China’s handbag market is rebounding unevenly, with growth concentrated in the premium and absolute-luxury segments while aspirational brands face structural pressure. Value polarisation, overseas spending and grey-market expansion are accelerating this divide and redefining competitive advantage.

While the personal luxury goods market is expected to return to growth in 2026, according to Bain, its largest category, leather goods, is set to continue contracting. This structural weakness not only weighs on overall industry momentum, but also raises questions around the perceived legitimacy of luxury value.

Handbags have long served as the commercial backbone of Europe’s leading luxury maisons. Houses such as Louis Vuitton, Hermès and Gucci all trace their origins back more than a century to leather craftsmanship. This intimate accessory – carried on the shoulder, wrist or in hand – has historically functioned as a powerful vehicle for brand storytelling and savoir-faire, while standing as one of the most recognisable status symbols sought after by consumers across social strata.

So what is happening? Luxury consumption has not disappeared. Yet handbags, once the most explicit marker of status, are beginning to lose their allure.

Nowhere is this shift more pronounced than in China, a market navigating a period of luxury fatigue. In response, DLG and ReHub’s latest whitepaper, Inside China’s Handbag Reset, examines how both demand drivers and the value proposition of luxury handbags are being challenged, and what legacy players can learn from premium brands that continue to thrive amid a market slowdown.

The Two Faces of Value

Against a backdrop of macroeconomic softness, consumers are becoming increasingly attentive to the intrinsic value of luxury products. This shift does not simply equate to a pursuit of lower prices. As consumption frequency potentially declines, the search for value for money is pushing consumers towards two distinct and increasingly polarised directions.

On one end, shrinking discretionary income is forcing consumers to trade down. They compare prices more actively, seek the most cost-efficient purchasing channels, or opt for brands positioned at lower price tiers. On the other, heightened value consciousness is prompting consumers to factor in a product’s monetisation value, including its scarcity, resale potential and market liquidity. Under this logic, items that are both exclusive and highly tradable are becoming more desirable.

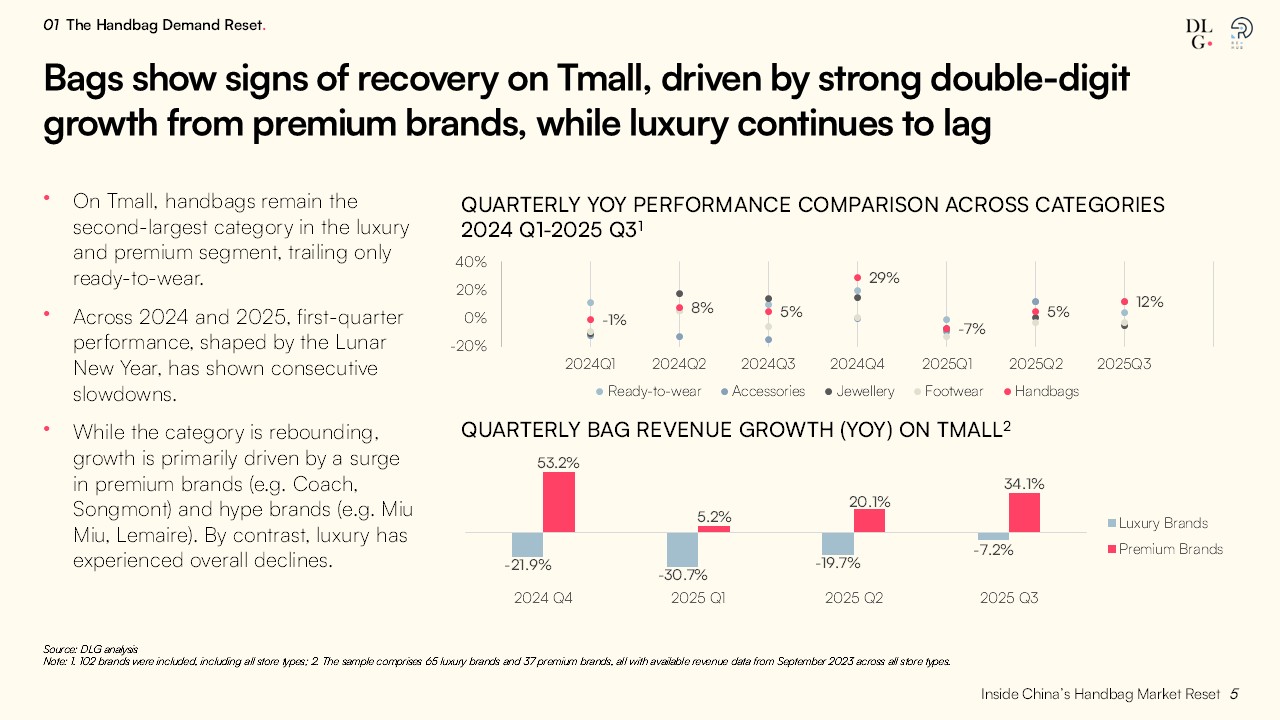

This dynamic is accelerating industry polarisation. Premium brands are gaining momentum, supported by accessible price points and renewed cultural relevance driven by brand rejuvenation efforts. At the same time, absolute luxury players, most notably Hermès, Brunello Cucinelli and Loro Piana, remain firmly on a growth trajectory.

Credit: Inside China’s Handbag Reset, DLG & Re-Hub

Caught in between, aspirational luxury maisons face sustained headwinds in an environment where value has become the dominant currency. Their pricing, symbolic status, exclusivity, and product power are increasingly squeezed by pressure from both ends of the pyramid. While the broader market may recover, these structural vulnerabilities remain unresolved.

Understanding Brand Revenue Leakage

For brands seeking to sustain growth in China, two factors can no longer be ignored.

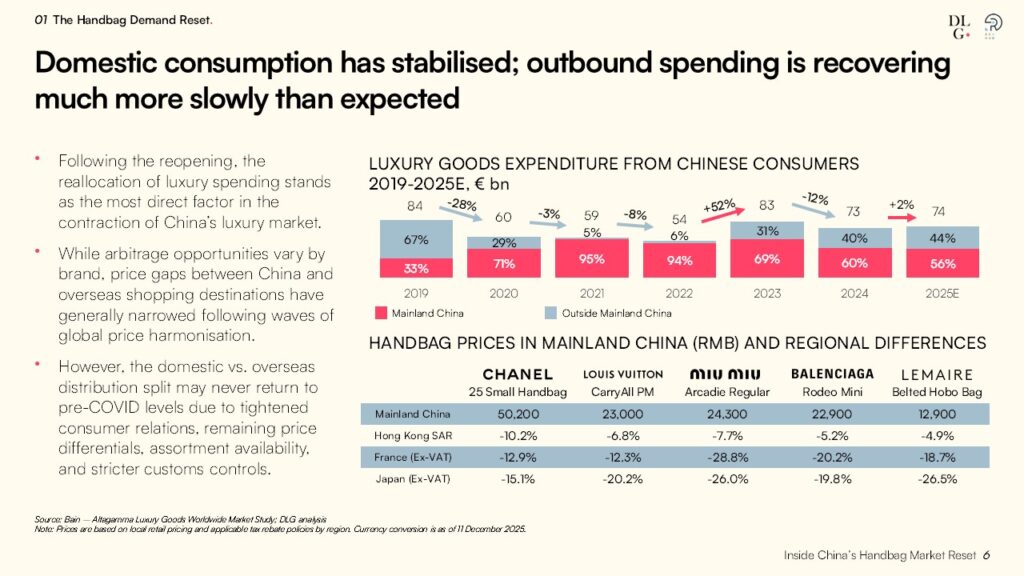

The first is consumption leakage overseas. While Chinese luxury spending abroad has yet to return to pre-pandemic levels, it has already rebounded to 44 percent of total consumption. The second is the rapid expansion of parallel channels, including the grey and resale markets, which are eroding brands’ direct revenues by offering lower prices and immediate availability.

Before the pandemic, overseas purchases accounted for nearly two-thirds of Chinese consumers’ total luxury spend. Travel restrictions temporarily redirected this demand back onshore, fuelling rapid brand expansion in mainland China. Historically, price arbitrage has been the primary driver behind overseas luxury shopping. While price gaps still exist today, ranging from 5 to 30 percent depending on brand and destination, the consumer context has fundamentally shifted.

Evolving travel habits, elevated domestic retail experiences and tighter customs controls are reshaping overseas consumption. More critically, domestic parallel channels are now offering consumers faster and more convenient access to discounted products.

Inventory sourced from daigou networks, wholesalers or royalty-linked channels often flows into the grey market through largely unregulated routes. On these platforms, products, excluding ultra-scarce brands such as Hermès and Goyard, are frequently priced below official retail, and often even below overseas prices. Grey-market platforms are absorbing entry-level, price-sensitive consumers. Beyond that, their see-now-buy-now convenience is increasingly influencing the behaviour of high-end clients as well.

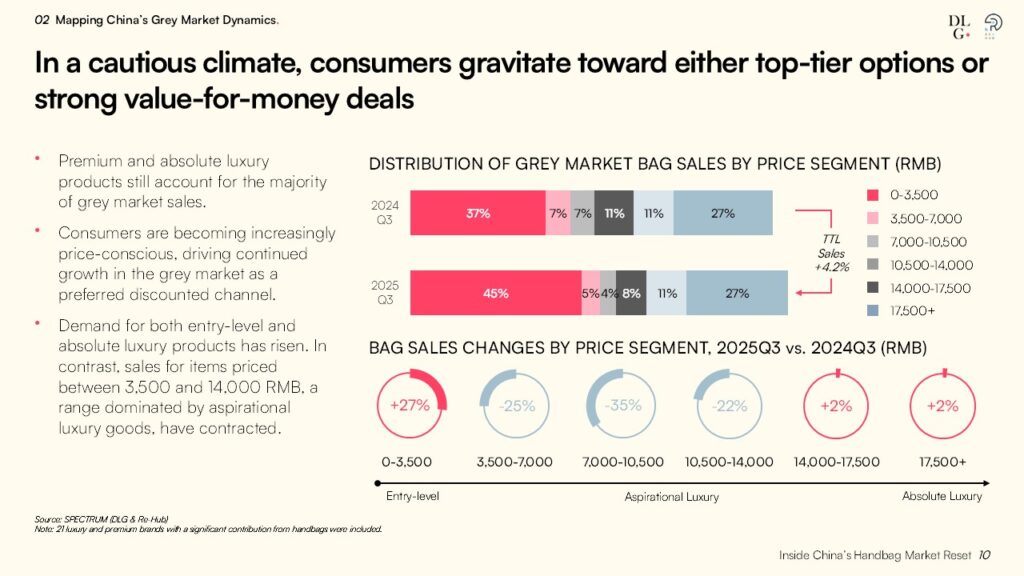

Compared with the third quarter of 2024, handbag sales rose by 4.2 percent in 2025 within the grey market. The data mirrors broader polarisation trends. Sales of handbags priced below RMB 3,500 surged by 27 percent, while products above RMB 14,000 grew by 2 percent. In contrast, the mid-range price segment declined sharply by 26 percent.

A Face-Off Between Premium and Luxury

As the gravitational pull of aspirational luxury brands – such as Gucci, Prada and Dior – weakens, premium brands are gaining visible traction. Crucially, this is not a story driven purely by affordability. Grey-market data shows that within the RMB 4,000 to 6,000 price range, premium brands’ share of sales rose from 29.2 percent in 2024 to 47.6 percent, indicating that these players are moving decisively upmarket.

At first glance, this may appear counter-intuitive. Historically, premium brands were positioned as a gateway to luxury, offering aspirational consumers prestige-coded products at lower price points. Today, however, the premium brands gaining momentum in China, such as Coach, Longchamp and local disruptor Songmont, are no longer relying on price alone to establish relevance with contemporary consumers.

Coach’s 2022 rebranding around the concept of “Expressive Luxury” marked a deliberate shift towards a more modern identity and an elevated product architecture. Subsequent breakout styles such as Empire and Brooklyn not only gained visibility through New York Fashion Week and the Lyst Index, but also enabled Coach to successfully premiumise its portfolio and expand its price range.

Credit: Courtesy of Coach

Coach’s repositioning did not come at the expense of its core audience. Entry consumers who prioritise affordability remain an integral part of the brand’s revenue base. On Tmall, discounted monogram styles such as Cassie and Day continue to contribute meaningfully to sales performance.

Coach has adopted a dual-track strategy. Runway-led new collections are tightly controlled in terms of volume and discount exposure to create desirability. On the other, flexible promotional mechanics are applied to more commercial styles to secure scale and revenue. Notably, official discounts on certain products are now aligned with grey-market pricing, effectively mitigating revenue leakage while protecting brand equity from further dilution.

The playbook of these premium brands illustrates a critical point. Image elevation and value accessibility are not mutually exclusive. Brands can move upmarket while still safeguarding their existing client base through approachable pricing structures.

At this generational inflection point, the definition of “luxury” itself is being re-examined. Its traditional association with high price, distance and exclusivity is under increasing scrutiny. By contrast, the meaning of “premium” has successfully decoupled from price alone. Driven by the rebranding of legacy players and the rise of new challengers, premium today stands for modernity, agility, and individuality.

To explore deeper insights into the evolving dynamics of luxury and premium handbags in China, please complete the form below to download the full report.