Which are the most-searched for destinations by Chinese consumers? And which luxury hotel brands are they searching for?

Which are the most-searched for destinations by Chinese consumers? And which luxury hotel brands are they searching for?

Kempinski Hotel Sanya Bay

China has been over the past decade, and still is, the fastest-growing tourism source market in the world, according to the UNWTO.

“Thanks to rapid urbanization, rising disposable incomes and relaxation of restrictions on foreign travel, the volume of international trips by Chinese travellers has grown from 10 million in 2000 to 83 million in 2012, equivalent to an average growth of 19% a year in that period.”

In 2012, China leaped to fist place in the UNWTO ranking by international tourism expenditure in 2012, spending $102 billion. In just one year, this amount increased to $129 billion, boosted by several administrational changes by leading tourism destinations as to the processing of Chinese tourist visas.

Historically outbound travel from China heads predominantly to regional destinations (UNWTO). The Asia and the Pacific region accounted for 91% of Chinese trips (64 million) in 2011. The Special Administrative Regions (SARs) of Hong Kong and Macao took the lion’s share, respectively 28 million (40%) and 19 million (28%).

“ China is the fastest-growing tourism source market in the world ”

Another 16 million trips (23%) were to the other destinations in the region, with the Republic of Korea, Taiwan (province of China), Malaysia, Japan, Thailand, Vietnam and Singapore, all receiving between 2.4 million and over a million. Beyond Asia and the Pacific, Europe is the largest destination region for Chinese travellers with over 3 million trips (4.4%) in 2011.

But now that the Chinese travel market is growing and tourists themselves are becoming more sophisticated, which destinations are most desirable? Where will Chinese travellers look to for future destinations? Are we noticing a shift away from Asian locations to the lure of Europe and the United States?

According to Digital Luxury Group, not yet. Based on the analysis of un-biased search intentions, originating from Mainland China and Hong Kong (between February & April 2014), consumers continue to search mostly for Chinese destinations, including Hong Kong and Macau. Singapore is the top searched International destination and has gained three positions in the ranking, rising from 22nd to 19th in the previous twelve months.

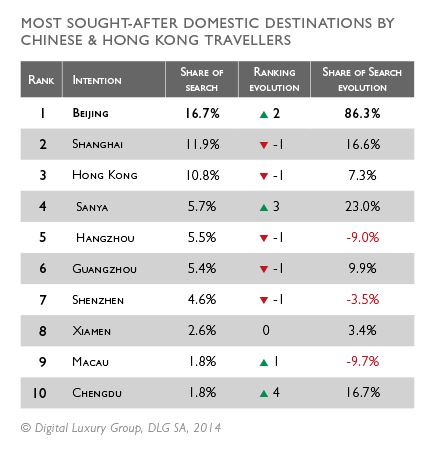

Domestic Travel

Beijing was above and beyond the most-searched for destination in Mainland China and Hong Kong, capturing 5% more attention than that of Shanghai. Interest in Bejing over the twelve-month period increased by a whopping 86.3%.

Sanya is the fourth most desired local destination as the ‘Chinese Riviera’ further develops with luxury hotels and a push towards European yachting culture. Searches for Sanya have grown 23% since this time last year, and should continue to grow as the region bolsters to become a leading Chinese tourism destination.

Interest in Hainan Island and Sanya Bay has also no doubt been boosted by th launch of Hainan Rendez-Vous. The four-day showcase combines Asia’s largest Business Jet Show, China’s most influential superyacht show and a luxury lifestyle & property show across 12,000 sqm of exhibition space. The event attracted almost 8000 visitors in April 2014.

The Sheraton is the most searched for brand by Mainland Chinese and Hong Kong consumers searching for luxury hotels in Sanya. Followed by Ritz-Carlton, Hilton, Renaissance and St. Regis. Since June 2013, search interest in the Kempinski Sanya has risen by 250%, potentially driven by the fact the hotel hosted the 14th annual Global Summit World Travel & Tourism Council during April 2014.

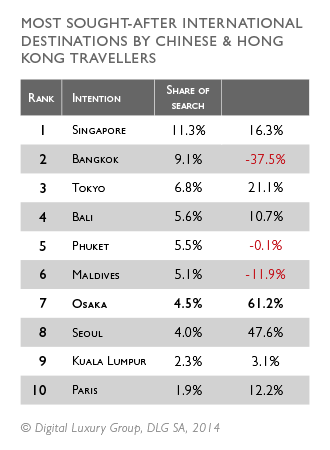

International Travel

The most searched-for international destination by consumers in Hong Kong and Mainland China is Singapore. Search interest in Singapore grew by 16%, a little short of interest in Tokyo, which increased by 20% despite political tension between China and Japan, which resulted in Anti-Japan protests sweeping China in late 2012.

Perhaps most surprising was interest in Osaka, which rose by 61% over the twelve month period. Of the 2.6 million international arrivals to Osaka in 2013 – a record for the Japanese region – 20.4% (approximately 531,000) were tourists from Mainland China and Taiwan. Travel to Osaka is thought to be spurred by the depreciation of the Yen and an increase in low-cost travel options.

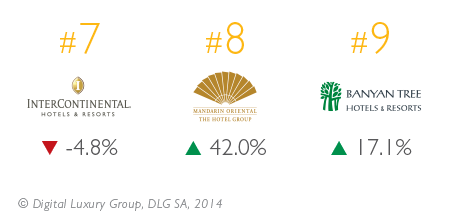

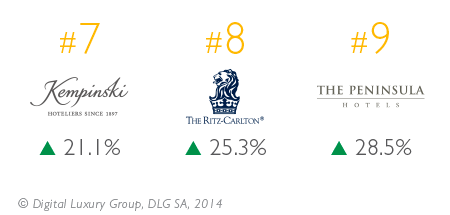

Brands

Overall, interest in international luxury hoteliers is on the rise. The most searched for brand was Shangri-La Hotels & Resorts. The most-searched for Shangri-La property was their domestic Chinese property in Wuhan. The first Shangri-La hotel debuted in Singapore in 1971 and until recently, the bulk of the brand’s expansion has been within Mainland China.

Westin is the fastest growing brand year-on-year , up an incredible 117%. The most-searched for property was The Westin Xiamen, a 300-room property located in the Wu Yi Plaza, an ultra-modern complex that combines arts, sports, retail, and entertainment.

The World Luxury Index is an on-going international ranking and analysis of the most searched-for brands within the luxury industry, covering over 400+ brands within six key segments.

The unbiased information is derived from 680 million consumer online searches originating from leading search engines Baidu and Google. Please see previous editions below:

– Chanel Overtakes Louis Vuitton in Chinese Share of Search

– Luxury Auto Brands Lead Share of Online Search in Brazil

– The Most Sought-After Luxury Watch Brands in China