As the boundaries between new and pre-owned luxury watches continue to blur, Watchfinder & Co. CEO Arjen van de Vall is witnessing a fundamental shift in how consumers – particularly younger generations – approach luxury timepiece ownership and investment.

While traditional watchmakers focus on crafting complications, the pre-owned market has been quietly reshaping the industry. Buying a second-hand Rolex or Patek Philippe has shifted from a niche collector’s activity to a mainstream retail channel that influences how consumers approach luxury watch ownership.

The numbers support this transformation. According to Deloitte’s Swiss Watch Industry Insights 2024, the pre-owned watch market growth continues to outpace the primary market, with projections indicating the secondary and primary markets will reach similar sizes within the next decade.

This represents a broader change in luxury consumption patterns. Provenance now carries weight alongside prestige, with digitally-fluent consumers establishing new expectations for how luxury goods are bought, sold, and valued.

Arjen van de Vall, CEO of Watchfinder & Co., one of the world’s leading pre-owned luxury watch retailers, has observed this evolution from the centre of the market. Speaking on The Luxury Society Podcast, van de Vall discusses operating in an environment where the distinction between “new” and “pre-owned” matters less to consumers, and where establishing trust has become essential to successful luxury watch retail.

The Digital Native Revolution and Changing Behaviours

The pre-owned luxury watch market is experiencing a generational shift that’s transforming how timepieces are researched, purchased, and valued. “I think that especially younger age groups, they’re much more used to using online to investigate and [research] before making a purchase decision. Typically, they are very well informed. That’s a different dynamic where it’s not just about the purchase – it is also about having an understanding of the Maison, of the heritage,” says Van de Vall.

Younger generations are demonstrating stronger engagement with luxury watches, with recent industry surveys revealing that consumers aged 18-24 show the highest interest levels – 36% own or are considering purchasing a luxury watch, according to Chrono24’s market analysis. At the same time, Gen Z consumers demonstrate high spending power, with Watchfinder & Co.’s 2024 survey revealing they’re willing to spend an average of USD $10,870 on luxury timepieces – nearly double what millennials typically invest (USD $5,325).

The pre-owned market has become particularly attractive to younger buyers. Van de Vall notes: “Younger generations see less of an obstacle in buying pre-owned, and this [extends beyond] hard luxury and watches [to include] accessories, handbags, and fashion as well.” This comfort with pre-owned luxury stems from broader sustainability concerns and financial pragmatism that defines their purchasing philosophy.

Credit: AMORE

Crucially, younger consumers increasingly view luxury watches as investment assets. According to Watchfinder & Co.’s 2024 UK market report, 45% of consumers under 20 consider luxury watches solid financial investments, with over 80% of Gen Z buyers purchasing through the pre-owned market.

Market Resilience and Brand Performance

This investment-driven approach has created new dynamics in brand performance, where market resilience depends on a brand’s ability to maintain value appreciation over time. Despite broader economic headwinds affecting luxury markets, certain brands are demonstrating remarkable strength in the pre-owned space, benefiting directly from this shift in consumer mindset.

Van de Vall highlights brands that exemplify this resilience: “Two brands that we’ve seen real strong growth with are Omega – and it’s really been over pronounced, in terms of their growth – [and] a second one is Cartier.”

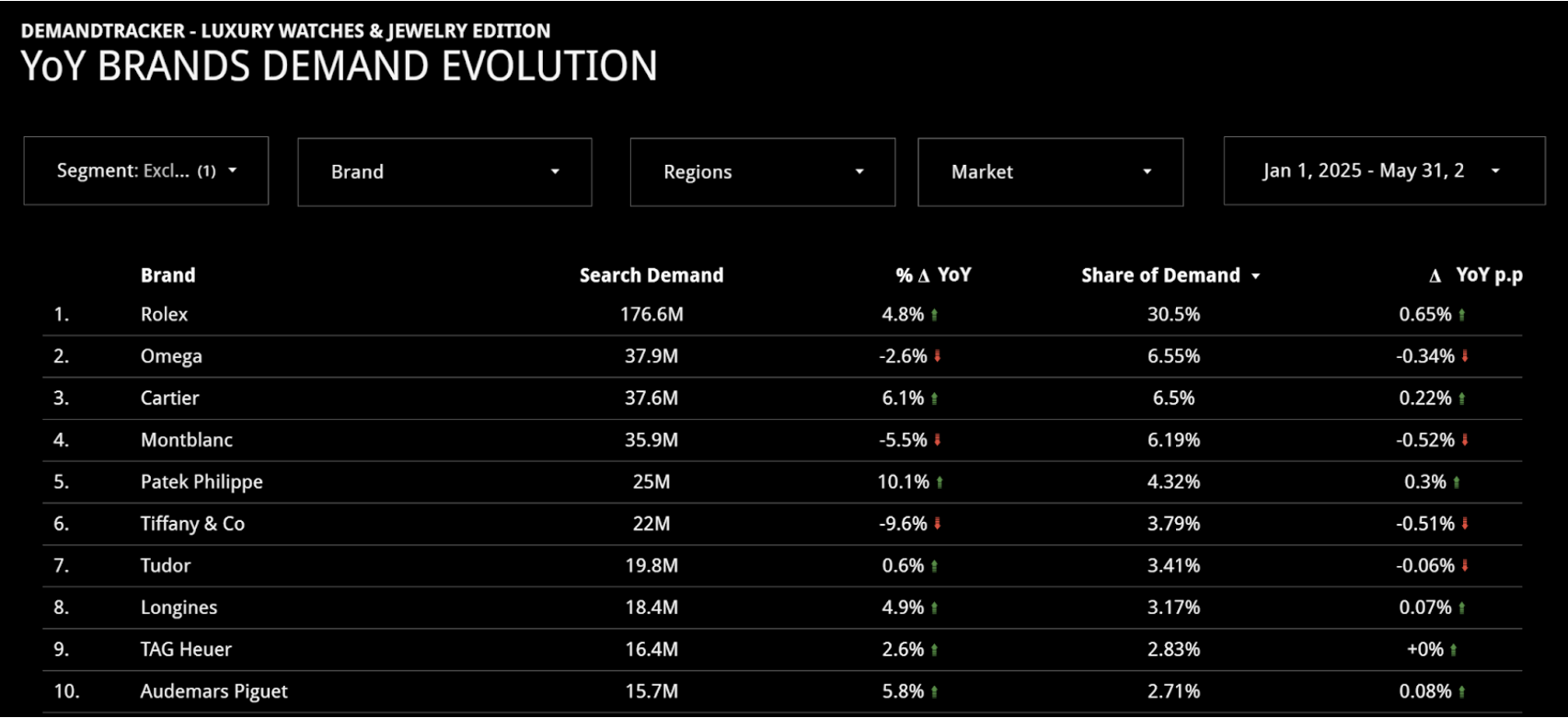

Based on DLG’s proprietary DemandTracker tool, Omega and Cartier ranked second and third, respectively, in terms of overall search demand in the first half of 2025, across 64 markets tracked. Cartier, in particular, saw a 6.1% increase in search demand from January to May 2025 YoY, with demand growing double digits in nearly all markets, coinciding with the launch of its 2025 heritage-focused novelties at Watches & Wonders 2025. Some significant gains were also observed in India (+40% YoY, due to intensified advertising efforts in the market) and the US (+10% YoY, driven largely by an efficient Mother’s Day campaign focusing on drive-to-store).

Credit: Cartier

“It is worth noting that the top five brands in terms of search volumes account for approximately 55% of total searches in the luxury watches and jewellery segment, with Rolex being in a league of its own, generating 30% of the demand,” says Benjamin Dubuc, DLG’s Partner & Innovation Director.

Notably, according to DLG’s DemandTracker tool, Rolex tops the charts in terms of search volumes globally, and its gap with other brands is widening. Rolex generated 4.7x more searches than second-place Omega within the first half of 2025.

Credit: DLG

Among the brand’s most searched watches are: the Submariner, which accounted for a third of Rolex search demand from January to May 2025; the Oyster Perpetual, which comprises another third; while the rest is split across the Explorer and other popular collections.

Notably, the brand’s Land-Dweller collection – its first new line in 13 years under the impulsion of CEO Jean-Frédéric Dufour – has also contributed to increasing overall desirability. The collection has been generating a large amount of search interest online, with over 2.9M searches between March and June 2025, resulting in an overall 8.4% YoY increase for the brand. For context, search volumes for the Land-Dweller alone are comparable to search volumes generated by entire brands during the same period, including Franck Muller (2.4M, at -3% YoY), Jaeger-LeCoultre (3.4M, at +2% YoY), and Vacheron Constantin (3.7M, at +17.6% YoY).

“I would say that what drives the pre-owned industry and the new industry is still sports watches,” says van de Vall. That said, consumer demand is not impervious to macroeconomic pressures, with van de Vall noting price sensitivity at the higher tiers (roughly USD $34,000 and above) of late.

“I think that people are probably a little bit more risk averse in the willingness to invest at really the highest price segment,” he adds. “We see that steel is doing very well, [but] precious metals is a bit all over the place. [And] we see less appetite than what we would’ve seen closer to peak.”

The Growing Counterfeit Challenge

Growing consumer demand for luxury watches, paired with increasing price sensitivity, has also created the perfect storm for one of the pre-owned market’s fast-growing challenge: counterfeits.

The landscape has also evolved dramatically. “Probably seven, eight years ago, 80% of the fake watches that we got, they were terrible. 20% were good. Now it’s completely reversed. 80% of those watches are actually good – as far as fakes can be good – and 20% are terrible,” says van de Vall.

The scale represents a significant industry challenge, he adds, with “40 million counterfeit watches sold globally each year” generating “roughly, $1 billion” in profits. The Federation of the Swiss Watch Industry estimates that counterfeit watch production significantly exceeds legitimate Swiss watch manufacturing, with fake timepieces representing a substantial portion of all counterfeit merchandise sold globally.

For Watchfinder & Co., counterfeits represent “less than 2% of the stock that is offered to [them],” though van de Vall acknowledges this isn’t “representative of the size of the problem” across the broader market. The company’s rigorous authentication process has become a competitive advantage in an environment where trust has become paramount.

This challenge is driving significant innovation in authentication technology. For example, brands like Vacheron Constantin and Breitling have implemented blockchain solutions to confirm their watches’ origins and combat counterfeits by providing each watch with a unique, unchangeable digital identity that ensures traceability and authenticity throughout its lifecycle.

The Way Forward: Certified Pre-Owned

As the industry continues to deal with the threat of counterfeits on brand equity, certified pre-owned programmes have emerged as an interesting counter-measure. This is being accelerated by brands themselves entering the certified pre-owned (CPO) space. “We’ve been very fortunate that we’ve been able to develop a pilot with Cartier, in certified pre-owned last November,” adds van de Vall.

Such partnerships represent a crucial shift, with 36% of luxury watch brands now investing in CPO platforms, according to Deloitte. Leading manufactures have moved decisively: Rolex launched its CPO programme in 2022 in Europe; Vacheron Constantin established its worldwide CPO programme in 2024 with Watchfinder & Co.; and most recently, Breitling introduced its CPO initiative with Bucherer in 2025.

The market’s willingness to pay premiums demonstrates CPO’s value. According to a Morgan Stanley & WatchCharts report, Rolex Certified Pre-Owned watches command a premium of approximately 30% more than non-certified models, with data showing global Rolex CPO sales reaching $300 million in 2024, up from $90 million in 2023.

Credit: Rolex

Most significantly, the distinction between new and pre-owned retail experiences is starting to blur. In March 2025, Watches of Switzerland Group notably launched its four-storey Rolex flagship on Bond Street in London that put brand new, and CPO watches, all for sale within the same space.

In an earlier episode of the podcast, CEO Brian Duffy also noted that “the biggest cohort of [Rolex CPO buyers] are people who are coming in [to the store], not knowing the market conditions,” and choosing to skip the queue for brand new pieces in favour of pre-owned.

“We very clearly see that the lines from a client perspective are actually blurring between both,” says van de Vall.

Tradition and Innovation

As the luxury watch industry navigates the balance between tradition and innovation, generational shifts will continue accelerating digital-first retail experiences, while successful certified pre-owned programmes will prompt more brands to develop official secondary market strategies, further legitimising the pre-owned space.

In a market where digital natives demand increasing transparency and authenticity, brands will need to embrace new standards of verification and customer engagement.

As van de Vall aptly sums it up: “We sell watches – but first and foremost, what we sell is trust.”

__________________________

To discover more about Watches of Switzerland Group and its Rolex CPO offering, read our interview with CEO Brian Duffy, or listen to the podcast interview available on Apple, Spotify, and other major podcast platforms.

Listen to the full interview with Arjen van de Vall on Episode 9 of The Luxury Society Podcast on Apple, Spotify, and other major podcast platforms.

Subscribe to The Luxury Society Podcast to receive notifications about new episodes featuring luxury industry leaders. Never miss an episode as we continue exploring the themes shaping the future of luxury.