The newly-released RedNote Beauty Index decodes the platform’s consumer-centric ecosystem, highlighting the strategic shifts prestige beauty brands must embrace to move beyond reach and foster genuine resonance in China.

In a global landscape where platforms like TikTok face headwinds in Western markets, China’s RedNote has quietly surged ahead. According to Bloomberg, the platform’s valuation surged to $31 billion by September in recent transactions—a rise fuelled not only by a strategic influx of international creators, dubbed “TikTok refugees,” but also by its remarkable domestic profitability, estimated at over $1 billion last year, primarily through advertising and commissioned sales.

The engine behind this growth is RedNote’s hyper-active user base: over 300 million monthly active users generate 6 million new posts daily, with 90% consisting of authentic User-Generated Content (UGC). More than a social network, RedNote has become a central hub in the Chinese consumer journey. It is the birthplace of “seeding culture” (literally, “planting grass,” or sparking purchase desire), with 170 million users turning to it for purchasing advice every month.

This shift is redefining China’s brand marketing playbook. Polished, brand-generated content is losing traction as consumers increasingly rely on peer recommendations. To decode this evolution, DLG (Digital Luxury Group), Newrank, and RedNote data platform Xinhong have once again joined forces to release the all-new RedNote Beauty Index 2025.

The report analyses the performance of 70 leading skincare, makeup, and fragrance brands across official accounts, share of voice, paid content, and search trends. By benchmarking this data against 130 leading luxury brands, it reveals how beauty—one of RedNote’s most established and mature industries—is navigating the seismic shifts of China’s digital ecosystem and competing in a red ocean.

Fighting for Visibility

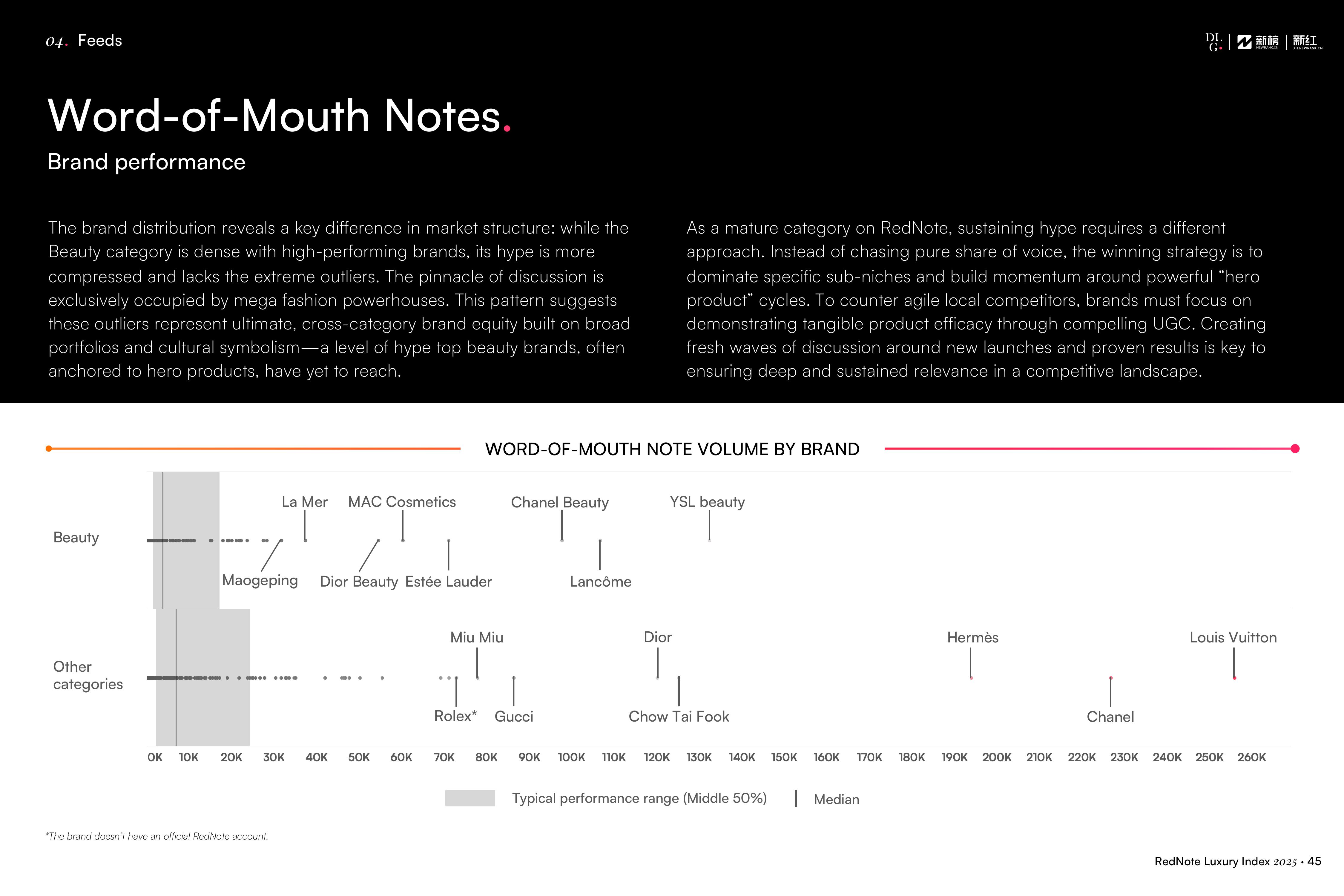

Once the uncontested home of beauty content, RedNote’s landscape has diversified. Today, prestige beauty accounts for just 27.2% of overall brand buzz, overshadowed by luxury fashion at 50.0%. Even top-tier brands like Estée Lauder and Lancôme struggle to match the per-brand word-of-mouth note volume of luxury powerhouses such as Louis Vuitton and Hermès. This signals a new reality: beauty must fight harder to maintain visibility.

Despite the rise of C-beauty, the prestige segment remains dominated by international giants. Yet challengers like Maogeping—founded by a renowned local makeup artist—are ascending to the top tier, rivaling legacy brands across almost all benchmarks: brand activity, share of voice, and search volume.

Credit: RedNote Beauty Index 2025, DLG (Digital Luxury Group), Newrank, and Xinhong

Where beauty truly excels, however, is in consumer intent. Search—the most direct indicator of purchase consideration—remains beauty’s stronghold. Prestige beauty commands 44.5% of total search volume across our luxury sample, proving that when it comes to research and purchase, RedNote users think beauty first.

A Shift of Influence

Compared to luxury brands, which prioritise meticulous curation of brand-owned accounts, beauty brands adopt a leaner approach. Their official accounts often post less frequently and with less content diversity, resulting in slower follower growth and lower reach for brand-owned content. However, this is not a weakness but a strategic choice, reflecting a deeper understanding of RedNote’s UGC-driven ecosystem.

Beauty brands have industrialised influencer marketing to drive visibility. The average beauty brand activates 876 commercial notes per month (paid collaborations managed via Pugongying, a RedNote-owned tool)—a staggering 18 times the average of the broader luxury sector.

This strategy is built on a sophisticated understanding of the influencer pyramid. Within beauty, specialist Top KOLs (500k+ followers) have cultivated powerful communities that generate over 120% more engagement per person than celebrities in paid posts, and over three times the engagement in organic content. This proves that on RedNote, deep expertise and community trust can be more potent than general fame. Beneath them, a vast army of KOCs (<5k followers) and Micro KOLs are activated at scale through product seeding, building widespread social proof at a decentralised level.

Credit: RedNote Beauty Index 2025, DLG (Digital Luxury Group), Newrank, and Xinhong

Agility is King

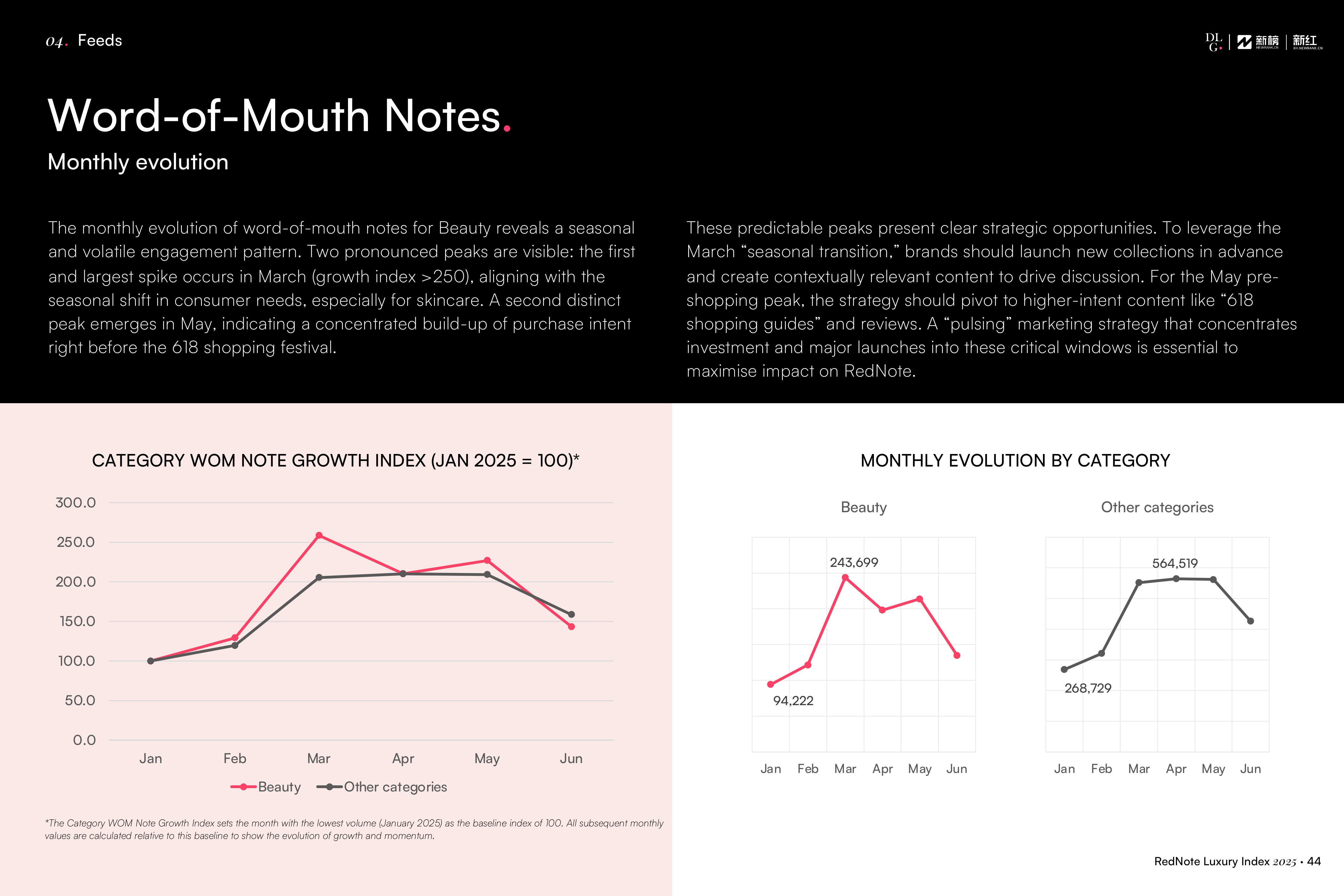

Even with a deeply embedded RedNote strategy, brands must contend with a consumer-centric platform where users follow their own cadence. A brand’s marketing plan does not always align with the natural rhythm of user discussion.

A stark example is Lunar New Year: whilst a peak period for brand marketing, it is a valley for organic UGC creation. Chinese consumers, focused on family and quality time, are less active on social media, proving that even major shopping events do not guarantee high engagement.

Credit: RedNote Beauty Index 2025, DLG (Digital Luxury Group), Newrank, and Xinhong

Beauty brands employ a more “pulsing” strategy than luxury—boosting post frequency by 15% during festivals—but true success requires alignment with organic user patterns.

Data shows, for instance, that March is a major organic peak for beauty UGC. This month, containing no major shopping festival, marks the transition from winter to spring—a time when countless users proactively research and purchase products for their changing skincare routines. For brands, this represents a golden opportunity to align content and commercial notes with genuine, consumer-led demand, rather than relying solely on the traditional marketing calendar.

Credit: RedNote Beauty Index 2025, DLG (Digital Luxury Group), Newrank, and Xinhong

The prestige beauty landscape on RedNote has undeniably matured. The challenge is no longer about establishing a presence, but defending and growing market share in a hyper-competitive environment. The future of prestige beauty on the platform will be defined not by who shouts the loudest, but by who connects the deepest. Success requires a strategic pivot from chasing reach to cultivating resonance—building a true brand moat.

Download the complete RedNote Beauty Index 2025 now below. The next edition, RedNote Luxury Index 2025, featuring a comprehensive analysis of 130 brands across Fashion, Jewellery, Watches, and Wine & Spirits, will be released in October. Stay tuned for insights into how luxury navigates China’s rapidly evolving digital landscape.