As social media becomes increasingly pay to play, the viewability debate between media owners – old and new – is definitively heating up.

As social media becomes increasingly pay to play, the viewability debate between media owners – old and new – is definitively heating up.

As social media becomes increasingly pay to play, the viewability debate between media owners – old and new – is definitively heating up.

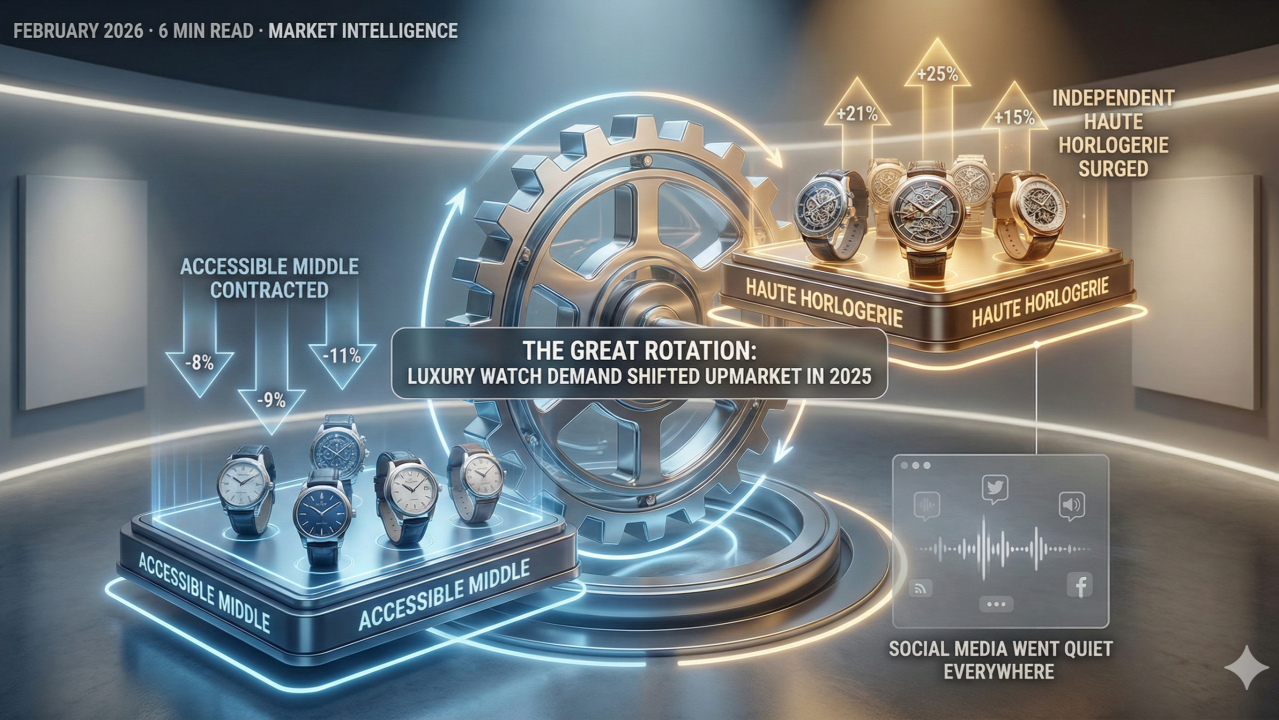

The final part in our investigation into the future of advertising for luxury brands. In part one we looked at the way digital has changed traditional advertising and forced new disruptive technologies.

Moreso than any other media outlet, luxury brands seem to have the most complicated relationship with social media. At first they avoided it completely, arguing the environment didn’t align with their brand values. Then Burberry knocked its number of Facebook ‘Likes’ right out of the park, and suddenly brands flocked to all kinds of social channels, many without dedicated strategies, simply because the numbers suggested that the eyeballs were there.

The eyeballs were definitely there, and continue to be there, if the statistics are to be believed. Facebook has clocked up 1.44 billion monthly active users (as of March 2015). In September, Instagram confirmed its audience has reached more than 400 million monthly active users, of which 100 million joined in the past nine-months. Twitter on the other hand grew just 15% year-on-year in the second quarter, rising to 316 million. LinkedIn boasts more than 380 million profiles.

Beyond eyeballs, McKinsey has also confirmed that luxury consumers in particular are highly social. According to their most recent consumer research, 80% of luxury shoppers use social media on a monthly basis, including Instagram, We-Chat, Facebook and Twitter. Half are weekly users and more than 25% are daily social media users. Nearly all luxury buyers have at least one smartphone – globally, the figure is 95% – and in most mature countries, it’s 100%.

“ 80% of luxury shoppers use social media on a monthly basis ”

“There’s a huge opportunity for luxury brands in social media advertising,” confirms Alex Kozloff, Acting Director of Marketing and Communications at IAB UK.

“It’s essentially the opposite of what you expect when it comes to luxury. It seems very broad and there is such a large scale and difference between users because of the mass. But think about how much information consumers give away on social media – it’s huge. And that information allows advertisers to target groups of relevant consumers very specifically and very, very effectively.

“They can also cross-reference that with their own data to better understand how a campaign has performed, which paints a very clear picture of ROI, and can assist with even more effective targeting on the next campaign. So it’s really up to them how far they want to drill down, because they can tap into insights that are very, very detailed and customise their campaigns to a tee.”

Concretely, the social opportunity for luxury brands is now pay to play to have their messages heard. In an article entitled 13 Stats That Should Terrify CMO’s, Contently recently confirmed that “for every 100,000 followers on Facebook, only 130 people will click on an organic post. "In other words, if you’re still trying to live on organic social media traffic, it’s probably time to give up.”

“ For every 100,000 followers on Facebook, only 130 people will click on an organic post ”

Instead of platforms for mass-broadcasting, social networks increasingly see their strength in ability to target niche segments of followers, with increasingly differentiated messages.

“New generations interact with media much differently than the previous ones," explains Andrew Lowrey of LinkedIn. "Therefore using data and studies to identify how these people consume media on mobile, social networks and more traditional media is important.”

“Our goal at LinkedIn is to allow our luxury partners to reach the right audience, at the right time, in the right environment. With 380 million members, using our data is key to allow luxury brands to display their message only to the most relevant audience based on criteria such as their job seniority, industry or company size.”

Mr Lowrey believes that the platform’s overall reach of senior business executives in Europe, Asia and the US is a strong competitor versus traditional titles, and its key solutions (onsite and network display, Sponsored Updates, Sponsored InMail and Lead Accelerator) are aimed at reaching the desired target audience at every stage of the marketing funnel.

Mercedes-Benz campaign on LinkedIn

“In particular our Sponsored InMail solution, which we re-launched at the beginning of 2015 has seen great success in promoting new collections, events and brand awareness by delivering a personalised message directly into the LinkedIn Inbox when users are connected,” he adds.

To this point, Ms Kozloff believes that the power of social media lies not only in razor-sharp targeting based on psychographic information, but also in the ability to create truly two-way conversations with consumers, which was very difficult to do with print. Social media has also been frequently touted as the key to reaching the millennial set, as the Baby Boomer population continues to age, and media consumption goes mobile.

“Consumers now spend more time than ever online and on their mobile devices,” explains Morin Oluwole, Director of Luxury Client Partnerships at Facebook & Instagram. “More than 20% of time spent on mobile in the US is spent on Facebook and Instagram.” According to Ms Oluwole, luxury brands are investing more heavily in social media advertising for this very reason.

“ The people luxury brands care about – affluent shoppers – are on Facebook and Instagram ”

“The people luxury brands care about – affluent shoppers – are on Facebook and Instagram,” Ms Oluwole decrees. “An IPSOS study conducted in France in November 2014 showed that 47% of affluent individuals in France are on Facebook, which is over 3.3 million people. These affluent shoppers are also changing the way they consume media – they are migrating from paper to online content. This phenomenon has been accelerated by the use of mobile phones.”

“Luxury brands have realised that in order to continue to build a long-term relationship with their affluent consumers, they must be present where they are spending their time. Facebook and Instagram provide luxury brands with the opportunity to reach their desired consumer in a way that’s personal and non-intrusive,” she explains.

“Facebook and Instagram are part of people’s everyday lives and, therefore, have become powerful personalised platforms. When a luxury brand is present and engaged on these platforms, they operate in a contained universe of luxury, which includes brands, media, influencers but also friends and personal connections.

In this context, luxury brands have the opportunity to develop more personalised messages and build deeper relationships with their consumers. In a sense, affluent consumers become friends with and engage more with brands on Facebook and Instagram.”

“ 47% of affluent individuals in France are on Facebook, which is over 3.3 million people ”

According to Ms Oluwole, “Facebook understands what affluent consumers are interested in, how they consume content, their favourite places and what they purchase. Compared to other affluents, consumers on Facebook are 33% more likely to buy dresses or suits worth over €1,000, 30% more likely to buy fragrances and cosmetics worth over €75, and 44% more likely to buy handbags worth over €500.”

Again citing the IPSOS study, Ms Oluwole adds that Facebook’s reach in France is 7.8 times higher than the reach of GQ Magazine, and 1.2 times higher than YouTube’s reach to the same audience. In Italy, Facebook suggests that it’s reach is 3.6 times higher than Vanity Fair and 8.3 times higher than Vogue Italia.

But it wasn’t always this way. Facebook and luxury brands were, for some time, quite uncomfortable bedfellows. Luxury brands, famously controlling about their brand image, were not rushing to surrender their brand to Facebook’s decidedly economical environment. A case in point – Burberry, as it nears 17 million followers, is still relegated to the confines of Mark Zuckerberg’s nonchalant navy blue.

Burberry’s Facebook Page

Where luxury brands have been quicker to adopt is Instagram, the photo sharing social network famously acquired by Zuckerberg in April 2012 for more than $1 billion. Namely because of the visual nature of the platform, and Instagram’s relatively clean and straightforward interface, where the images literally take centre stage.

“The most powerful marketing comes from friends, family, someone you trust and from influencers who inspire you, In its short five-year history, Instagram has become the desired platform of choice for luxury brands to build relationships with their consumers,” Oluwole says.

“One in five (20%) people on Instagram follow a fashion/luxury account. Luxury and beauty influencers have developed the most engaged audiences on the platform as they have crafted and honed their content to grow the following they have. Affluent consumers are taking more direction from these influencers, a huge opportunity for luxury brands to collaborate with the right influencers.”

“ 1 in 5 people on Instagram follow a fashion/luxury account ”

What Facebook – as a group – is now pushing heavily, is its ability to influence consumer behaviour on both channels simultaneously, with differentiated messages, and command a comprehensive picture of how luxury consumers are consuming media and when they might be most receptive.

The social powerhouse has launched a host of advertising solutions, from creative development to audience insights and no shortage of tools to track performance across devices and channels.

“Until now, advertising has been developed on a model of interruption. In a world more personal and personalised, advertising can no longer interrupt the user experience. It is our obligation as luxury marketers to propose new formats that are less interruptive, more respectful – and above all, more relevant,” she says.

“Advanced targeting capabilities on Facebook and Instagram like “Custom Audiences” (to reach luxury customers you already know) and “Partner Categories” (to reach luxury consumers based on their offline purchase behaviour) are primed to help luxury brands identify and reach affluent consumers online," Ms Oluwole explains.

“ Beyond targeting, across publishers and platforms, the buzzwords are emotion and experiences ”

“For example, luxury watchmaker Roger Dubuis used Facebook to showcase its creative video content and drive brand awareness – with an end goal to position itself as an unconventional watchmaker. Using Custom Audiences and luxury watch interest targeting, they were able to reach 50% of all people with an interest in luxury watches (on Facebook) in two weeks, mostly via mobile.”

Beyond targeting, across publishers and platforms, the buzzwords are emotion and experiences, and ipso facto, video. The Wall Street Journal for one, certainly believes in video’s power to create real resonance with luxury consumers, as Teads makes moves to create more and more premium video advertising industry available to publishers.

Facebook is similarly banking on the rise of video, which it expects to soon become “the dominant visual of choice". According to the megalith, over four billion videos are viewed per day on Facebook, up from one billion in June 2014.

To this effect, Facebook is now testing “immersive experiences” that will give luxury brands the ability to create fully-branded, interactive destinations within the Facebook News Feed. “We know how important it is for brand advertisers to share their stories through sight, sound, and motion,” Ms Oluwole confirms.

Volvo’s Virtual Reality App allows ‘virtual’ test drives using smartphones

Overall the advertising industry as a whole can agree that the future of advertising for luxury brands lies in personalised human-to-human experiences, which are designed with deep psychographic and behavioural data to target consumers in mind. Ergo, they are also likely to touch more and more senses, and inspire more emotional connections between brands and consumers.

As Katie Allen of The Wall Street Journal concedes, “Consumers like to interact with brands and be made to feel a part of that universe. Virtual reality therefore has great potential for luxury brands as a way to totally immerse the consumer.”

Where there is less consensus, however, is on the theme of viewability, a debate that is currently running wild in the greater industry.

As The Wall Street Journal reports: “To most people across the industry the concept of buying and selling ‘viewable’ ads instead of ‘served’ ones makes complete sense. The problem is, nobody can seem to agree on what ‘viewable’ actually means”.

“ Nobody can seem to agree on what “viewable” actually means ”

According to the IAB, a display ad is viewable if 50% or more of its pixels appear on-screen for at least one continuous second. A video ad is deemed viewable if 50% of its pixels appear on-screen for at least two consecutive seconds.

By comparison, Facebook’s definition of viewable is the instant it appears on a user’s screen, regardless of how many pixels are in view or for how long. LinkedIn sells the majority of its products based on clicks, as does Twitter, whereby advertisers can choose their own segments of customers by geography, industry and seniority using self-service interfaces.

In contrast, disruptive startup Chartbeat is challenging both clicks and impressions simultaneously, suggesting that “your audience’s attention is worth more than their clicks”.

The New York based analytics firm has so far raised $31 million and is being used by the Financial Times, Forbes, TIME, The New York Times and Disney, to name a few. Their credo explains: “Since the web’s creation, the standard unit of success has been the click. Yet the goal of content creation has always been to get the right information to the right people and have them consume it, understand it, learn from it".

Gucci’s Cruise 2016 Campaign

“This massive disconnect of goals and metrics has led to a web that rewards empty traffic, clickbait headlines, and billions of unseen ad impressions.” This comes at a time when WPP CEO Martin Sorrell has gone so far as to call out Facebook’s viewability standards as ‘ludicrous’.

As Adweek reports: “Facebook, in particular, has come under heat in recent months from some advertisers who do not want to pay for videos that are viewed for only three seconds as someone scrolls through a newsfeed. Many of those videos play without sound since someone has to click on a clip for the sound to kick in”.

To this, however, Teads is quick to highlight its Cost-Per-Completed-View business model, where advertisers pay only when a user has viewed an entire video, or for longer form videos after 30 seconds of content has been viewed, at 100% of the surface area.

“ WPP CEO Martin Sorrell has gone so far as to call Facebook’s viewability standards ludicrous ”

What does all this mean for luxury brands? Little more that no media buy will (currently) tick all the boxes. Each platform still presents its own specific pros and cons. Audiences might be flocking to social media in droves, but the advertising solutions offered by digital’s new guard don’t seem to have their viewability quite worked out. Furthermore, their operational environments are not always ‘on-brand’ for luxury.

Conversely, prestige media brands such as The Wall Street Journal have the advantage as being recognised in their own right as global brands, with environments that increasingly lend themselves to luxury brand advertising. Where they will feel pressure to innovate is the ongoing development of digital products, now that Internet advertising has moved far beyond taking the half-page to the web.

The future beckons, and for luxury brands, it certainly looks a lot brighter – as advertising solutions continue to tread down the road of refinement. In the face of this evolution of choice, channels and metrics, perhaps the real challenge for luxury players will be remain subtle enough in their strategy to enage a wave of consumers actively blocking advertising.

May the most engaging brands – and publishers – win.