The luxury industry’s first comprehensive AI survey reveals a sector at a crossroads. The majority of executives agree adoption cannot be delayed, yet data fragmentation and talent gaps threaten to separate winners from laggards in the race toward transformation.

The luxury industry has long prided itself on resisting technological disruption in favour of heritage and human craftsmanship. Yet artificial intelligence is forcing an unprecedented reckoning. Nearly one in three luxury executives now report that AI has become integral to their operations – a striking shift for an industry built on the irreplaceable human touch.

This transformation is far from uniform. The findings from The State of AI in Luxury – the first comprehensive research examining how luxury decision-makers approach AI adoption – reveal a sector increasingly divided between aggressive adopters and cautious observers. Conducted by DLG (Digital Luxury Group) in partnership with Europa Star, the study surveyed over 250 luxury executives, with over 55% holding C-suite or senior positions and over 60% wielding significant influence over AI investment decisions.

The AI Divide

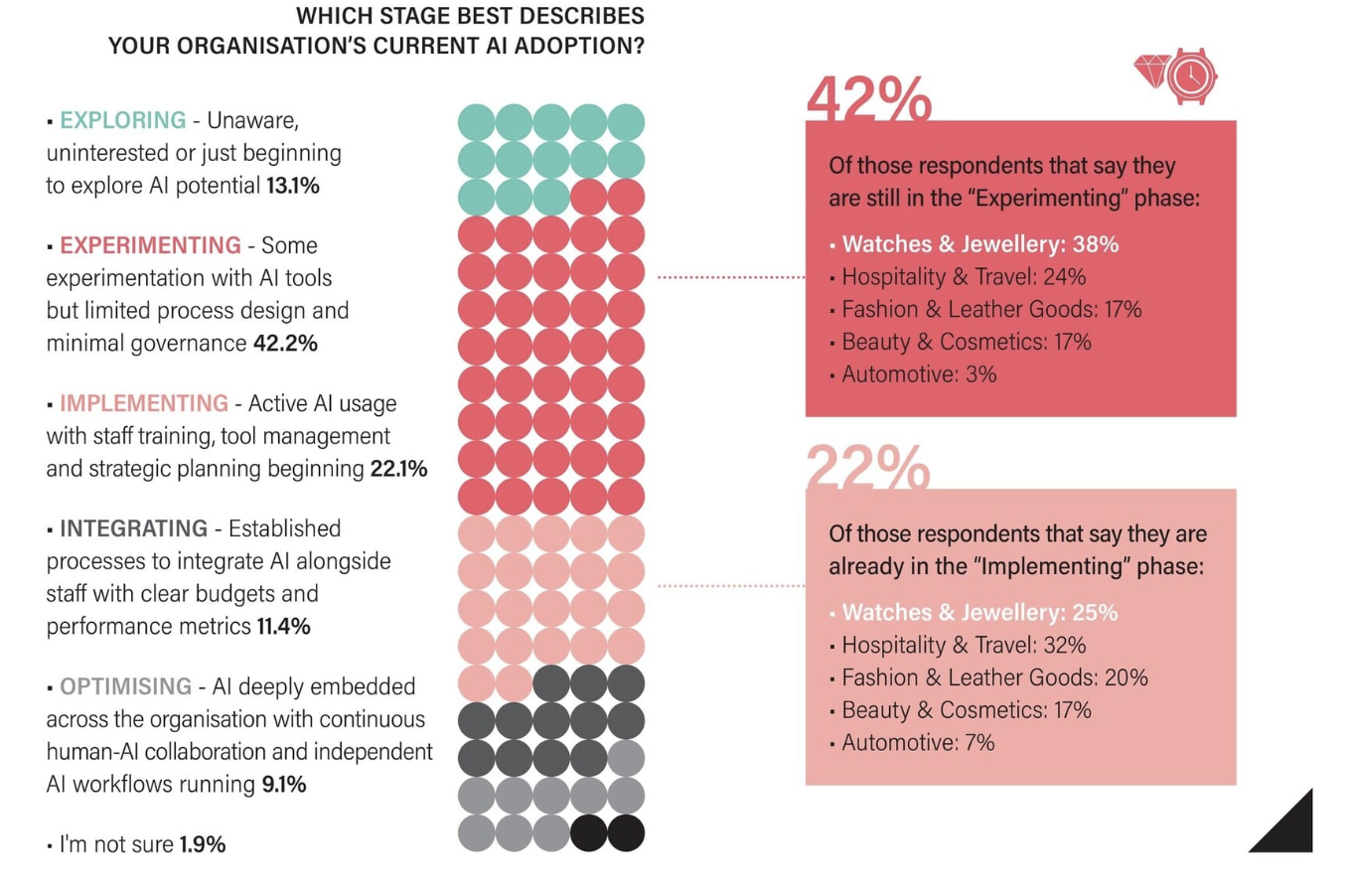

The luxury industry has reached a decisive moment in its relationship with artificial intelligence. Whilst 71% of executives acknowledge that AI adoption cannot be delayed, a telling paradox has emerged: nearly half the sector remains trapped in what might best be described as “pilot purgatory”. Some 42% of luxury brands are still in an experimentation bottleneck, unable to move beyond pilot programmes, while their more decisive competitors race ahead. This hesitation carries significant risk, as the 43% who have progressed to implementation, integration, and optimisation phases are already establishing advantages that will prove increasingly difficult to replicate as time stretches on. The window for strategic positioning is narrowing, and the costs of delayed action are steepening in an increasingly AI-native marketplace.

What distinguishes this transformation from previous technological shifts is its compressed timeline within the industry. Nearly one in three luxury executives report that AI is already woven into the fabric of their organisations, with an additional 43% expecting full integration within the next year. This isn’t gradual evolution; it’s fundamental reshaping occurring with alacrity.

The inflection point facing luxury brands demands recognition that AI adoption is no longer about technological capability alone, but about organisational readiness and strategic courage. The 55% still in early-stage adoption must confront an uncomfortable truth: experimentation without implementation creates the illusion of progress whilst delivering none of its benefits.

The Challenges Are Not Just Technical, But Human

Data fragmentation emerges as the single greatest technical barrier to AI adoption, cited by 37% of luxury executives – and for good reason. Luxury brands operate across complex ecosystems where customer information resides in scattered silos: point-of-sale systems capture transaction data, CRM platforms hold clienteling notes, e-commerce sites track digital behaviour, and marketing automation tools store campaign interactions. This fragmented landscape creates inconsistent formats, missing information, and disconnected customer views that fundamentally undermine AI’s potential.

Without unified, high-quality data foundations, even the most sophisticated AI models produce unreliable outputs. The challenge is compounded by legacy systems that weren’t designed for interoperability and regional operations that maintain their own data standards. Technology infrastructure limitations, reported by about 19% of executives, further constrain efforts to consolidate these scattered sources into the coherent datasets that effective AI requires.

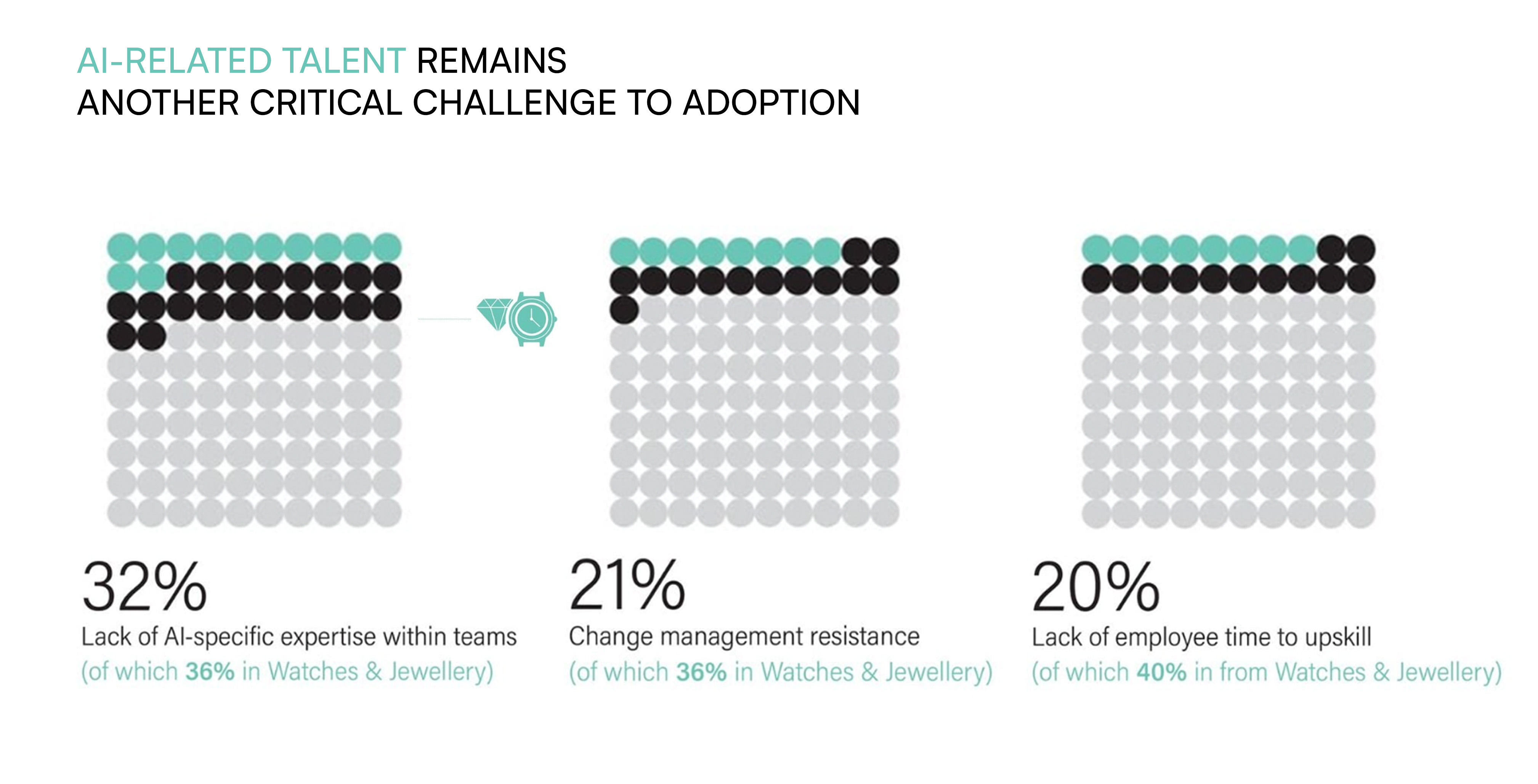

Beyond data, talent represents the next most significant barrier to AI adoption, but the challenge facing luxury is distinctly unique. 32% of executives identify this skills gap as a primary obstacle. However, the core issue likely isn’t a simple lack of technical expertise but a shortage of hybrid talent – individuals who can bridge information technology with the nuanced, qualitative world of brand equity. At the same time, around 21% cite change management resistance as a barrier, indicating deep-seated cultural friction between data-driven futures and organisational cultures built on heritage and human craftsmanship.

This challenge is compounded by the fact that approximately 20% identify a lack of employee time to upskill, symptomatic of an industry running at a relentless pace. This creates a critical bottleneck: organisations lack internal expertise, face cultural resistance from teams fearing AI’s impact on their craft, and remain too operationally focused to invest in strategic learning. As these pressures converge, AI fluency will likely emerge as a defining competitive differentiator, separating brands that successfully maintain their human essence whilst scaling through technology from those that lose their soul in pursuit of efficiency or their relevance through inaction.

Consumer Insights: AI’s Most Compelling Promise

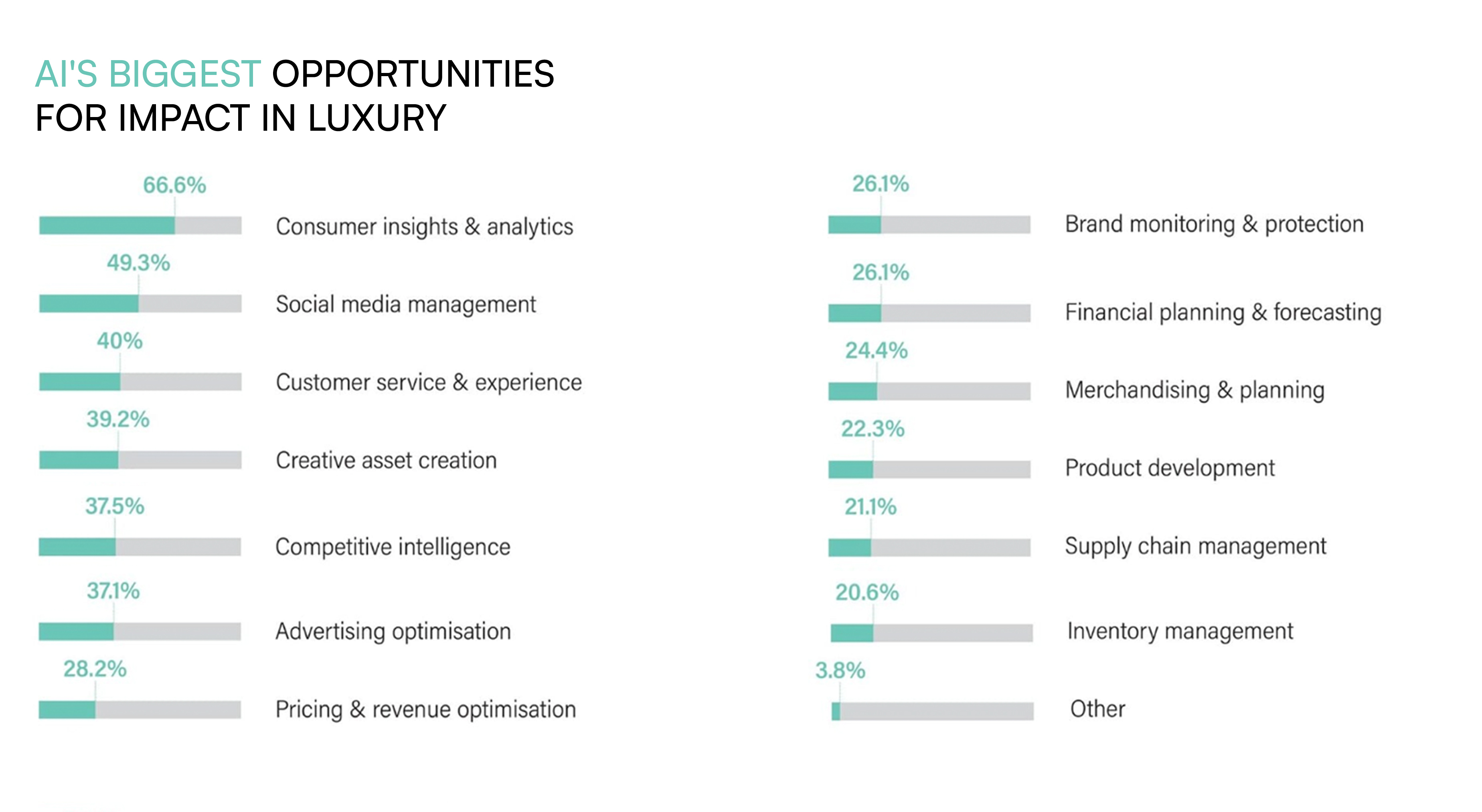

Over 66% of executives cited consumer insights as AI’s top opportunity, revealing a fundamental truth about luxury’s current predicament. Today’s luxury consumer moves fluidly across digital channels, social platforms, multiple markets, and various touchpoints, leaving fragmented data trails that no single human can synthesise. AI offers the only viable path to reconstructing this scattered intelligence into unified client profiles, enabling brands to deliver the personalised attention that defines luxury service, but at the scale demanded by global, omnichannel operations. This isn’t about replacing human intuition with algorithms; it’s about equipping brand ambassadors with a comprehensive understanding previously impossible across dispersed customer journeys.

On top of that, executives also recognise AI’s potential across social media management (49%) and creative asset creation (39%), indicating that luxury’s AI ambitions extend beyond understanding customers to engaging them more effectively and producing content at the velocity modern platforms demand. Yet none of these applications approach the priority accorded to consumer insights, underscoring that knowing your client remains the foundation upon which all other marketing and creative efforts must build.

The luxury industry’s AI transformation represents more than a technological upgrade – it’s a fundamental test of strategic vision and organisational courage. As the gap widens between aggressive adopters and cautious observers, brands face a stark choice: invest decisively in AI capabilities now, or risk permanent disadvantage as competitors establish a head start in consumer understanding, operational efficiency, and creativity.

Access a preview of The State of AI in Luxury report by completing the form below, or request for the full report.