Despite economic headwinds, Chinese luxury consumption remains resilient – it is simply changing location. An industry insider reveals why brands must look beyond domestic sales figures to understand the true state of the market.

As the world turns its attention to the escalating trade tensions between China and the United States, keen industry observers have started weighing in on the implications of these new tariffs on both economies. This added pressure on the Chinese economy has fueled mounting questions about a further slowdown in Chinese luxury consumption. But has Chinese luxury spending really been experiencing the dramatic decline that headlines suggest?

In the second episode of The Luxury Society Podcast, Jacques Roizen, former Greater China GM of Pandora and current Managing Director of DLG China Consulting, offers a more nuanced perspective on this hotly debated topic.

Reframing China’s Luxury Narrative

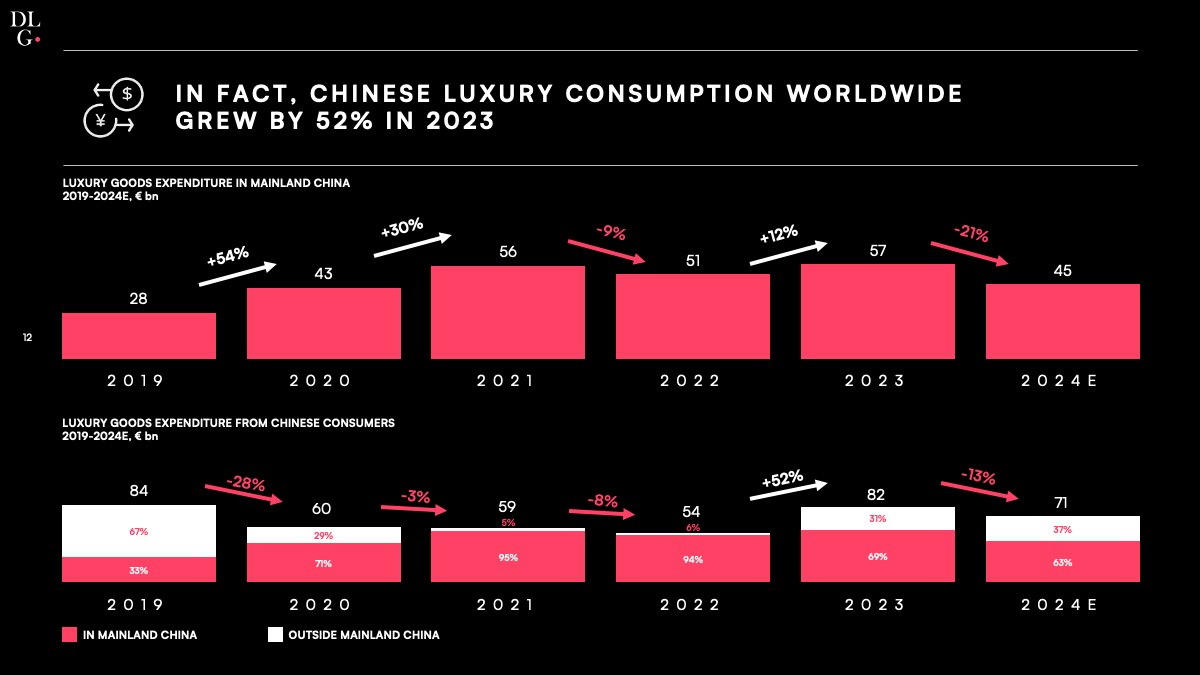

The supposed luxury slowdown in China requires careful contextual analysis rather than headline-grabbing generalizations. While Bain & Company reported a 10% decline in personal luxury goods sales in mainland China for 2023, this figure fails to capture the complete picture of Chinese luxury consumption globally.

“I think the narrative gets a lot of the core facts right, but the conclusion is wrong,” states Roizen, challenging the prevailing perception of China’s luxury market.

“What happened during the pandemic is that Chinese consumers, not being able to travel, started spending a hundred percent of their luxury consumption inside China. However, they only spent two-thirds of what they used to spend,” he explains.

This shift created a misleading impression of market growth within China’s borders. “From that standpoint, there was a lot to celebrate because luxury consumption inside China increased by a hundred percent. What nobody really emphasized is that in the process, the luxury industry lost a third of its Chinese consumer expenditure during COVID,” Roizen points out.

China’s economic challenges remain significant in 2025, with youth unemployment and a sluggish real estate sector impacting consumer confidence. The National Bureau of Statistics reported a youth unemployment rate of 16.9% in February 2025, reflecting ongoing difficulties for young job seekers despite government efforts to stimulate the economy. The real estate sector continues to struggle, with property developer debt issues affecting market stability. These fundamentals have contributed to a more cautious consumer environment, particularly in the luxury market.

“There’s a difficult job market. There’s a challenging real estate market in China, and these are fundamentals that affect the growth of the market,” Roizen acknowledges. Yet he cautions against catastrophic interpretations: “The narrative of a slowdown is correct in the sense that the market hasn’t grown in the last five years. However, you can’t talk about it in double-digit declines.”

Post-Pandemic Redistribution of Luxury Consumption

The reopening of borders following pandemic restrictions has triggered a significant redistribution of Chinese luxury spending patterns, challenging brands to adapt their strategies accordingly.

“Because of this redistribution of consumption from a hundred percent in China during the pandemic to today, where up to 40% of luxury consumption happens outside China, has had an impact on this one KPI that can be quite misleading, which is the consumption of luxury in China,” explains Roizen.

This shift in spending locations rather than overall spending power explains much of the apparent “slowdown” within mainland China. According to Morgan Stanley research, Chinese travelers are expected to take approximately 260 million outbound trips by 2029, representing a significant recovery and growth from pre-pandemic levels.

Luxury Retail in the Region Surges

The geographical patterns of this overseas spending have evolved noticeably. “When the borders reopened, 80% of the luxury consumption outside China by Chinese consumers was taking place in Hong Kong and Macau,” notes Roizen. “Today, the number one destination is Japan. When you go to Tokyo luxury stores, you see about 80% of the consumers inside the stores are Chinese consumers talking to sales associates who speak to them in Chinese.”

This observation aligns with recent data from Japan’s Tourism Agency, which reported that Chinese visitors were the top spenders among foreign tourists in late 2023, contributing over ¥380 billion (US $2.5 billion) in total expenditure with an average per-capita spending of ¥370,000 (US $2,450) per visit. Luxury purchases accounted for approximately 43% of this spending, according to the agency’s quarterly consumption survey. The Japan Department Stores Association noted that duty-free sales in department stores have surged by 31.7% year-over-year, with brands like Louis Vuitton and Hermès seeing particularly strong demand from Chinese tourists, who now account for 62% of all luxury purchases by foreign visitors in Tokyo’s Ginza district.

Southeast Asian destinations have also become increasingly important. Singapore Tourism Board data shows Chinese visitors ranking among the highest spenders, with an average expenditure of SGD $2,850 (US $2,130) per visitor in 2023, with luxury shopping being a primary activity representing 37% of their total spending. Chinese tourists accounted for over SGD $2.1 billion in retail expenditure in Singapore, with Orchard Road’s luxury boutiques reporting that Chinese customers now make up over 40% of their clientele on weekends.

“The challenge is that at the end of the day, when you are managing a China P&L and your revenue is down, you have to right-size your cost structure,” says Roizen. “And so brands are currently reshuffling their P&L in order to reallocate spend accordingly.”

The China Marketing Imperative: Why Cutting Back Is Costly

Despite the geographical redistribution of spending, maintaining strong marketing investments within China remains crucial for luxury brands seeking global success with Chinese consumers.

“Whether [a consumer] spends in China or outside China, you need to invest in China because the desirability needs to be created where [he or she] is to receive all the marketing investments,” Roizen says. This insight highlights the importance of understanding the customer journey rather than focusing solely on the point of purchase.

The consequences of reducing China-focused marketing can be severe and far-reaching. “Brands that are tempted to cut marketing in China because revenue is down are going to pay the price not just in Shanghai, Beijing, or Chengdu, but also in Tokyo, Singapore, Hong Kong, and Europe,” warns Roizen.

McKinsey’s 2023 China Consumer Report reinforces this view, finding that over 70% of Chinese luxury consumers research brands extensively online before making purchases, regardless of whether those purchases ultimately occur domestically or abroad. This underscores the critical nature of maintaining digital touchpoints within China.

One particularly powerful platform for brand building in China is Tmall. “Take any luxury brand that has a flagship store on Tmall – they don’t have a single retail store, fashion show, or campaign in the world at any point that gets more eyeballs every day than their Tmall flagship store,” Roizen points out. “You’re talking about the most visible consumer touchpoint, and it stops being about just generating e-commerce revenue and becomes about shaping the perception of the brand.”

Changing Geopolitical Conditions

Amid intensifying trade tensions, luxury brands face a complex operating environment. Recent tariff hikes and retaliatory measures have prompted more cautious investment strategies. Yet, according to some analysts, brands with strong heritage equity may be better insulated from short-term geopolitical volatility, as their value proposition is rooted in cultural legacy rather than transactional appeal. Marketing efforts in such times serve less as direct conversion drivers and more as long-term brand equity builders – especially vital in a market as nuanced as China.

Looking ahead, staying relevant means future-proofing through next-gen engagement. China’s Generation Z is projected to account for 20% of global luxury growth through 2025, according to Bain & Company – underscoring the importance of sustained presence despite economic headwinds. Brands that deprioritize China risk losing touch with a demographic critical to the sector’s evolution – one that is digitally native, values-driven, and increasingly influential on global luxury trends.

For more insights from Jacques Roizen, Bénédicte Soteras, and Brian Duffy, CEO of Watches of Switzerland Group, tune in to the second episode of The Luxury Society Podcast on Spotify, Apple Podcasts, or other major podcast platforms.