The new RedNote Luxury Index reveals that community power on RedNote is actively reshaping how brands approach content creation, influencer collaborations, and word-of-mouth marketing.

On 30 May 2025, Chanel finally made its debut on RedNote, posting content for its fashion, jewellery and watch lines. This move signals that even the most digitally cautious luxury houses have acknowledged the platform’s clout. In just five months the account has racked up nearly 60,000 followers. By contrast, Chanel Beauty joined the platform five years earlier and now boasts over 250,000 followers.

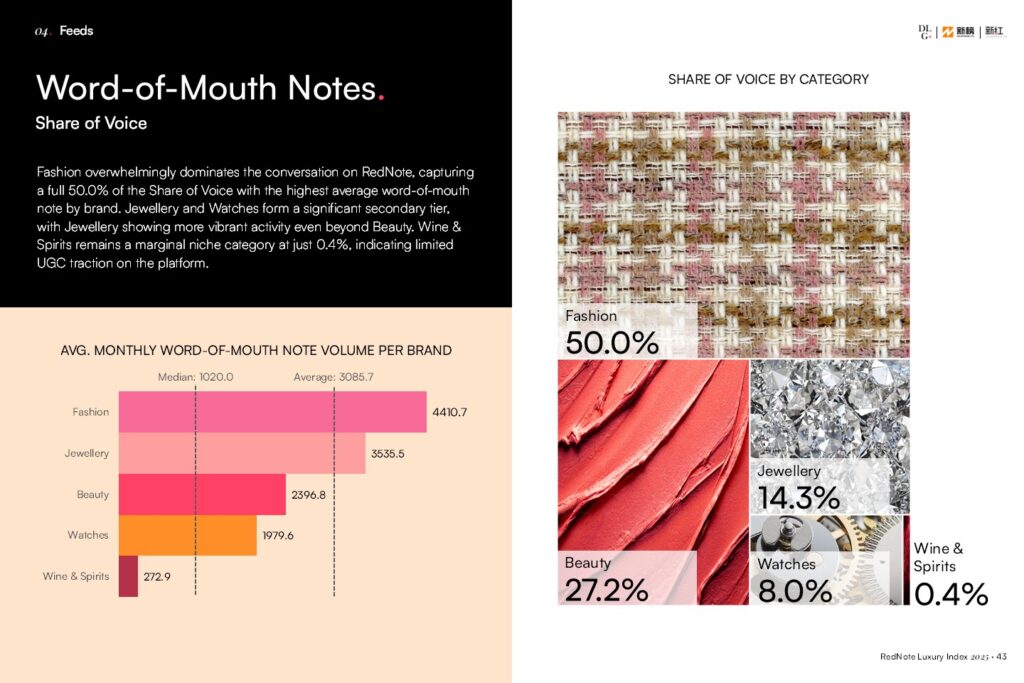

Chanel’s arrival highlights a crucial change in how RedNote is perceived. Once pigeonholed as a lifestyle app for young women where beauty content reigned supreme, RedNote has evolved. Research by DLG, NewRank and Xinhong into 200 premium brands shows a clear shift: high-end fashion has overtaken prestige beauty in share of voice on the platform.

This trend cements RedNote’s position as a strategic digital channel for luxury. Leading brands are reallocating budgets towards the platform, while niche players see it as a powerful way to build a dedicated Chinese community and amplify their voice through authentic advocacy from followers and KOLs (Key Opinion Leaders).

To probe luxury’s strategies and impact on RedNote today, DLG, NewRank and XinHong have joined forces. Following last month’s prestige beauty report, they now present the RedNote Luxury Index 2025. The study analyses 130 luxury brands across four categories: fashion, jewellery, watches, and wines & spirits. The report finds that user-generated content (UGC) is now the dominant source of brand visibility, and that the vox populi is actively reshaping how brands approach content, influencer partnerships and word-of-mouth marketing.

Flavour of the Month, But Still Green

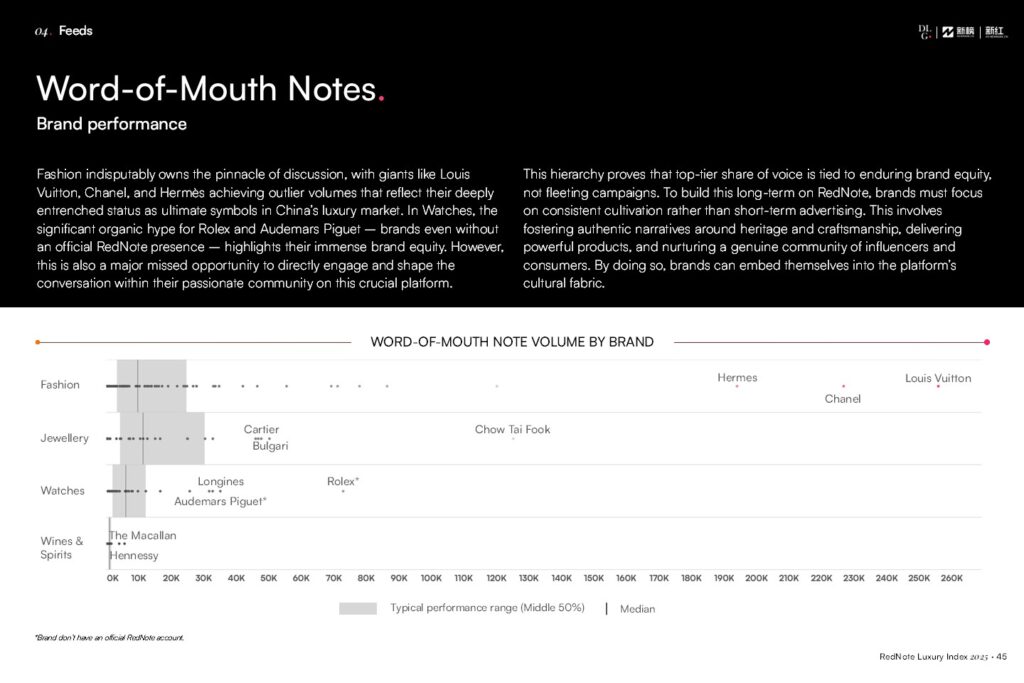

In the first half of 2025, UGC volume for 70 luxury fashion brands was nearly double that of 70 prestige beauty brands. Jewellery and watches followed, though with fewer players and more niche audiences. Fashion’s share of voice is dominated by mega-houses such as Louis Vuitton, Chanel and Hermès, whose cross-category presence and cultural legacy give them an influence most product-driven beauty brands cannot match.

Most brands have established an official presence on RedNote, seeing it as essential to fuelling platform visibility. The watch industry, however, remains a notable exception: the two loudest names – Rolex and Audemars Piguet – still do not have official accounts. While they clearly aim to preserve exclusivity by keeping social media at arm’s length, their brand power alone keeps them at the top of platform conversations.

There is a marked difference in consumer behaviour. Compared with beauty shoppers, most luxury consumers on RedNote are still at the start of their journey – a pattern evident in search behaviour. Over 40% of beauty searches are for specific product names; in luxury, that figure drops to just 8%. In fashion and jewellery, roughly half of all searches are for general category terms (for example, “handbag” or “necklace”), indicating that many users are browsing and discovering rather than shopping with clear intent.

There are exceptions. Twenty brands in the study have created truly iconic products whose names alone rank among top search keywords – from the Louis Vuitton Carryall to Tod’s Gommino loafers – showing these pieces have become cultural shorthand and top of mind for consumers.

Community-Defined Strategies

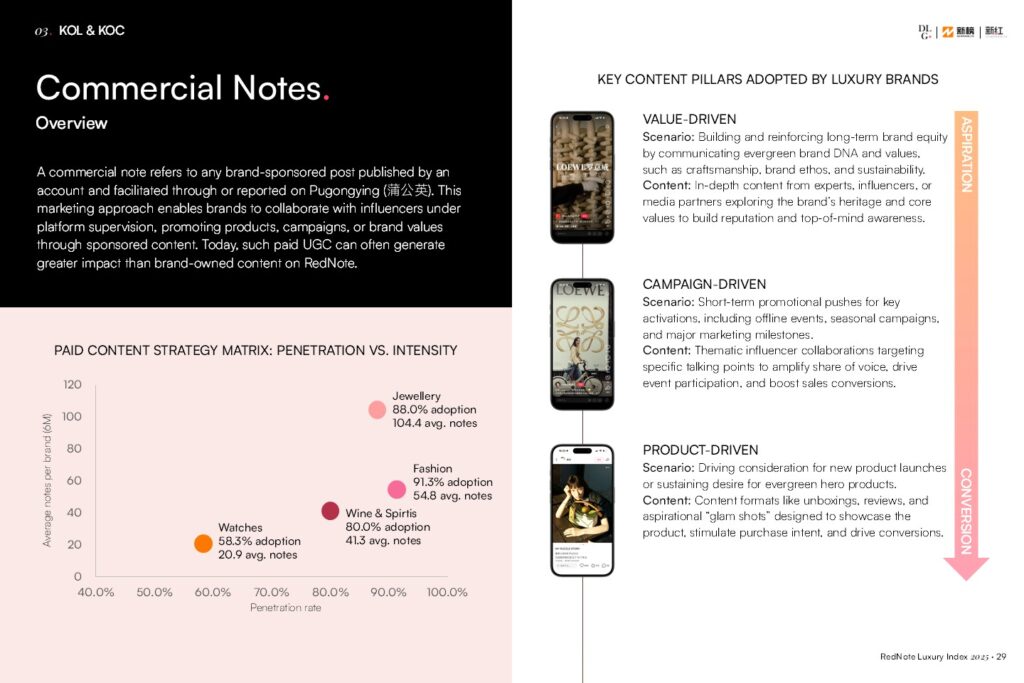

RedNote’s luxury community largely defines brand buzz: it sets trends, fuels hype and shapes reputation. The platform sees roughly six million new posts a day, around 90% of them from ordinary users. That collective power is now directly influencing brand activation strategies.

To earn sustainable engagement, brand posts must blend into the community’s native content flow. That means using familiar formats (such as scrapbook-style photo-text posts, a trick leveraged in the past); adopting a relaxed, relatable tone; and weaving brand messaging into lifestyle storytelling rather than relying on one-way broadcast campaigns. Over 35% of luxury brand content now explores wider lifestyle themes – entertainment, travel and hobbies – showing brands are diversifying narratives to build broader relevance.

Brands must also align their marketing calendars with user behaviour. RedNote is a platform for research and inspiration; purchase consideration can begin weeks or months before peak shopping events. Given the platform’s algorithm- and search-driven feed, content posted at the last minute may struggle to surface to the right audiences and followers.

This mismatch is clear around Lunar New Year, the key marketing moment for luxury. Although brand posts during the festival attract engagement, January and February see the lowest levels of UGC as users go offline to spend time with family. The lesson: to enter consumers’ consideration sets, brands must seed their campaigns on RedNote well in advance rather than simply mirroring the timing used on other social or e-commerce platforms.

An Underused Influencer Ecosystem

RedNote’s preference for peer-generated content has fuelled a thriving influencer ecosystem. These creators combine professional production values with an approachable voice that helps seed desire among everyday users.

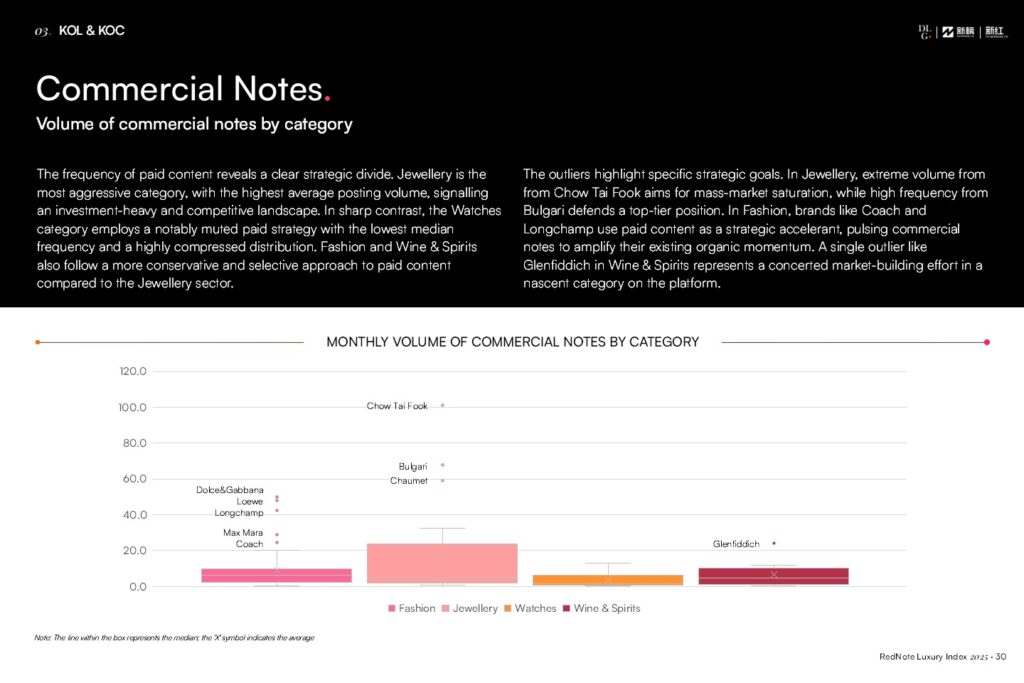

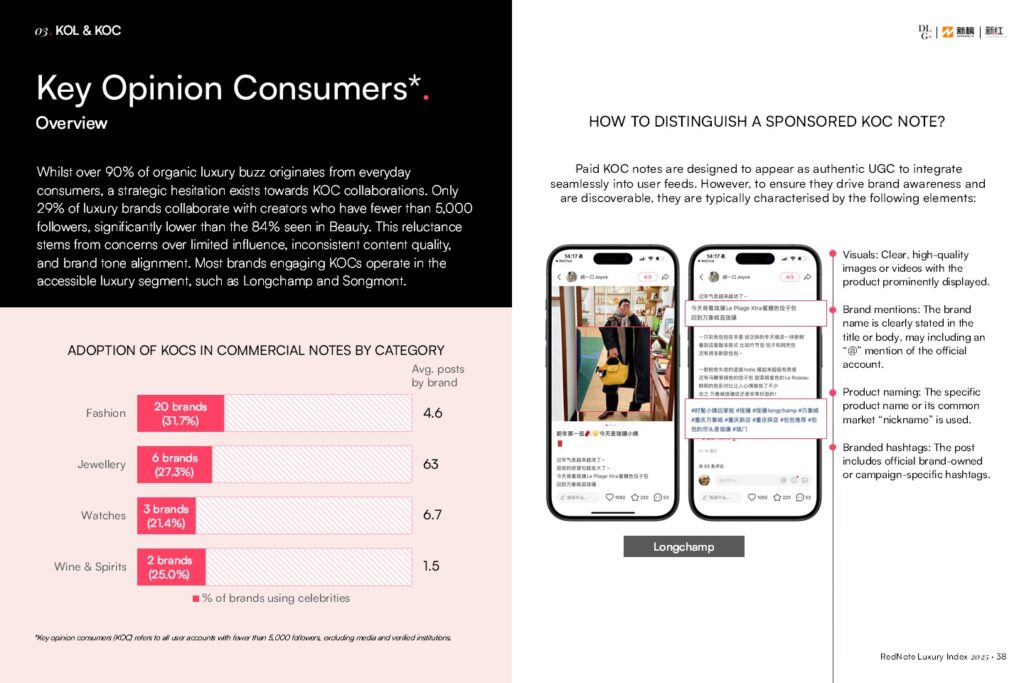

Beauty is the master of influencer marketing. Brands such as Helena Rubinstein, SkinCeuticals and Charlotte Tilbury built momentum in China through strong KOL networks. In the first half of 2025, 96% of beauty brands on RedNote engaged in monitored KOL collaborations by Pugongying (蒲公英), averaging over 150 co-created pieces of content per month. By contrast, while 84% of luxury brands also partnered with influencers, their monthly average was just 10 – a striking disparity.

This gap shows that while luxury brands recognise influencer value, much of their investment still centres on building official accounts rather than committing to deep KOL strategies. Concern over image alignment and tone consistency is a significant restraint.

In beauty, over 84% of brands work with Key Opinion Consumers (KOCs, with under 5,000 followers). In luxury, only 31 brands (23.8% of the sample) do so, mostly accessible luxury names such as Chow Tai Fook and Longchamp. Part of this reflects content quality concerns; another part is practical – luxury goods’ high price points make mass seeding less feasible.

Yet forward-thinking brands like Loewe are shifting from “product seeding” to “culture seeding,” partnering with micro-creators in travel, design and art to promote brand culture without a direct product focus. It’s a refined way to convey brand values and widen collaboration opportunities. The same thinking now underpins large-scale offline activations and exhibitions in China, inviting consumers to visit, experience and share.

RedNote’s rise has reshaped China’s luxury marketing mindset and reflects a wider global trend: top-down, broadcast-style communication no longer resonates. Savvy brands understand that real influence today is not merely broadcast – it is co-created.

Alongside industry benchmarks and case studies, the report includes brand rankings on Voice, KOL Investment and Heat, powered by the RISE methodology. For full rankings and the complete report, download the RedNote Luxury Index 2025 below.

Cover image credit: This image was generated by Google AI for illustrative purposes.