Bain & Company’s new report notes early signs of recovery in mainland China’s luxury market, but growth is increasingly shaped by grey market cannibalisation and competition from local brands.

The mainland Chinese personal luxury market contracted by 3% to 5% in 2025, according to The 2025 Chinese Personal Luxury Goods Market newly released by Bain & Company. This marks a sharp improvement from the 17% to 19% decline recorded in 2024.

This once “too-big-to-fail” market began to show signs of recovery in the third quarter, with low single-digit growth reflecting a gradual return of consumer confidence alongside a brighter macroeconomic outlook.

Yet the fundamentals of the market are changing. As younger generations take up a larger share of luxury consumers, perceptions of luxury are being reshaped. While luxury remains desirable, the traditional playbook is no longer sufficient and must be revisited, recalibrated, and rebalanced.

The Next China Is in China

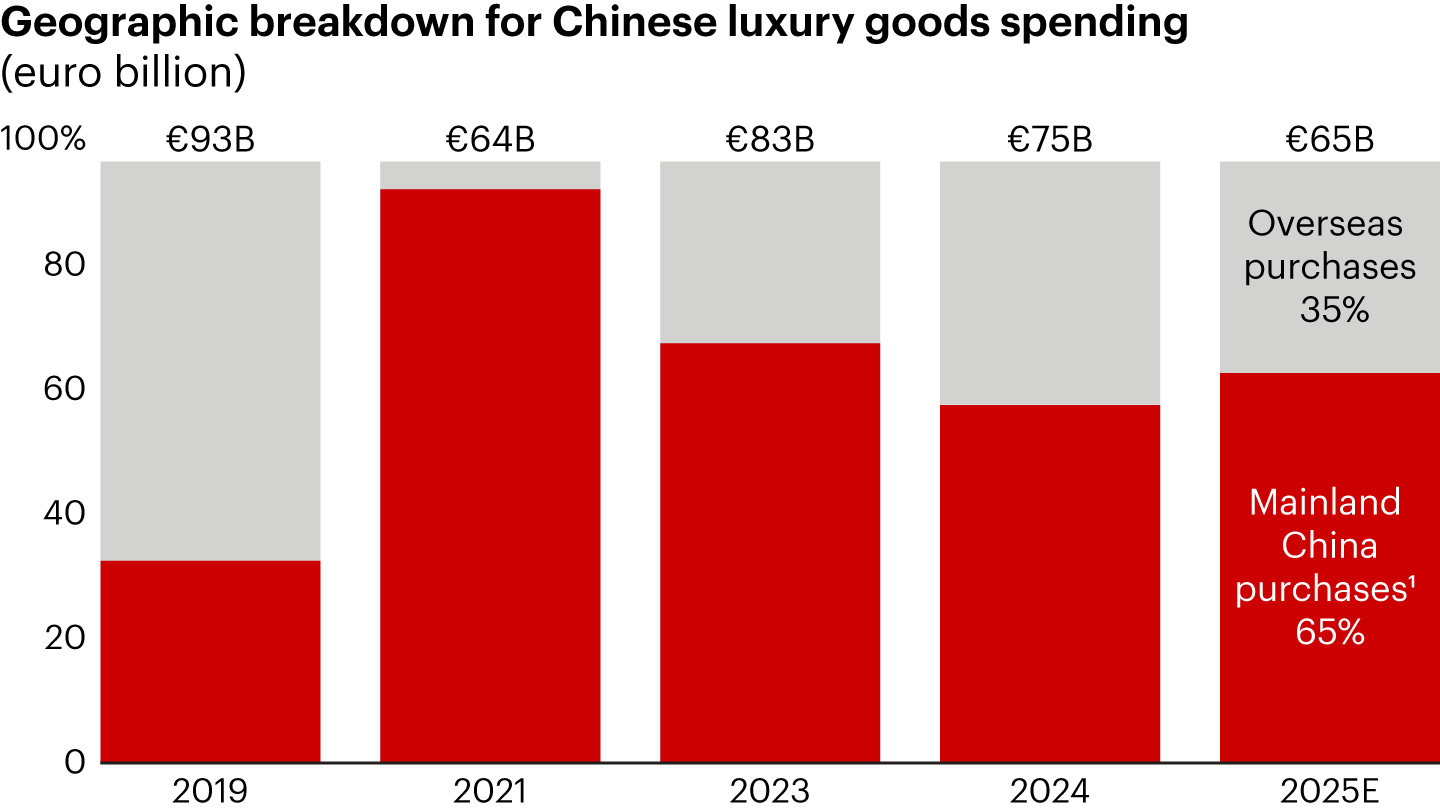

While mainland consumption is showing a modest rebound, global Chinese luxury consumption is facing a more pronounced contraction. Total spending fell by 13%, from €75 billion to €65 billion.

Credit: Bain-Altagamma 2025 Worldwide Luxury Market Monitor; Global Blue; Bain analysis

This decline is primarily driven by a contraction in overseas purchases, which dropped to €22.8 billion in 2025. Contrary to expectations of a post-COVID rebound, overseas luxury spending declined once again. More notably, 2025 marks the first year in which its share of total Chinese luxury spending also fell after the pandemic, shrinking from 40% to 35%.

This shift reflects evolving travel patterns, continued price harmonisation, and a more cautious approach to discretionary spending on outbound trips. Luxury shopping is no longer the top priority for Chinese travellers, as spending shifts toward experience-led consumption and more diversified destinations.

At the same time, the recovery of the mainland market reinforces the appeal of domestic purchases. Narrower price gaps, better product availability, and long-standing relationships with sales associates continue to anchor spending locally.

Brands are clearly voting with confidence. Following early green shoots in the second half of the year, LVMH’s three megabrands, Louis Vuitton, Dior, and Tiffany & Co., unveiled major flagships in Beijing’s Sanlitun. Hermès is preparing two new openings in Chengdu and Beijing, while niche players such as Lemaire and Polène are also expanding their physical footprint.

Credit: Courtesy of Louis Vuitton

The Risk of the Daigou Market

Another key factor weighing on overseas spending is the continued prevalence of grey channels, particularly daigou (代购). These individuals or organisations source products from overseas or discounted channels and resell them in mainland China to capture arbitrage opportunities.

As consumers become more value-conscious, daigou offerings appeal to price-sensitive and occasional buyers. Beyond pricing, instant availability, especially for highly sought-after brands such as Hermès and Goyard, also attracts high-net-worth consumers who bypass brand-owned channels both domestically and abroad.

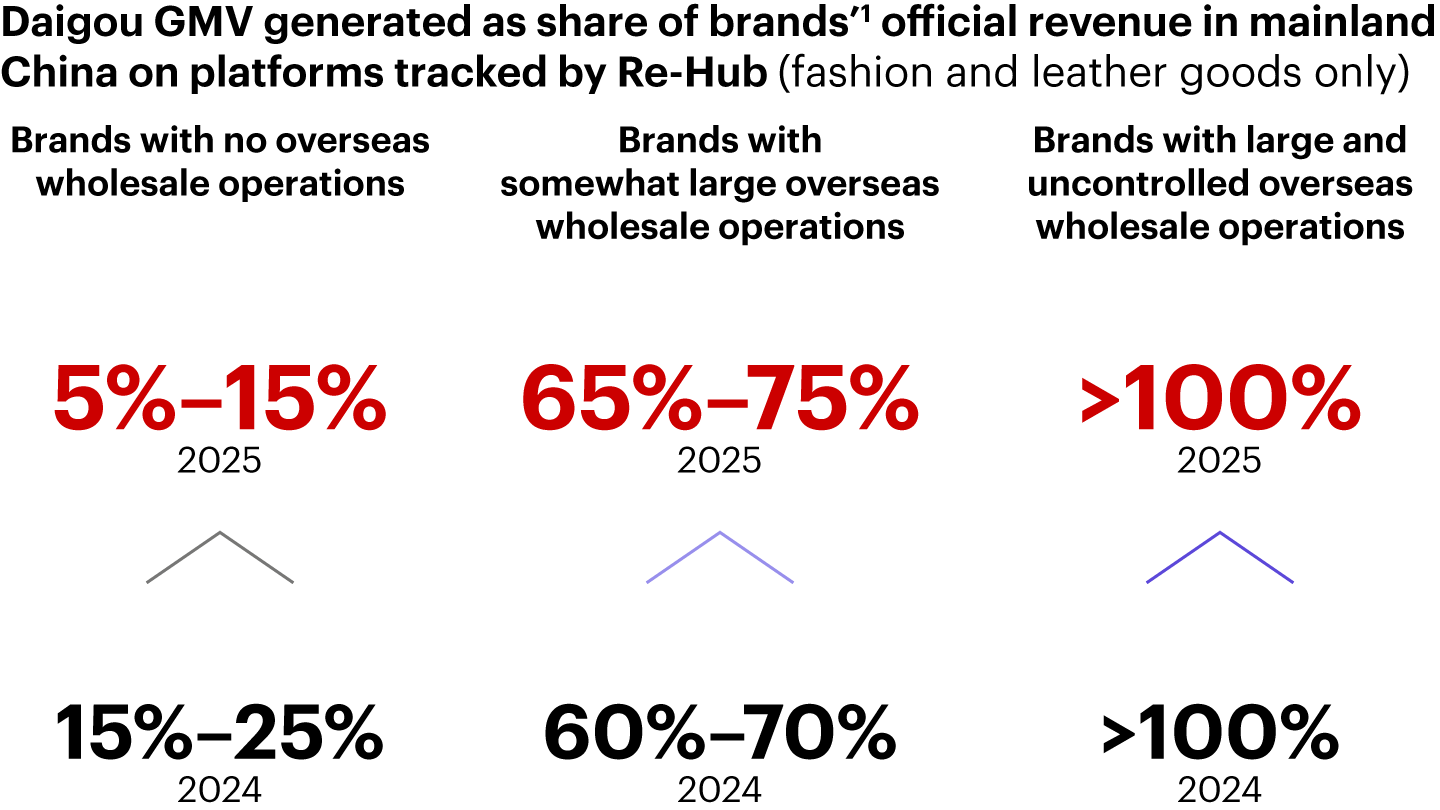

As a result, daigou activity continued to grow in 2025. The top 45 brands tracked by Re-Hub across daigou platforms recorded a 3% increase in sales in 2025, outpacing the overall growth of China’s luxury market.

The expansion of the grey market exposes structural weaknesses in brand management, including uneven regional pricing, limited item traceability, and insufficient channel control. These loopholes enable growing daigou activity to directly cannibalise brand-owned revenue, with grey-market GMV in some cases rivaling official sales.

For brands with larger and less regulated overseas wholesale networks, daigou sales can represent 65% to 75% of brand-recorded mainland China sales, and for some brands, even exceed revenue generated through official channels.

Credit: Re-Hub; Bain analysis

Rebuilding Relevance

At the heart of these shifts lies a fundamental change in how Chinese consumers perceive luxury. Younger luxury shoppers, raised in an era of abundance, are no longer driven primarily by the symbolic value of heritage brands.

This has fuelled the rise of premium disruptors, niche designer brands, and local players expanding rapidly across categories. Seeking emotional value and self-expression, younger consumers are redistributing their spending across segments, eroding the automatic premium once attached to the word “luxury”.

The success of Laopu Gold and Songmont has drawn attention from Western peers. Their rise is not solely driven by rising patriotism. Songmont has gained share through agile merchandising that blends trend relevance with everyday practicality. Laopu Gold, meanwhile, taps into a risk-averse and value-driven mindset, outperforming luxury jewellery peers through more transparent pricing.

Western luxury brands increasingly recognise that cookie-cutter localisation no longer resonates. Market leaders are embedding Chinese iconography, craftsmanship, and cultural references into their brand DNA with greater depth and sophistication.

This Lunar New Year, against a warming market backdrop, luxury maisons delivered standout activations. Miu Miu transformed central Shanghai with large-scale light installations, while Rimowa collaborated with Peking Opera master Geng Qiaoyun to showcase the traditional “Horse-Riding Pantomime” (趟马) in its New Year campaign.

Credit: Courtesy of Miu Miu

As Chinese luxury brands evolve from challengers into market shapers, Western brands must acknowledge that success in China now requires more than cultural relevance alone. It also demands faster, more responsive business optimisation to keep pace with an increasingly discerning and dynamic consumer base.

To download the full report The 2025 Chinese Personal Luxury Goods Market by Bain & Company, please fill in the form below.