Will the love story between Chinese shoppers and luxury continue this 520? DLG and Re-Hub examine the occasion through six definitive rankings across 105 luxury brands.

520, China’s Digital Valentine’s Day, is the next major test for luxury brands after Lunar New Year.

In the most recent earnings season, China—a market that dazzled during the pandemic—has now become a drag on global performance. With consumer sentiment subdued and spending increasingly shifting overseas, recovery has proved challenging. Bain predicts that the mainland China luxury market will remain flat in 2025, “with a challenging first half and an improving second half.” Against this backdrop, the 520 festival carries a noticeably downbeat tone.

For luxury brands, these local celebrations typically call for China-specific campaigns, festival-exclusive products or capsules, and special activations—leading to spikes in both sales and brand visibility.

Will the love story between Chinese shoppers and luxury continue this 520? DLG (Digital Luxury Group) and Re-Hub examine the occasion through six definitive rankings across 105 luxury brands, evaluating their performance on social and e-commerce channels during this moment.

A Lukewarm E-commerce Result

China’s “festival-making” strategy has undoubtedly supercharged its e-commerce industry over the past decade. But as growth slows, the endless stream of festivals—whether traditional like Lunar New Year, culturally-inspired like 520, or platform-driven like 618—has led to consumer fatigue, dampening the excitement once associated with these occasions.

This year, Tmall placed its strategic focus on the mid-year 618 festival, launching it as early as 13 May, resulting in the longest promotion period in the 618 history—37 days in total. In this shift, 520’s once-dedicated “Confession Day” event has effectively been absorbed as a warm-up to 618.

520 has long held strategic importance for luxury brands. Seen as a key gifting moment in the first half of the year, it allowed brands to activate localised campaigns—typically without requiring markdowns, preserving their brand equity.

But this year, the overlap with 618 produced mixed results depending on brand positioning. Some benefited from the extended promotional window and boosted performance through tactical discounts. Others were overshadowed by the broader retail noise.

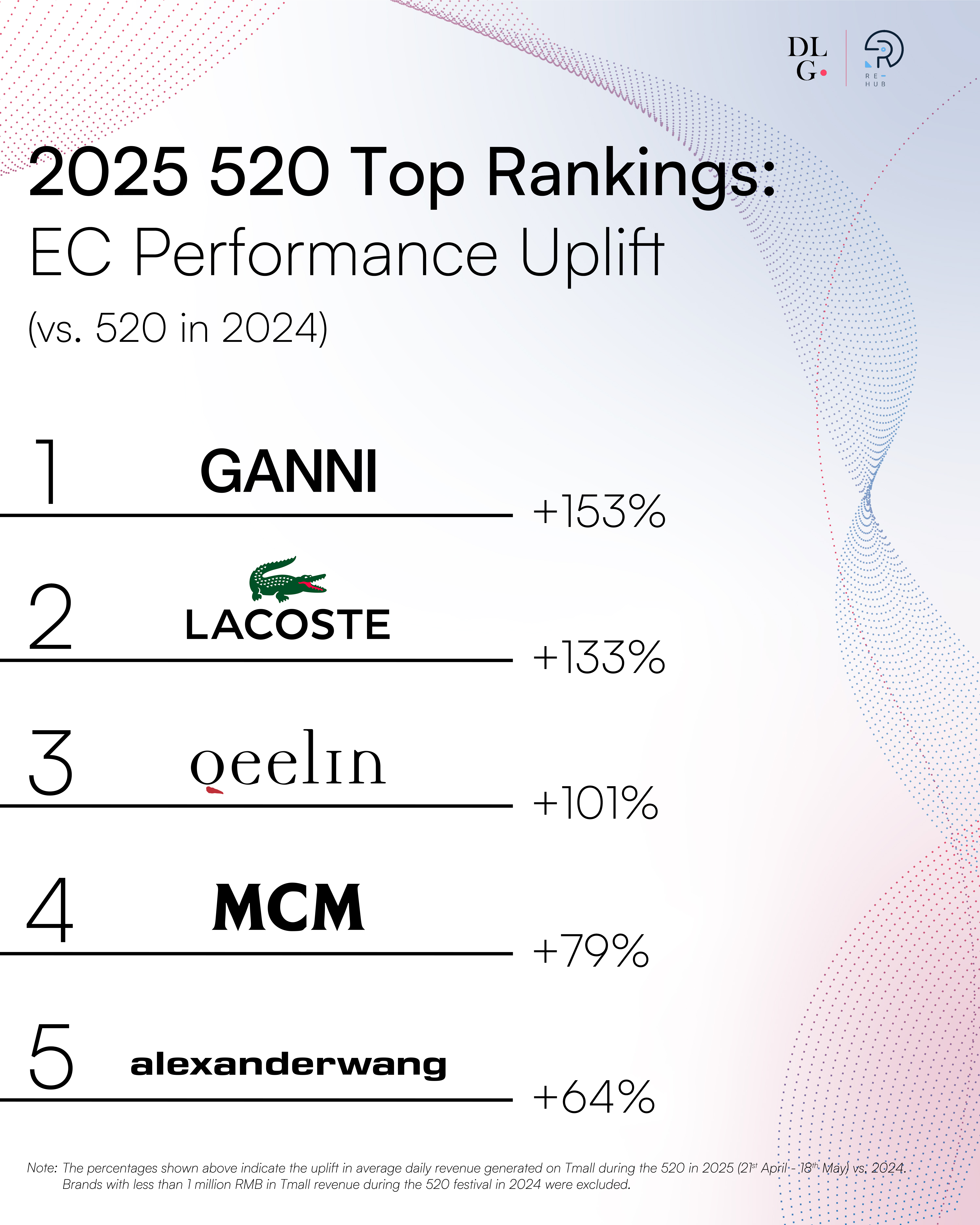

Premium luxury and designer brands such as Lacoste and Alexander Wang saw notable YoY Tmall sales growth of 133% and 64% respectively, largely fuelled by discounting strategies made possible by the early 618 timing.

Credit: Decoding Luxury Marketing Milestones in China 2025: 520, DLG and Re-Hub

However, 54% of tracked brands saw a YoY drop in Tmall sales. Many of these maintain a strict no-discount policy on the platform, making it harder to stand out in an environment dominated by price-led promotions.

The overall outcome? Despite the polarised results, total Tmall luxury sales rose a modest 1.9%, lifted primarily by brands agile enough to adapt with smart promotions.

A Shift in Narrative

With China’s broader luxury slowdown continuing, brands are rethinking how they approach these festivals. In an era of rapid growth, every festival offered an opportunity to drive revenue. Now, fatigued consumers, capricious trends, and shrinking marketing budgets are forcing brands to be more selective.

Where once a campaign might have spanned weeks with cinematic celebrity-fronted productions, today it might be reduced to a single WeChat post or a product flat lay. The creative downgrades reflect a more cautious approach to marketing in China. This year, average daily brand content engagement per brand dropped 23.6% from 520 in 2024.

Yet, those who come prepared can still cut through.

Qeelin, for instance, named Olympic table tennis champion Wang Chuqin as its brand ambassador ahead of 520—a rising star with over 25 million followers across Chinese social platforms. This aligns Qeelin with a growing trend among brands like Omega, Dior and Prada, who have enlisted elite Chinese athletes as faces of the brand.

Credit: Courtesy of Qeelin

And it worked. Qeelin’s engagement on RedNote grew 8-fold, with Weibo interactions also rising by double digits. The brand’s most engaged posts across both platforms featured Wang Chuqin.

This social heat translated into commercial gains. Qeelin’s average daily revenue on Tmall jumped 101% during the festival. The Wulu Small Necklace in Jade and Diamonds and Wulu 18K Black Cord—both endorsed by Wang—ranked in the Best Selling Products and Best Selling Novelties rankings.

Qeelin’s success highlights two key trends in today’s China luxury landscape. First, brands are pivoting their celebrity strategies, aligning with patriotic sentiment and a lifestyle shift toward sport. Second, it shows that brands can—and should—reinterpret these festivals on their own terms. Instead of following the usual festival script, brands can insert their own milestones into these celebrations, generating similar traction without getting lost in the crowd.

What Shines and What Dims

Jewellery continues to be the most sought-after category during 520—not just because of its natural fit with gifting, but also due to its sentimental significance and long-term value, making it resilient even in a softening market. This isn’t unique to China: according to a report by McKinsey & Company and BOF, jewellery is expected to be the most resilient luxury category through 2027, with a CAGR of 4–6%.

In addition to Qeelin, Cartier, Graff, and Chaumet also recorded double-digit growth this 520. Jewellery took up four spots in the Best Selling Products ranking. Tiffany & Co. made a notable splash by launching new variations of its Tiffany Knot Pendant, including a mainland China exclusive in 18K Rose Gold with Pink Sapphires, which ranked second in the Best Selling Novelties list.

Credit: Decoding Luxury Marketing Milestones in China 2025: 520, DLG and Re-Hub

In contrast, luxury handbags saw muted performance. Once-dominant bestsellers and brands are now on the decline, partly due to the return of outbound travel, where Chinese consumers can purchase these products at lower prices abroad. Additionally, a cautious economy is pushing consumers to invest in more “value-retaining” pieces—Hermès’ 7% growth in Q1 underscores this preference.

Interestingly, accessible luxury bags told a very different story. Brands like Coach, MCM, and Tory Burch saw strong gains by promoting classic models at attractive prices. MCM’s Tmall revenue soared 79% YoY, driven by its popular TONI series.

Yes, the perception and approach towards 520 have inevitably shifted amid ongoing uncertainty. However, these milestones still represent valuable opportunities to resonate with local audiences through compelling desirability and offerings — and will continue to do so.

This ranking series is powered by COMPASS, Re-Hub’s proprietary data tool. Contact them at the link to book a demo or find out more.