"And those couples who appreciate the traditions of their culture and country probably will choose the local brand or atelier," she said. "Maybe international brands can try to enter the market with special bridal capsule collections, let's say to test the waters, for example many premium and luxury brands did special collection exclusively for the Middle East."

Cover image credit: Jimmy Choo

Article originally published on Luxury Daily. Republished with permission.