Results of the latest WorldWatchReport™ Benchmark uncover four digital trends that are shaping the luxury watch industry’s global business. From key markets in the Middle East and China, to the role of online advertising spend, the new report offers a bird’s-eye view of the industry’s digital ecosystem.

For over 10 years, Digital Luxury Group (parent company to Luxury Society) has been publishing the WorldWatchReport™, the leading market intelligence study in the luxury watch industry. Over the many years of its publication the report has been uncovering insights such as this, this, and this.

Last year, the most important new enhancement to this study since its inception was introduced. For the first time ever, luxury and prestige watch brands were given the ability to measure their digital performance versus the industry, with the unveiling of a detailed digital analytics benchmark specifically tailored to the watch industry.

In the most recent data from the report, four revealing trends were identified:

MORE ADVERTISING, MORE TRAFFIC

Looking at the 77 million website visits analyzed in the study, the first indicator of the strength of the luxury watch market is the year over year growth. On average, watch brands saw an increase of +9% in their web traffic between 2015 and 2016. This growth was notably possible because most brands of the industry increased their online media spending. Noteworthy is that on average online advertising generated 50% more web traffic in 2016 than it did in 2015.

MIDDLE EAST: INCREASED DIGITAL PRESSURE

Luxury watches are getting more and more digital exposure in the Middle East. From a web traffic perspective, Saudi Arabia is the fastest growing market worldwide for luxury watch brands: traffic to luxury watch brand websites has risen by as much as 43% month over month. Saudi Arabia is also the #1 country for mobile web traffic (with 57% of Saudi web traffic from mobile devices) and heavily supported by advertising (nearly 1/4 of the Saudi web traffic is linked to ads).

Still in the Middle East, traffic from smaller neighbor countries such as the United Arab Emirates is increasing at a pace of +38%. Digital Luxury Group experts also expect web traffic from Iran to grow significantly in the coming years following recent political changes and economic reforms that should open this 80 million inhabitants market to international luxury brands.

AUSTRALIA & HONG KONG: DESIRE TO BUY

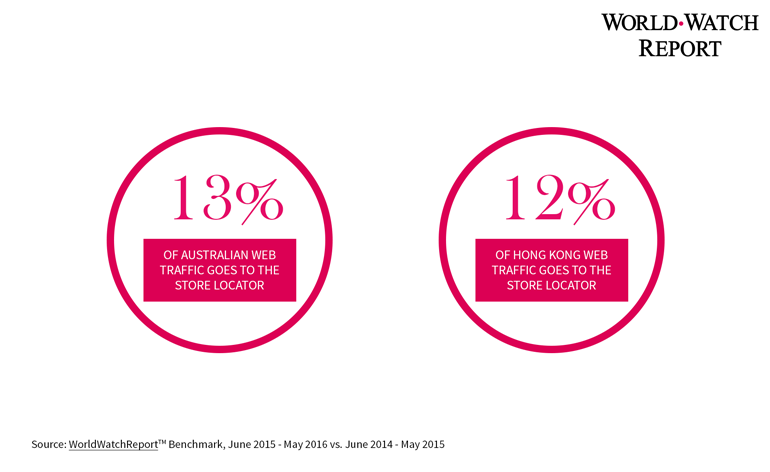

Visits to a luxury watch brand’s online store locator, a good sign of purchase intent, is proportionally higher in some markets. This happens to be the case with Australia and Hong Kong. 13% of website traffic to a luxury watch brand website in Australia is directed to the store locator, 12% in Hong Kong. The global average is 9%.

Why Australia and Hong Kong? Both locations are hot destinations for affluent Mainland Chinese and Southeast Asian travellers, who benefit from the lower tax levels than in their home cities. This highlights the importance for brands to setup drive-to-store specific campaigns, especially across important feeder markets. Ways to boost the online-to-offline connection include tactics such as offering appointment booking functionality on the website, promoting store events, using WeChat to help Chinese travelers find points of sale, among many others.

CHINA: ADVERTISING EXPOSURE REMAINS HIGH

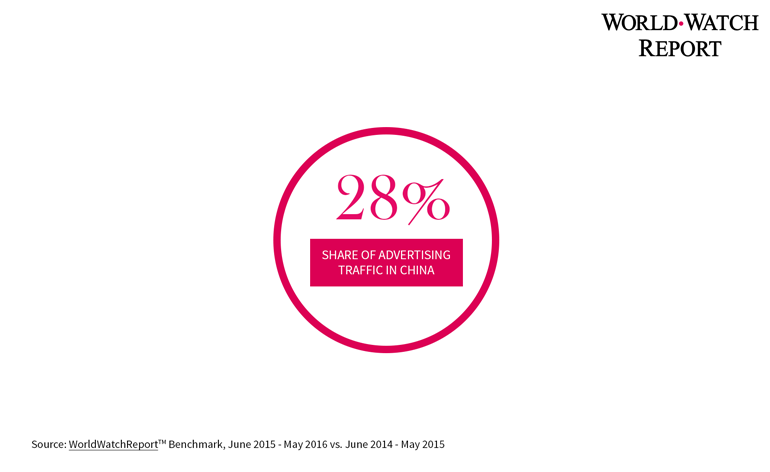

With a digital ecosystem unlike the rest of the globe, the Chinese market is a world apart in many ways. Chinese traffic to luxury watch websites doesn’t even resemble any other western market. For example, 28% of the local web traffic is directly linked to advertising (compared with only 17% for the rest of the world). From traditional display and social campaigns generating more traffic than anywhere else, to massive Baidu Brandzone and cost-per-click activations on search engines, China is by far the country with the highest advertising exposure. From a short term perspective, investments in local website optimizations wouldn’t make up for a drastic reduction in advertising spend. Hence DLG experts recommend to focus on campaign ROI optimization with a close monitoring of the traffic quality generated.

ABOUT THE STUDY

The new WorldWatchReport™ Benchmark provides participating luxury watch brands with industry figures on the digital ecosystem.

The Benchmark is based on a sample of 77 million web sessions recorded on luxury watch brands websites over a designated period. Data is extracted from Google Analytics for sites with similar types of functionalities and all data is then anonymized, normalized, and aggregated in order to highlight general industry trends.

To access the report, eligible brands can opt-in to the panel by sharing access to their Google Analytics account. All data are handled anonymously and with the strictest of confidentiality. For more details on how to participate visit www.worldwatchreport.com.