Could recent announcements by LVMH, Daimler, Remy Cointreau & the Fondation de la Haute Horlogerie mark the end of the luxury industry’s economy-defying performance?

Could recent announcements by LVMH, Daimler, Remy Cointreau & the Fondation de la Haute Horlogerie mark the end of the luxury industry’s economy-defying performance?

Could recent announcements by LVMH, Daimler, Remy Cointreau & the Fondation de la Haute Horlogerie mark the end of the luxury industry’s economy-defying performance?

Not so long ago we took a look at how the luxury industry is really performing, in the wake of news that Burberry, Daimler and Porsche were lowering 2012 sales expectations and implementing austerity measures.

In our investigation, we confirmed that whilst growth is set to slow, luxury as a greater industry continues to prove itself significantly profitable across most geographical markets. Case in point at Mercedes-Benz Cars, whilst first-half operating profit fell by 10%, it was still over €2.5 billion.

This week however, announcements by LVMH, Daimler, Remy Cointreau and the Swiss Timepiece Industry, have sparked yet another round of pessimistic headlines and stock market declines. Further compounded by Bain & Co’s forecast that sales growth in the global luxury market will slow this year to 5%, from 13% in 2011 (Reuters).

A change in government in China and a crackdown on corruption have dented luxury spending by its consumers. The Chinese domestic luxury goods market is set to grow by just 8% at constant currencies to reach €15 billion, as compared to 30% in 2011.

That said, the report did confirm that Chinese consumers have become the world’s No. 1 buyers of luxury goods, ahead of the Japanese, the Americans and the Europeans. Luxury spending growth in Europe is expected to halt to just 5%, with Italy and Spain suffering the biggest slumps.

“ China’s luxury goods market will grow at 8% to reach €15 billion, compared to 30% in 2011 ”

Automotive

In a bid to boost profitability, Daimler AG has announced plans to cut annual costs by at least €1 billion euros in response to Europe’s deteriorating auto market. The world’s third-largest maker of luxury cars will not reach 2011’s operating profit of €5.2 billion, and announced a “Fit for Leadership” efficiency program in late September, without providing any operational details.

The automaker has also negotiated an agreement with its works council to cut production of the flagship S-Class model by approximately 8,000 vehicles in the fourth quarter. BMW has shifted “tens of thousands” of vehicles from Europe to the U.S. and Asia, as the European car market prepares for its steepest decline in 19 years (Bloomberg).

At Jaguar Land Rover, September vehicle sales fell 4% year-on-year, for the first time since July 2011 (Reuters). Whilst VW Group is said to delay the launch of new SUV’s at Lamborghini and Bentley, and instead develop higher volume models and review spending on equipment and factory upgrades (Luxuo).

“ Mercedes-Benz will cut S-Class production by 8,000 units ”

Fashion & Accessories

French luxury group LVMH reported its slowest growth since 2009, acknowledging decelerations ‘here and there’ but confirming there had been no drop in demand for Louis Vuitton products. “There is no major slowdown in the third quarter compared to the second quarter," explained LVMH Chief Financial Officer Jean-Jacques Guiony (Reuters).

Total revenue at LVMH in the quarter rose 15% to €6.9 billion reflecting “a tougher environment”, but the group remains confident in its outlook for 2012 and suggests “one shouldn’t see the bottle half empty.” Guiony confirmed that Louis Vuitton has raised its prices by 8% in Europe this October, as “the appetite for luxury goods is still there” (Businessweek).

Burberry’s second quarter earnings demonstrated slowed demand, particularly at lower price points. Chief Financial Officer Stacey Cartwright suggested that the “aspirational luxury consumer” had been hit by a faltering global economy, as the brand sold a higher proportion of goods from its top-end collections in its fiscal second quarter, as well as a larger share of goods at full price (Reuters).

Total first-half revenue – including wholesale and licensing sales – was £883 million pounds, up 8% at constant exchange rates, with first quarter growth of 11% slowing to 5% in the second. The British heritage brand will be “planning conservatively” and not banking on next month’s Chinese leadership change to stimulate the economy.

“ Burberry’s first quarter growth of 11% has slowed to 5% in the second ”

Fine Spirits

Remy Cointreau has reported a sharp slowdown in sales growth in the last three months, explaining that Asian wholesalers were holding back on new cognac orders after stocking up in the previous quarter. But despite the decline, demand for its most expensive brandies remains robust in Asia and the United States, which is expected to fuel a significant improvement in full-year earnings.

“The very high end is doing very well and is growing in Asia and all our markets,” explained Remy Martin CEO Patrick Piana. “There is a very strong appetite in Asia for recognised quality.” High-end brands were the fastest-growing category of cognac sold in 2011 in volume terms, growing 18.2% for “Extra Old” blends, where the youngest eau de vie in the mix has been aged for at least six years (Reuters).

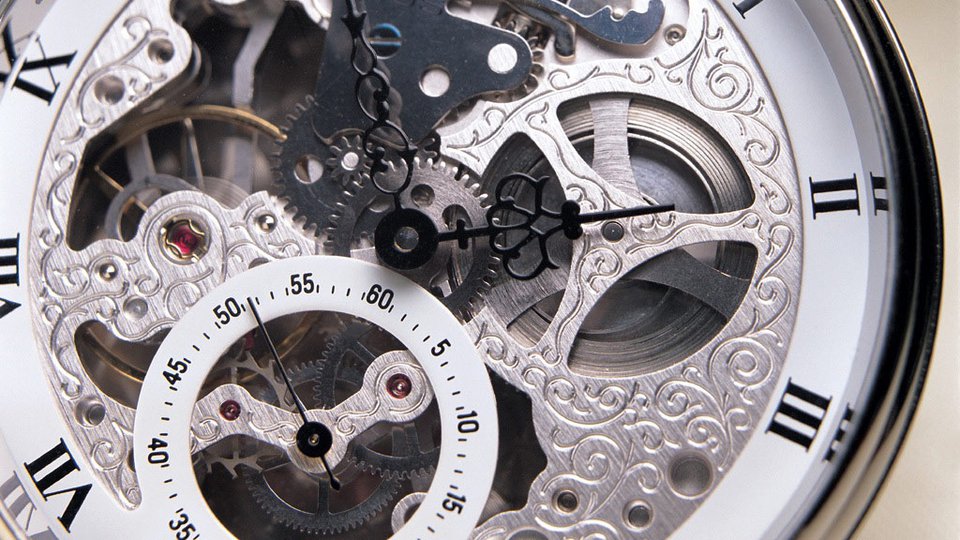

Timepieces

Swiss watch exports recorded a decline in September, following more than 30 months of consecutive increase. Their value, 2.7% below the figure recorded for September 2011, amounted to 1.7 billion Swiss francs, or approximately €1.4 billion.

The downturn has been attributed to watches costing less than €2,500, whose decline in volume terms was 10.7% on average. Asian markets were most affected by halted growth, where Hong Kong, Mainland China and Singapore recorded some of the steepest declines across the board.

In more positive news, timepieces costing over €2,500 improved 3.7% year on year, confirming sentiments that the aspirational segment is tightening purse strings. Growth was found in Germany, Italy and France, as well as Japan (6.9%) and the Middle East (31.8%), according to the Fondation de la Haute Horlogerie.

“ The aspirational luxury consumer is spending conservatively in the face of a pessimistic global economy ”

The Common Thread

The aspirational luxury consumer is spending conservatively in the face of a pessimistic global economy. As evident in the cases of Burberry, Remy Cointreau and the Swiss Watch industry, the highest-end collections are the ones that continue to drive sales.

The latest round of fiscal reporting confirms a definite slowdown in China, but not necessarily a wane in demand from the Chinese. As Bain’s 2012 study confirmed, one in four purchases of personal luxury goods comes from Chinese consumers, they are just not necessarily made in home markets.

At the end of the day, it’s not the end of the luxury boom, but consumption looks set to become more measured by consumers. The brands that will continue to prosper are those that keep up with the quickening pace of change in the market and adjusting to shifts in tastes and demographics, according to Claudia D’Arpizio, a Bain partner in Milan.

“Concerns about market weakness are somewhat overblown,” she explained at the presentation of the 2012 study. “Fundamentals for growth remain strong, but it’s going to be a bumpy ride.”

To further investigate industry performance on Luxury Society, we invite your to explore the related materials as follows:

– 2012’s Best Global Luxury Brands

– How China’s Luxury Goods Market is Really Performing

– How the Luxury Industry is Really Performing in the Face of Crisis