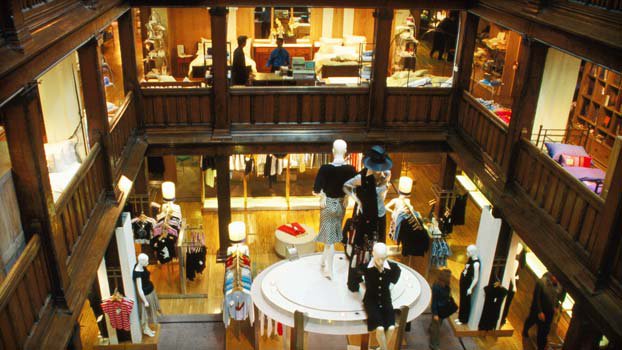

Retailers including Liberty’s and Harrods are leveraging their brand value as they launch their own fashion labels.

Retailers including Liberty’s and Harrods are leveraging their brand value as they launch their own fashion labels.

Following its recent sale to Qatar Holding LLC for $2.3 billion, the iconic London department store, Harrods is planning to open an in-store shop selling Harrods-branded clothing and accessories by 2012. General merchandise manager Jason Broderick revealed that the range of men’s clothing and accessories will be positioned as an alternative to brands like Brioni Roman Style SpA, the Italian maker of $5,000 suits. Broderick believes that private-label fashion is “a growing part of our business with huge potential.”

The model seems to have worked for Saks whose re-launched men’s collection is set to become the New York retailer’s largest menswear brand, according to Thomas Ott, Saks senior vice president of menswear. The theory is that by leveraging the image of the stores themselves and slightly undercutting the main luxury brands, or eclipsing those who have lost their sense of identity, they can appeal to a broader base of more price sensitive, post-recession consumers. “The recession seemed to reset everyone’s expectations as to price point, bringing it back into reality,” said Liberty’s buying director Ed Burstell. But lower price points do not mean inferior product or branding. Product, packaging and promotion have all been stepped up such that “They don’t look like private labels anymore,” said Ciccoli, a former partner at consulting firm Bain & Co. “they’re more like real brands.”

Liberty, another iconic London retailer is pushing the idea even further with plans to distribute their own Spring Summer 2011 men’s clothing line, unveiled at Milan fashion week last week, in competitors’ stores as well.

Big retailers like these have the advantage of carefully positioning their own brand alongside their buy to give customers a great range of options. “Our private label business is complementary rather than strategic,” says Alberto Baldan, managing director of Milan-based retailer Rinascente Spa, whose private label accounts for 20% of revenue. Moreover, department stores also have the upper hand in ensuring that their brand is serving a unique consumer purpose, or “white space” within the store. Ott has also taken a gradual approach at Saks “Each season we edit our portfolio of resources and instead of filling with only other new brands, some of these dollars and floor space have gone to our own collection.” Moreover, by pulling in new customers with a new, exclusive line department stores can also hope to capitalise on their custom in other product areas.

Sources

Bloomberg