Our weekly analysis of the must-read luxury news headlines

Boutiques.com: Is it Worth All the Fuss?

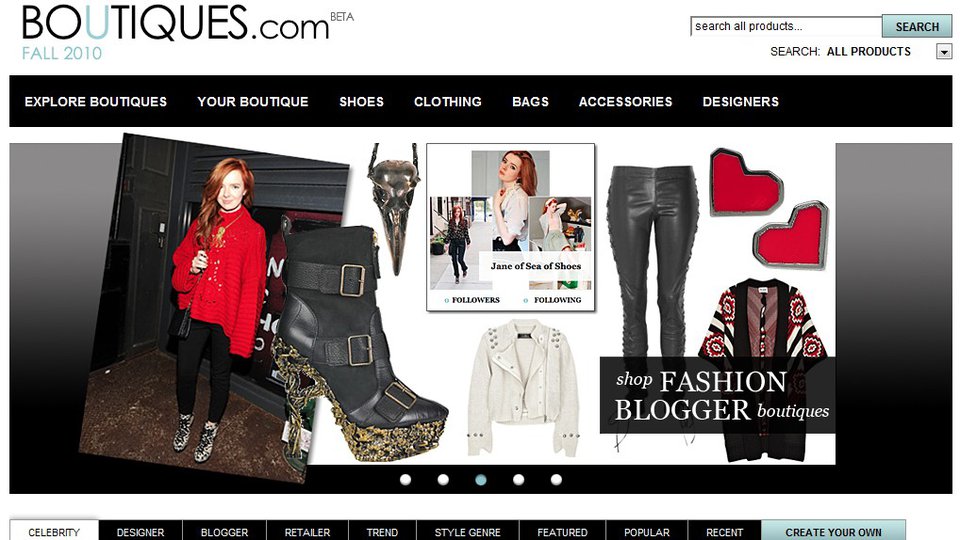

Virtual storefronts (“boutiques”) have been created by celebrities and popular fashion bloggers

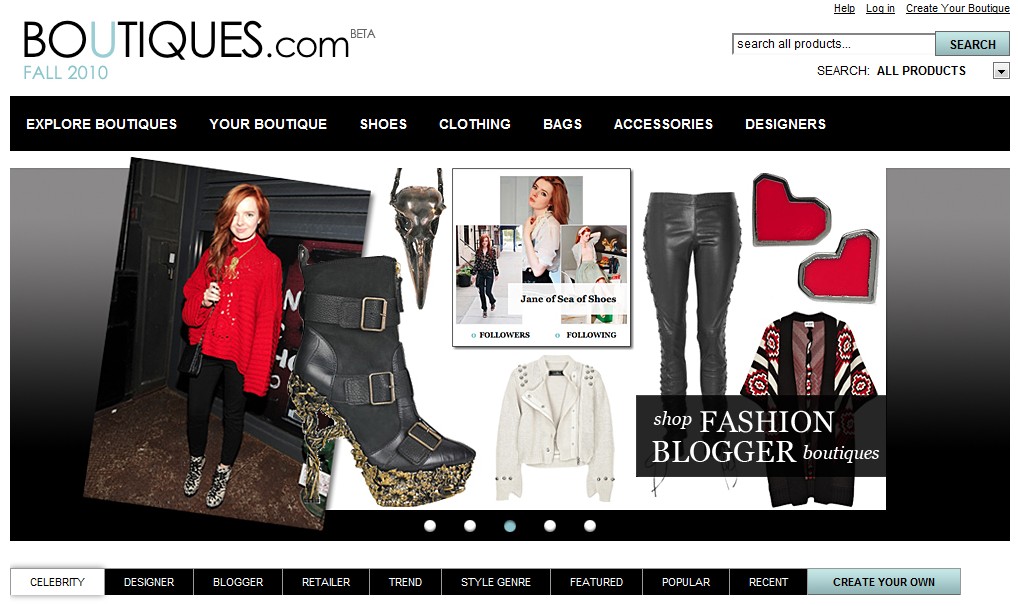

Following our report in the last edition of The Bulletin which predicted the launch of a high fashion business venture from Google, the internet leviathan made good on our forecast last week. On Wednesday, the world was introduced to Boutiques.com, Google’s new site featuring an A-Z directory of products from luxury footwear, clothing and accessories brands as diverse as Akris is to Zac Posen.

But crucially, the site is not an e-commerce business in the conventional sense. In exchange for a small commission on sales, Boutiques.com drives traffic to other online fashion retailers like department stores or multibrand boutiques through its visual search engine technology and virtual storefronts created by celebrities, bloggers and users themselves.

WWD’s account of the back-story behind the new website provided some insight into how Google’s acquisition of Like.com first kick-started the project. It also highlighted how other pioneering digital fashion peer sites like Lookbook.nu and Polyvore.com are involved in Boutiques.com — and how together they could alter the direction of fashion retail going forward

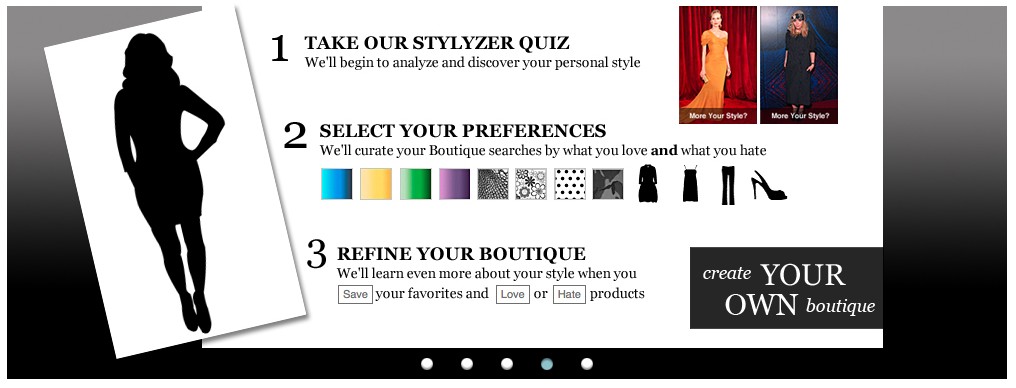

By and large, the early reviews for Boutiques.com have been quite positive. “In a deliberate collision between nerds and fashion mavens, Google has created a new e-commerce site that significantly improves how fashion is presented and sold online,” wrote the New York Times’s Cathy Horyn who suggested that it will fulfil industry experts’ expectations to be a game-changing tool by the way its algorithms analyse the users’ preferences to achieve a personalised shopping experience.

“Despite the number of products a search on Boutiques.com kicks out, the download time is very fast, and choices appear on extra-long pages so you don’t have to keep clicking. Virtually every kind of information is analyzed — price, brand, color and so on…Additionally, there is a good sense of discovery on the site,” Horyn raved.

“ It is already poised to slaughter the competition ”

Boutique.com’s “stylyzer” tool helps customise user experience

Elle.com’s Britt Aboutaleb was even more enthusiastic. “[Boutique.com] is already poised to slaughter the competition. It’s as comprehensive as a Google search for anything else, but prettier,” she wrote. Overlooking a few glitches she said she had found, Aboutaleb continued, “The site’s incredibly easy to navigate; it starts with a few broad categories and slowly narrows them down to help you find either what you’re looking for, or more likely, stumble into a pile of things you don’t need, but really love."

But some observers hinted that the website could have less than positive consequences for the luxury industry by encouraging some consumers to ‘trade down’ to derivative designs by cheaper brands. “With image-matching technology that allows you to see similar styles made by a variety of brands, getting the designer look you want for less is as easy as doing a Google search,” pointed out a writer at Stylite.com.

Luxury Daily concluded that it is still unclear who will be the winners and losers emerging out from Boutiques.com’s success. “A fashion search engine that effectively serves as the gatekeeper for fashion shopping could possibly have the same effect on ecommerce brands that Google had on content-driven industries such publishing, shifting the business model,” wrote the m-commerce and mobile marketing specialist reporter, Peter Finocchiaro.

What’s Being Bought, Sold, Consolidated – and Saved from Bankruptcy

The piano room in the DVF suite of Claridge’s

As obsevers continued to ruminate over last week’s news that the Hôtel de Crillon was bought by Saudi investors affiliated with the royal family and that Gianfranco Ferré and Ittierre SpA had been saved by new owners from bankruptcy, another crop of acquisition headlines appeared on the horizon.

Only months after Qataris bought Harrod’s department store and the Qatari emir expressed an interest in buying Christie’s, the country’s investment vehicle, Qatar Holding, wasbeen identified] as the likely buyer for yet another London luxury landmark: Claridge’s Hotel.

In addition to Claridge’s, an acquisition of the Maybourne Hotel Group would also transfer ownership of London’s Connaught and Berkeley hotels to the Qataris (as well as several Four Seasons hotels in Dublin, Milan, Budapest and Prague). If the deal does go through, this would add to the already bulging portfolios in the Middle East which include some of Europe’s finest luxury hotels.

“ The sale of Claridge’s would add to already bulging portfolios in the Middle East which include some of Europe’s finest luxury hotels ”

Inside the Coin department store in Rome

In another European luxury sector, the week was dominated by talk of consolidations. Borletti Group’s chairman Maurizio Borletti admitted that he was an interested bidder for the Italian premium department store chain Coin, which has been on an upmarket trajectory in recent years and is expected to go up for sale in a few months time. The sale would bring Coin under the same umbrella as Borletti’s Italian department store chain La Rinascente chain and his French chain Printemps.

But M&A; chatter didn’t stop there. Across the channel, Selfridges Group, (a subsidiary of Wittington Investments which owns department store chains Holt Renfrew in Canada and Brown Thomas in Ireland) announced that it will buy Holland’s upscale department store chain De Bijenkorf from Maxeda Retail Group. Several observers are wondering if this is the beginning of an acquisition spree across Europe by Galen Weston, the billionaire philanthropist and chairman of the firm which owns these department store chains.

The word ‘consolidation’ was also on the mind of auto industry analysts this week, as they digested the statement made by Fiat’s CEO, Sergio Marchionne, who said that in order to consolidate Chrysler Group, he may sell the Italian conglomerate’s stake in Ferrari. For several weeks, speculation has been rife that Volkswagen’s supervisory board chairman Ferdinand Piech was making overtures to Marchionne to acquire Fiat’s luxury auto unit which includes Ferrari and Alfa Romeo. Equally, analysts are excited over the interview that Fisker Automotive’s CEO recently gave about an IPO for the luxury plug-in hybrid electric car manufacturer.