After several months of slowing demand, the Hotel & Lodging sector is exploring new paths to growth, thanks to strong signs of recovery providing a positive outlook.

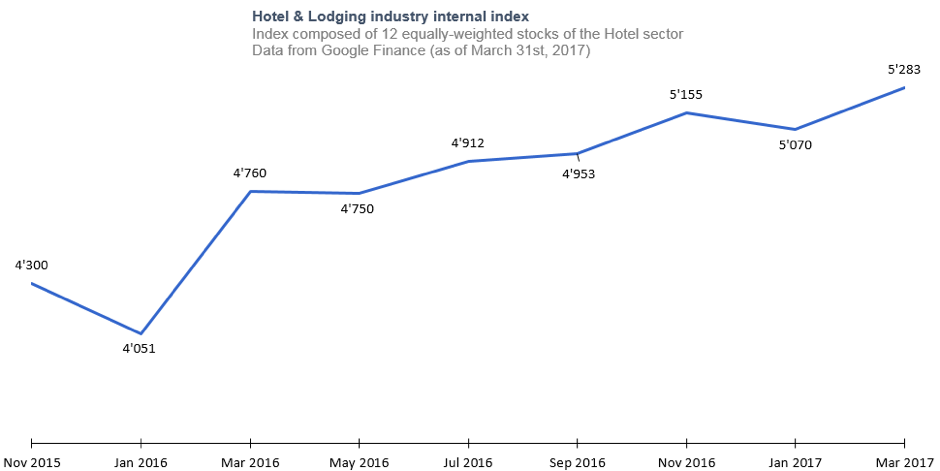

In 2015 & 2016, the Hotel and Lodging industry suffered from the effects of terror attacks and political turmoil in highly favoured touristic destinations (United States, Turkey, South Korea). However, the trend reversed in late 2016, thanks to the early recovery of business tourism. We had to wait for the first quarter of 2017 to see Leisure tourism gaining momentum, particularly in Asia. These market improvements coupled with the rally of the stock market since the election of President Trump in November 2016 is reflected on our sector performance. The hotel industry is doing better, the large companies have a strong pipeline of new rooms under construction and investor’s optimism reached an all-time high in March.

Our sector index is composed of 12 equally-weighted stocks of the Hotel sector.

Macroeconomics are improving despite political risks

First factors of improvements for the lodging industry came from macroeconomic data. Worldwide growth was +3.1% in 2016 with an acceleration in the last quarter. According to the IMF, the global GDP growth is expected to reach +3.5% in 2017. As a consequence, hotel managers are reporting a recovery of bookings for business trips as well as a clear come back for leisure tourism.

Asians tourists, and mostly Chinese, are traveling more frequently thanks to the stabilization of the Yuan, which provides a higher purchasing power. They came back to traditional European capital cities, as fear of terrorism decreased. Since November 2016, the negative trend for tourism reversed, the Paris Convention and Visitors Office reported a strong +44% rise in Chinese tourists while Japanese tourists increased by +65% during the same period. The positive trend continued during the first quarter of 2017 as the European market recorded a +6.5% growth in RevPAR (Revenue Per Available Room).

The only destination which was out of favour was the USA, as US bans deterred foreign tourists. Large hotel groups are cautious about the US market after reporting lower bookings at the end of the first quarter. Hence, the sector relies on domestic tourism, fuelled by the acceleration in numbers of business trips and domestic trips. More generally, the Americas region reported all-time high revenues in Q1 2017 thanks to strong tourism in Central and South America.

Industry players are active to capture growth

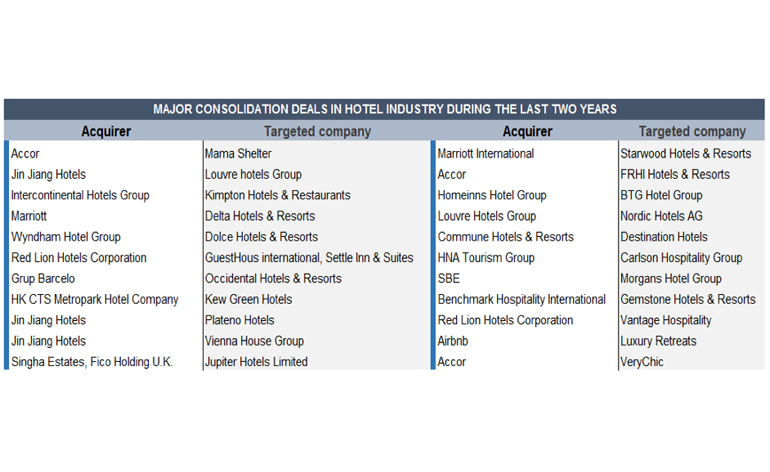

M&A; transactions were up in 2016 across all the industries, the Hotel industry was one of the largest contributors as hotel companies positioned themselves for growth catalysts in new markets while also targeting new consumers.

Marriott, which is finalising the integration of Starwood Hotels, managed to increase the quality of its assets outside the United States. Accor group was also active as the French company lagged in the luxury positioning compared to its American peers. The group acquired several companies such as FRHI Hotels & Resorts, the parent company of Fairmont, Raffles and Swissôtel, to step into the higher-end segment of the industry.

The sector is also seeing Chinese companies either taking minority stakes or buying-out hotel chains such as Carlson Hospitality. Jin Jiang Hotels or HNA Group have enough cash to close multi-billion deals in the industry. In addition, they aim at investing their cash outside China to capture the fast-growing tourism while taking advantage of a strong Yuan.

The latest player to ink a deal in the industry is AirBnb, which acquired Luxury Retreats to enter the segment of experiential luxury. The arrival of AirBnb confirms the high growth potential in the sector for those able to adapt to new lifestyles, demographic changes and customers’ expectations.

Source: Hotelnewsnow.com

At the opposite, the Hilton spin-off in 3 different companies will allow the newly formed entities to be dedicated to their core competences (property management, timeshare vacations, and hotel management) and further focus on their strategy to capture new growth drivers as each business is specific. Hilton announced the creation of the Tapestry brand, which will offer highly qualitative and more human-sized resorts for short-time travellers and younger customers.

Millennials are waiting for an experiential package when booking a hotel stay. People book shorter periods but want to enjoy their stays more intensively. As a consequence, hotel managers focus on operational efficiency, offering better side services to their clients in addition to their assets standings.

Positive outlook for the sector and for tourism

The number of travellers per year is expected to exceed 8 billion people by 2021 from 6 billion in 2016. First, the notion of experience will be crucial to the tourism industry in addition to other complementary services such as full digitalisation. Recent changes in company structures show that top management understood the importance of these changes to keep their market leadership. Secondly, the increase of the number of wealthy people in the world, mostly in China and emerging markets. Hotel chains must adapt their cultural way of doing business to this new population of young and wealthy individuals craving for authentic memories. After the strong policy against corruption in China, traveling and telling unique souvenirs is a new way to show one’s status.

Provided that they succeed in leveraging these opportunities, and embrace the digital and experiential turnaround, the Hotel & Lodging sector is expected to report a robust growth of +3% to +4% in 2017. The only threat to this growth path will remain political instability. Unfortunately, it has already been the case for South Korea last month, which was harmed by the travel limits imposed by the Chinese authorities due to growing tensions with North Korea.