Oliver Petcu, managing partner of CPP Management Consultants Ltd examines consumer behaviour in emerging markets against an evolving political backdrop.

Oliver Petcu, managing partner of CPP Management Consultants Ltd examines consumer behaviour in emerging markets against an evolving political backdrop.

Oliver Petcu, managing partner of CPP Management Consultants Ltd, examines consumer behaviour in emerging markets against an evolving political backdrop.

Consumers of luxury products and services, especially in emerging markets, are becoming increasingly selective in how they allocate their spending budgets. They not only spend less but are also becoming more aware of the price / quality ratio. Another important defining criteria in purchases of luxury goods is the investment aspect of the product. Consumers are looking at non seasonal and durable products, hence the success of the classic brands which have never compromised on the quality of their products. There is an increased awareness of raw materials, with consumers paying attention not only to their quality but also to the standard of processing.

And these are just some of the changes in consumer behaviour brought about by the international crisis, some of these changes being applicable at an international scale, some are specific to certain geographical areas. For instance, in the mature markets of Asia such as Japan, Hong Kong and Singapore, luxury consumers are more and more influenced by the ‘’shame factor’’. Consumers have become ashamed to display their wealth by wearing luxury brands and that is why, on the major luxury shopping streets, one could notice how more and more consumers are careful to carry mass market brands shopping bags, along with those of major luxury brands.

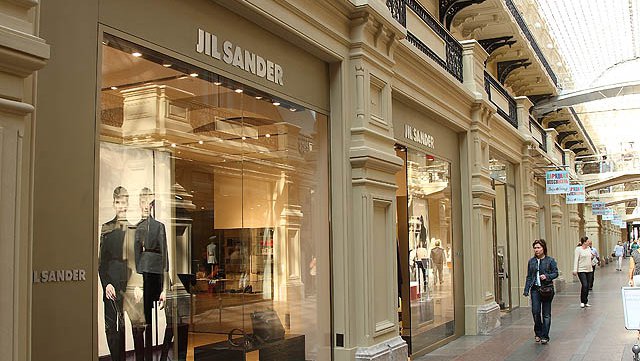

In Eastern European markets, including Russia and Ukraine, luxury consumers are becoming more discreet about their shopping sprees, bringing less attention to themselves. This is indirectly given by the crisis, as wealthy consumers in these markets are the primary targets of local authorities when it comes to showcasing tax evasion and frauds. One such resounding example is Bulgaria, where the government has run an extensive media campaign in 2009 publically exposing tens of luxury cars registration cases, for which owners intentionally avoided paying the governmental taxes. Far from proving efficient, such measures have eventually become media tools for governments to express their socialist policies, especially during the ongoing international crisis.

Another such example is being provided recently by Romania, which is about to re-introduce the additional taxation of luxury goods which it had withdrawn earlier this year at the request of the E.U. which ruled these measures as illegal under European legislation. From June, Romania is likely to see increases of up to 20% in fragrances, cosmetics and jewellery (except wedding rings) and over 50% for furs and rare leathers. The hardest hit will be guns and hunting weapons retailers, as the prices of their products will increase by 100% because of the new taxation. These measure are very unlikely to bring additional revenues for the Romanian Government which is desperately seeking to counter the effects of the current international crisis. Instead, these measure will likely result in stimulating the already growing grey and black markets, which have reached alarming levels in many sectors especially in alcohol / spirits and tobacco. The positive side of these measures is presented by the populist or rather socialist image they convey, showing Government as caring more for the poor by attacking the rich.

“ …in the mature markets of Asia such as Japan, Hong Kong and Singapore, luxury consumers are more and more influenced by the ‘shame factor’ ”

There are, however, trends of changes in luxury consumer behaviour which have an international applicability. One such trends is the so called ‘’mix and match’‘. If before the crisis, wearing a Zara shirt with an Hermes bag was seen as fashionable and trendy, the current crisis has made mix and match as a defining trace of consumer behaviour. It is no longer regarded especially fashionable to mix and match and consumers are adopting this as an essential part of their shopping habits. The mix and match trend is nowadays being reflected differently, in two directions, one which is ’’anti-luxury’’ and the second being ’’vintage’’. While the ‘’anti luxury’’ trend is more embraced by consumers in mature markets, especially in Western Europe and the U.S.A, the ’’vintage’’ trend has been gaining ground in emerging markets.

Another important change in the luxury consumer behaviour has been happening in hospitality. Wealthy consumers are no longer driven by the fame and notoriety of the hotel brand or its reputation, but rather by pricing and also the way they allocate both their leisure and corporate travel budgets. Many luxury consumers nowadays would prefer to take a shopping weekend to Milan, Paris or New York but would rather allocate the most important part of their budget to the actual spending including entertainment such as restaurants, cafes, bars etc. Some are downgrading, going for a lower category hotel and some are downgrading in the room categories. Wealthy consumers who used to be loyal suite guests are now staying the standard rooms. As for corporate, it is more and more regarded as unacceptable for a company CEO to pick a luxury hotel brand for a business trip, especially considering the current crisis. These will prove to be long term challenges which top luxury hotels will find hard to tackle, especially considering the fact that any compromise they might be tempted to make, especially in service, will result in an immediate downgrading.

Oliver Petcu, managing partner of CPP Management Consultants Ltd