1.087 billion people travelled internationally in 2013, spending $1159 billion, prompting luxury brand executives to name travel retail as the ‘sixth continent’

1.087 billion people travelled internationally in 2013, spending $1159 billion, prompting luxury brand executives to name travel retail as the ‘sixth continent’

1.087 billion people travelled internationally in 2013, spending $1159 billion, prompting luxury brand executives to name travel retail as the ‘sixth continent’.

1.087 billion people travelled internationally in 2013, equivalent to approximately 15% of the global population (7.71 billion in 2013, according to the United States Census Bureau). These tourists contributed an estimated $1159 billion to various local economies, purchasing accommodation, food and drink, local transport, entertainment and shopping in destination countries (UNWTO).

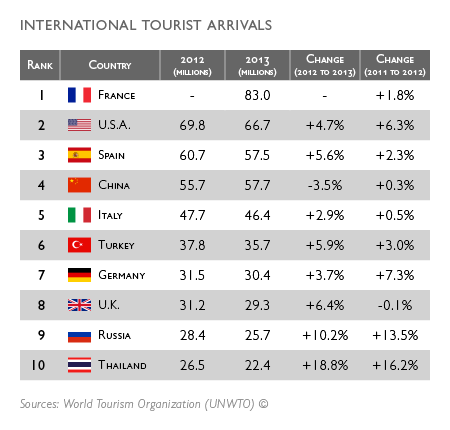

Europe remained the most popular region for global tourism in 2013, attracting over 52% of all international tourists. The most visited country in the world during this period was France, with over 83 million international arrivals, followed by the United States (69.8 million), Spain (60.7 million), China (55.7 million) and Italy (47.4 million).

Visitors to the United States spent the most, contributing a whopping $139.6 billion to the local economy. Followed by Spain ($60.4 billion) – the country with the most favourable VAT tax rebate within Europe – with France ($56.1 billion), China ($51.7 billion) and Macau ($51.6 billion) rounding out the top five biggest recipients of tourist spend.

The Chinese were the biggest spending nationality, collectively spending $128.6 billion abroad in 2013. Chinese international tourism spending has increased almost tenfold in the 13 years since 2000, when it ranked only 7th. In 2013 the gap in expenditure between China and second and third largest spenders – the United States and Germany – widened to over US$42 billion.

“ Tourists contributed an estimated $1159 billion to various local economies ”

Preferred Destinations

Favourite travel destinations have remained largely static over the past decade. France, United States, Spain, China and Italy were the five most visited destinations in 2013 (in that order). Only two changes took place in the 2013 Top 10 ranking by arrivals. Spain (with 61 million arrivals) regained the third position it had lost in 2010 to China (56 million).

And Thailand entered the top 10 arrivals for the first time, ranking at number 10, climbing an amazing five positions since 2012 (UNWTO). The number of international arrivals to Thailand has increased by over 65% since 2010. Though political instability in the capital of Bangkok may have an impact on its ability to attract visitors in 2014.

In regional terms, South East Asia was the fastest growing from 2012-2013 (up 10.5%), led by increases in Thailand, Cambodia (up 68%) and Vietnam (up 50%). Tourist arrivals to Sri Lanka have surged by 95% since 2010, and in the Maldives by 42%, as both destinations further develop their hospitality offerings and infrastructure.

Desire for European destinations still reigned supreme – six of the ten most visited countries in 2013 were European (UNWTO considers Turkey part of the European region). Despite local economic headwinds, international arrivals to Spain increased by 5.7% and in Italy by 2.9%, as visitors contributed $60.4 billion and $43.9 billion to each local economy respectively.

Visitors to the United Kingdom increased by 6.4%, as spending in the U.K. jumped by 12.1% in just one year, reaching $40.6 billion for 2013. Though a recent study estimates that the U.K. is losing over $2 billion worth of revenue every year, solely from Chinese tourists. The same research estimates that Chinese visitors spend 64% more than the average overseas visitor (FT).

Retailers continue to warn that the UK’s insistence on remaining outside the border-free Schengen area covering means that Britain is missing the economic boost given to capitals such as Paris and Milan (FT). The UK has begun to introduce measures designed to better facilitate Chinese tourism, but there remains some way to go before the destination reaches the visitor numbers achieved by its EU neighbours.

“ 82% of Chinese traveller respondents agreed that shopping is my priority when I travel ”

Globe Shoppers

“Shopping is becoming an increasingly relevant component of the tourism value chain,” explains Taleb Rifai, UNWTO Secretary General. “Shopping has converted into a determinant factor affecting destination choice, an important component of the overall travel experience and, in some cases the prime travel motivation.”

Research by JCDecaux confirms this new category of travellers, who consider shopping an integral part of their travel experience. In a recent survey, 96% of people interviewed agreed that they enjoy shopping when visiting a foreign city. 83% consider that shopping is an important part of their trips and 68% choose their travel destination according to the shopping opportunities and available brands at a location.

According to the study, Duty Free shopping is their preferred point-of-sale (75% buy in Duty Free shops, with 78% shopping on their return trip). However high street stores are also important, with 70% of Global shoppers buying in department stores, 62% in luxury brands’ stores and 55% in perfumeries.

Guerlain, Champs-Élysées, Paris

Global Blue christened this segment Globe Shoppers and set out to investigate their habits. 82% of Chinese traveller respondents in their research agreed that ‘shopping is my priority when I travel.’ 56% of Middle Eastern respondents felt the same way, as did 48% of Russian respondents. According to their data, the average shopping budget of a Chinese globe shopper per European trip is €10,800.

In 2013, overall international tourism receipts achieved $1,159 billion, lead by Chinese tourists for the second consecutive year – spending 11.1% of all international tourism receipts globally ($128.6 billion). Ahead of North Americans and Germans, Russian tourists were the 4th biggest spenders, spending $53.5 billion for the year, slightly ahead of travellers from the United Kingdom ($52.6 billion).

Somewhat surprisingly neither Middle Eastern nor Nigerian travellers registered in the Top Ten, yet, Canadians and Australians ranked 7th and 8th respectively. Despite a faltering local economy, Italians still ranked 9th in terms of international tourism expenditure, spending $27 billion on travel related receipts in 2013.

“ In 2013, overall international tourism receipts achieved $1,159 billion, lead by Chinese tourists ”

The Golden Hour

Outside of tax-free shopping and the lure of duty-free, increasing investment is being made by luxury brands into travel retail, specifically within airports. This fast growing market was worth approximately $48 billion in 2013, prompting L’Oreal and Pernod Ricard executives to coin travel retail as ‘the sixth continent’. Luxottica, an Italian maker of sunglasses, described airport sales “the Formula 1 of retail”.

Now more than ever, luxury brands are investing in developing sophisticated flagship boutiques within airports, catching travellers during periods of enforced ‘downtime’ when they are in the mood to spend. “Once passengers step through the security scanner a ‘golden hour’ begins” explains The Economist.

“Most are relatively prosperous; all are briefly at loose ends. Airport retailers, knowing the flight schedules and shopping habits of travellers according to their boarding cards, are primed to receive them.” Merchandise changes hourly depending on arrivals – Cognac for Nigerian men, skincare for Chinese women.

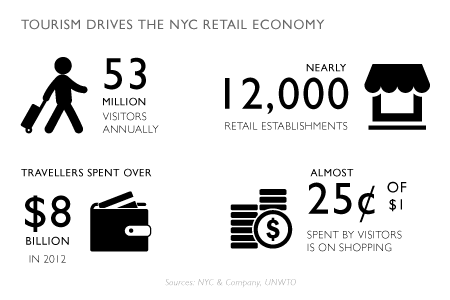

The impact of Tourism on the New York City economy

Sales at airports alone are expected to grow by 73% from 2013 to 2019, according to consultancy Verdict Retail (The Economist). Perfume and cosmetics represent the biggest product category for travel retail with 28% of the market, according to Generation Research, ahead of wines and spirits (18%), fashion and accessories (13.5%) and watches and jewellery (12.2%).

“This channel is becoming very important,” confirms Bruno Pavlovsky, chairman of Chanel’s fashion business. “Customers are spending time in airports where the environment has become increasingly sophisticated” (Reuters).

“This channel affects customers that are more interested in luxury than the average,” echoed Patrick Albaladejo, deputy managing director of Hermès, adding that travel retail represented a “significant” portion of the brand’s total sales. The French brand is working to optimise an existing network of 50 boutiques in airports, to better reflect their global retail design concept and service offering.

In 2013, Selective Retailing – the travel retail arm of LVMH – was the fastest growing of all the group’s businesses for the second consecutive year. The ‘travel retail’ business recorded organic revenue growth of 17% – exceeding €9.8 billion in sales – as recurring profit from operations reached €901 million. The group plans to debut a new retail concept in Venice in 2016, aimed squarely at the traveling luxury consumer.

“ Customers are spending time in airports where the environment has become increasingly sophisticated ”

The Right Audience

Travel retail presents many opportunities for luxury brands beyond transactions. Airports, with their giant hoardings and promotional spaces, are “media”, according to Fabio d’Angelantonio, Luxottica’s chief marketing officer. Airport travellers are generally more receptive to marketing messages than the average consumer, effectively ‘stuck’ in airports in search of entertainment.

In a survey by JCDecaux, 87% of respondents claimed that advertising helps them to better understand the local culture, hence the special attention they pay to brand advertising when landing at an airport when visiting a city. 92% pay particular attention to advertising in airports and 95% to advertising in cities. Effectively, brands can the undivided attention of travellers if they play it the right way.

The Business of Fashion reports that one of the biggest draws for brands within airport stores is the premium customer profile of international passengers. “At an airport you have the best customers,” Brian Collie, former group retail director of the British Airport Authority, explained to BoF.

Hermès, Munich Airport

“Ten, fifteen, twenty million customers going past your door every year and they are 60 percent AB’s,” said Collie, using socio-economic classifications developed by the NRS (National Readership Survey) in which A’s are upper middle class and B’s are middle class. “Airports are a fantastic piece of real estate. The sales density can be significantly higher than the best locations downtown.”

And when they do shop they leave a wealth of data in their wake, giving brands insights into the nationalities, genders and age groups purchasing their products, and which products they prefer. Retailers know precisely when flights will land with what number of passengers from which location, adjusting their offering of products or price points.

Travel retail sales are also assisting brands in knowing where to open future stores, based on purchase spikes by specific nationalities. For L’Oréal travel retail serves as a “kind of control tower”, explains Barbara Lavernos. When she spots groups of travellers heading towards new destinations she alerts the company’s agents in those markets.

“ Travel retail sales assist brands in knowing where to open future stores ”

A Bright Future

According to the UNWTO, the number of international tourist arrivals worldwide is expected to increase by an average of 3.3% a year over the period 2010 to 2030. At the projected rate of growth, international tourist arrivals worldwide are expected to reach 1.4 billion by 2020 and 1.8 billion by the year 2030.

Over time, the rate of growth will gradually slow, from 3.8% in 2012 to 2.9% in 2030, but on top of growing base numbers. In absolute numbers, international tourist arrivals will increase by some 43 million a year, compared with an average increase of 28 million a year during the period 1995 to 2010.

Give or take, the population of China is estimated to sit around 1.3 billion in 2014. Only 97 million Chinese tourists travelled abroad in 2013 (approximately 7.5% of the population) yet these travellers spent $128.6 billion (over 11% of all tourism receipts).

A new report by Asia brokerage group CLSA predicts that the number will double in six years – hitting 200 million by 2020 – driven by higher pay, increased annual leave, relaxed visa policies and overloaded domestic tourism infrastructure.

According to the research, demand for luxury goods from Greater China expanded by 135% between 2009 and 2012, and will comprise 50% of the total luxury goods market by 2020, rising from today’s 31% share. 80% of Chinese tourists surveyed for the report said they purchased goods from local specialty shops, and 60% from duty-free travel stores (Jing Daily).

Louis Vuitton at Incheon Airport

And this is just one group of consumers. Similar patterns can be seen in Brazil, India and Russia, where import and customs issues, difficult foreign direct investment legislation and exorbitant taxes hamper local consumption of luxury goods. Instead, increasingly wealthy middle-class tourists prefer to do their shopping in Miami, London and Dubai, where the prices are lower and the range of products must broader.

Miami is often referred to as the capital of Latin America, whereby wealthy Brazilians are either visiting expressly to shop for luxury goods or investing in Florida real estate. Around 690,000 Brazilians visited Miami in 2012, an increase of 8.8% over the previous year, and they are estimated to have spend $1.5 billion.

Essentially, it seems unlikely that the world of travel will do anything but continue to open. Commercial aviation remains forever changed by low-cost carriers, as services such as AirBnB look to revolutionise the places that we stay. Travel has never been so accessible to such a broad range of consumers, at such low costs. More travel, with more budget to spend on goods.

“Travel retail is like a sixth continent in the world” confirms Barbara Lavernos, managing director of worldwide travel retail for L’Oreal Luxe. “In six years, travel retail will be a US$100 billion business, up from $48 billion today. Our customers today are global shoppers and that has changed how we operate our business.”

To further investigate travelling consumers on Luxury Society, we invite your to explore the related materials as follows:

– What Chinese Consumers Were (And Weren’t) Buying Over Chinese New Year

– To Infinity and Beyond: The Next Frontier of Luxury Travel

– The Growing Complexity of The Chinese Shopper