With 34% sales growth, a younger customer base, and an unwavering commitment to sustainability, the Swedish electric carmaker is proving that challenger brands can thrive in a market dominated by legacy giants

The global electric vehicle market has entered a new phase. After years of explosive growth – global EV sales surpassed 17 million units in 2024, according to the International Energy Agency – the industry now faces a more complex reality: intensifying competition, subsidy rollbacks in key markets, and a consumer base that is growing more discerning about which brands deserve its attention. Legacy automakers from Mercedes-Benz to BMW have poured billions into electrification, while Tesla continues to command outsized market share. Amid this crowded field, a Swedish-designed, Chinese-owned challenger brand is quietly building momentum.

Polestar, the electric performance marque, delivered more than 60,000 vehicles in 2024 – a 34% increase on the prior year and a record for the company. Speaking on a recent episode of The Luxury Society Podcast, CEO Michael Lohscheller laid out a vision defined by patience, design conviction, and sustainability – qualities he believes will differentiate Polestar in an era where simply being electric is no longer enough.

Rising to the Challenge

Originating as a Volvo‑affiliated racing and performance outfit in the 1990s, Polestar was re‑launched in 2017 as a standalone electric performance car brand in which Volvo Car Group and its parent company, Geely, have stakes in. Headquartered in Gothenburg, Sweden, the company combines Scandinavian design sensibility with access to Chinese manufacturing scale and technology – a combination that gives it strategic flexibility but also places it in direct competition with well-capitalised incumbents. To reach profitability, Lohscheller estimates the brand needs to surpass 100,000 units in annual sales, a threshold that remains some distance away but one that he approaches with measured confidence.

“We don’t do cars for everybody. Some of our cars, like the Polestar 4, doesn’t have a rear window. Not everybody loves it, but a lot of people love it and that’s why the car is very successful,” says Lohscheller.

The Polestar 4, which comes without a rear window and instead relies on a digital rearview mirror

This willingness to polarise rather than please is central to Polestar’s brand strategy. In a segment where many manufacturers are converging on similar design language and feature sets, the company has opted to lean into distinctive choices – from unconventional vehicle architecture to its early adoption of Google’s Android Automotive operating system, making it one of the first carmakers globally to integrate the platform natively into its vehicles.

“Our game plan to win is that we are a challenger. We are challenging the industry. We are challenging the competition, and we try out new things. Over and above that, we do beautiful cars,” says Lohscheller. He frames the company’s ambition through a lens of purposeful restraint, drawing an analogy from his personal passion for distance running.

“I’m a passionate runner and one of the secrets of long distance running is don’t pace too fast at the beginning or in the middle. It’s a longer journey, and we are on the right path and we have the right pace. So let’s continue.”

This measured approach appears to be resonating. According to Polestar’s 2025 annual report, the brand’s growth was driven by strong demand across its expanding model range, which now includes the Polestar 2 fastback, the Polestar 3 SUV, the Polestar 4 SUV coupé, and the Polestar 5 four-door GT.

“We want to have very special cars, very unique cars where people get excited and see like it’s a beautiful car. It has special things in terms of performance, innovation, but also where you know you do something good for climate,” he adds.

The Sustainability Imperative

While sustainability as a communications narrative has cooled across much of the consumer landscape, Polestar has moved in the opposite direction, doubling down on climate-conscious positioning as a core brand differentiator.

According to a McKinsey & Company survey published in December 2023, a significant generational gap exists in electric vehicle (EV) adoption intent. The study found that 50% of younger consumers (defined as those under age 50) would consider an EV for their next car purchase, compared to only 29% of older consumers (those aged 50 and above).

The numbers suggest this strategy has tangible appeal. The average age of a Polestar buyer is 45, roughly a decade younger than the industry average of 55, according to Lohscheller.

“We use renewable energies. We brought the CO2 emissions down in our cars by 25% the last four years. People want to feel good about the car. You spend a lot of time in a car every day,” Lohscheller says. “And I think it’s important that you think: ‘Yeah, it looks good, it feels good, and I feel good as a driver or as a co-driver, as a passenger, because I have made the right decision.’”

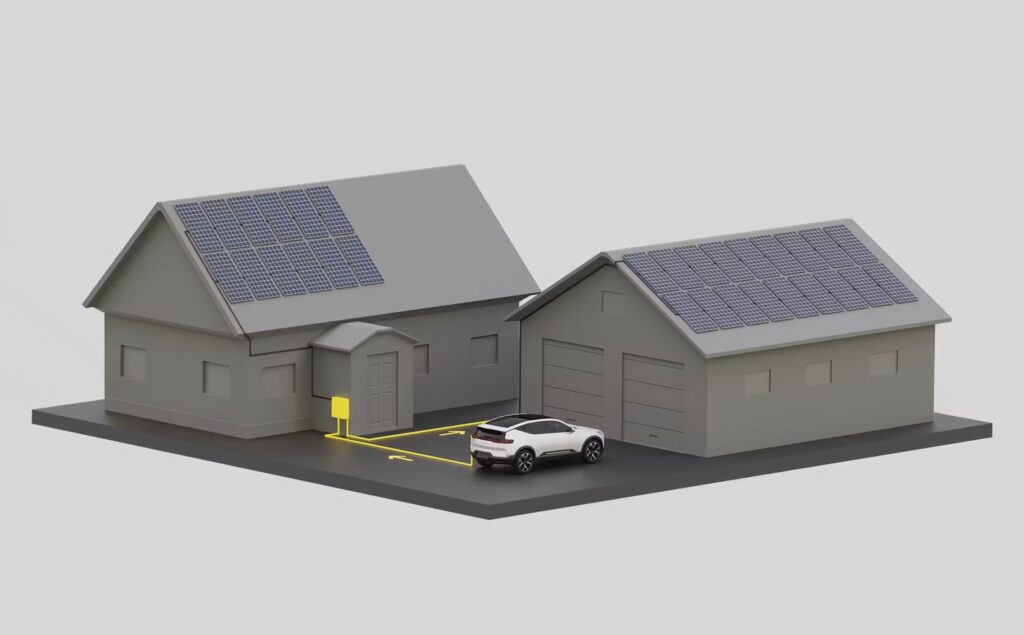

Polestar’s bidirectional charging debuted on the Polestar 3, enhances sustainability by transforming vehicles into mobile energy storage units that stabilise the electrical grid and power homes, particularly with renewable sources

This emphasis on emotional storytelling echoes a broader pattern across the luxury automotive sector. As Porsche’s Global Director of Brand Management & Partnerships Deniz Keskin observed in an earlier episode of The Luxury Society Podcast, desire in luxury is driven by something “emotional and irrational” – and brands that forge this connection early with younger audiences are building long-term loyalty. For Polestar, sustainability serves as that emotional bridge, turning a climate-conscious value set into a compelling reason to choose the brand

Polestar has also been advancing its Polestar 0 project, an ambitious initiative aiming to produce a truly climate-neutral car by 2030 – eliminating emissions across the entire supply chain, from raw materials to final assembly. If realised, this would represent a meaningful step beyond the current industry standard, where carbon offsetting rather than elimination remains the norm.

“We are probably the only car brand in the world focusing so much on sustainability,” he notes. “Climate change is real. We all want to do our part to contribute and make sure emissions are coming down, and putting all this together makes us a very unique and special brand.”

Lohscheller adds that as competitors have stepped back from overt sustainability messaging – particularly in the wake of political and consumer pushback in certain markets – Polestar’s consistency has paradoxically amplified its voice. The connection between sustainability and youth appeal is one Lohscheller returns to with conviction.

“If the young people are following you, you have a future. You have a future, and Polestar has a future, because our customers are much younger than the average in the market. And why is that? It is because of sustainability,” he emphasises.

The Best of Both Worlds

Polestar’s ownership and governance structure is unusually complex for a consumer-facing brand. Chinese-owned through Geely, Swedish by design and operation, listed on the Nasdaq in New York, and with corporate governance headquartered in the United Kingdom, the company straddles geographies and cultures in a way that creates both strategic advantage and navigational complexity – particularly in an era of rising geopolitical tension and trade fragmentation.

At present, Europe is Polestar’s centre of gravity, accounting for 78% of total sales. The brand’s appeal on the continent is driven by a convergence of factors: its Swedish heritage, the strong regulatory tailwinds for zero-emission vehicles in the European Union, and a consumer base that has proven more receptive to EV adoption than many other regions.

Polestar product line-up: Polestar 2, Polestar 3, Polestar 4, and Polestar 5

According to the European Automobile Manufacturers’ Association (ACEA), battery electric vehicles (BEVs) accounted for 13.6% of all new car registrations in the EU in 2024, down from 14.6% in 2023. However, the market rebounded significantly in 2025, with BEVs reaching a 17.4% market share.

“The uniqueness of Polestar is that both Geely and Volvo are key shareholders and both are also very important for our business,” shares Lohscheller.

The Volvo relationship, in particular, provides practical infrastructure advantages that would be difficult for a standalone startup to replicate. Polestar vehicles are sold and serviced through Volvo’s extensive dealer network, giving the brand physical presence at scale without the capital expenditure of building its own retail footprint from scratch.

On the technology side, access to Geely’s rapidly advancing Chinese automotive capabilities gives Polestar a competitive edge in areas such as battery technology, cost engineering, and manufacturing efficiency. China’s automotive sector has undergone a dramatic transformation, with the country now serving as the global hub for electric mobility.

“I think it’s fair to say it’s very good that we have access to [Chinese] technology in this case, because the Chinese automotive industry has made huge progress in the last couple of years,” he says.

“I went to China again first time after a few years, in October of 2024. And I was really impressed by what has happened in a short period of time. And I think that’s a big benefit for Polestar.”

Based on the IEA’s Global EV Outlook 2025, China accounts for more than 70% of global electric car production. Furthermore, by the end of 2025, electric vehicles reached a historic tipping point in the Chinese domestic market, accounting for more than 50% of all new passenger car sales.

Beyond Europe, Polestar maintains a presence in markets including Canada, South Korea, and Australia. The United States remains an important market for the brand, though one characterised by uncertainty – driven by fluctuating federal EV incentive policies and shifting political dynamics around electrification.

Looking Ahead

Polestar’s trajectory offers a compelling case study in how a challenger brand can carve out a credible position in a market increasingly shaped by scale, regulation, and consumer values. The road to profitability remains a work in progress, but with record deliveries, a distinctive brand identity, and a sustainability narrative that is gaining rather than losing relevance, the foundations appear sound.

As Lohscheller puts it: “I’m very optimistic because I feel when you do the right things sooner or later, that will work, and be very successful.”

“And yes, maybe with electrification, everybody says ‘The growth is not as we thought a few years ago’ – but we are doing the right things for the future, right? We are offering mobility without emissions. This will be the future.”

______________________

Listen to the full interview with Michael Lohscheller on The Luxury Society Podcast on Apple, Spotify, and other major podcast platforms.

To discover more about how luxury automotive brands are building emotional connections with consumers, read our interview with Deniz Keskin, Global Director of Brand Management & Partnerships at Porsche, or listen to the podcast episode available on Apple, Spotify, and other major podcast platforms.

Subscribe to The Luxury Society Podcast to receive notifications about new episodes featuring luxury industry leaders. Never miss an episode as we continue exploring the themes shaping the future of luxury.