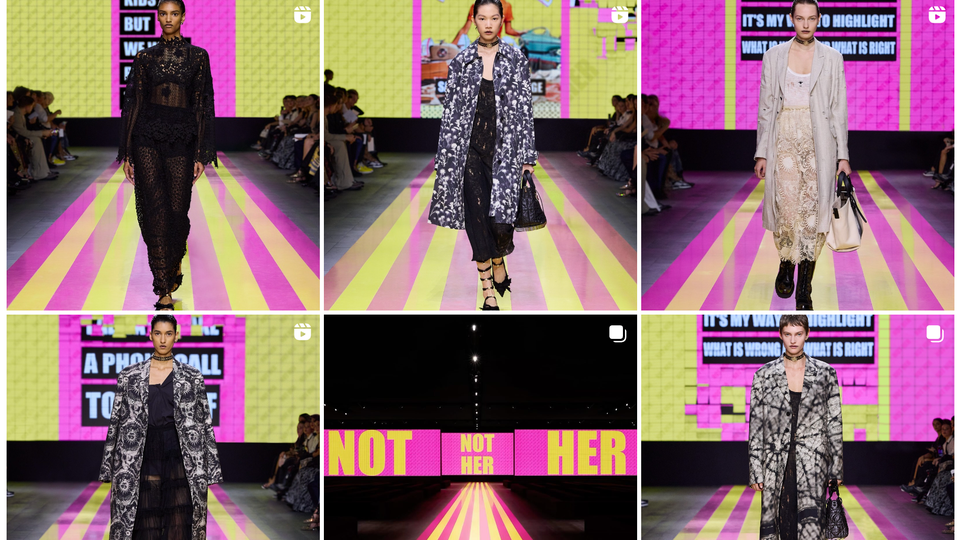

Across the globe, the fashion industry is embracing a new dynamic. Between the opening up of once private shows to a larger audience, to the prevalence of live video, to the rise of influencers, and more recently the discussion of “on demand” fashion, it’s easy to see how fashion is going through big changes. And nowhere was this more evident than at the recent 2017 Spring/Summer shows across world.

From Live-Streaming to VR, Brands Capture Attention of China’s Digital Fashionistas

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

Across the globe, the fashion industry is embracing a new dynamic. Between the opening up of once private shows to a larger audience, to the prevalence of live video, to the rise of influencers, and more recently the discussion of “on demand” fashion, it’s easy to see how fashion is going through big changes. And nowhere was this more evident than at the recent 2017 Spring/Summer shows across world.

For a Chinese audience, who may be physically removed from the activities happening in Europe and the US, social and digital media is the way to stay in the know on the latest runway trends.

Interested to know which brands captured the most attention from a Chinese digital-savvy audience, Digital Luxury Group (parent company to Luxury Society) and simplyBrand, one of China’s leading social listening companies, decided to investigate the here and now of Fashion Week: Which fashion brands performed well? What strategies did they adopt? What are the latest trends that we can expect to see more of in the future?

Why Fashion Week?

Hosted twice a year and most recently in mid-October, International Fashion Week sees industry elite descend on the four major fashion capitals of the world, New York, London, Paris and Milan. Satellite fashion cities across the globe also hold concurrent events, including Shanghai Fashion Week now in its 14th year, attempting to build on the city’s fashion-forward reputation.

International and local brands; fashion houses and independent designers; digital innovators and social media strategists, these weeks are a hotbed for outside-the-box thinking centered chiefly on the inextricable relationship between influencers (better known as Key Opinion Leaders or KOLs in China), brands and social media used to tap into the lucrative Chinese consumer market.

"98% of posts came from Weibo, versus merely 2% on WeChat"

Loewe Leads

Over the years, social media has forced brands to dramatically revamp their PR and marketing strategies to best connect with consumers; the new power-holders.

After analyzing more than 65,000 posts on WeChat and Weibo over the course of the four major international fashion weeks, the stand out brand performer was identified as fashion house Loewe. Far in the lead with a phenomenal 2.39% share of voice of all fashion week related conversations, Loewe was followed by Burberry (0.93%) and Coach (0.46%).

What made Loewe, a name not usually associated in the same leagues as Gucci or Marc Jacobs, capture such a substantial share of voice during this critical moment? Loewe’s strategy heralds the effectiveness of the simple approach of using a key influencer to attract a specific audience’s attention.

Loewe invited actress, model, and K-pop sensation Song Qian (English name Victoria Song) who has an audience of 22 million on Weibo alone. Victoria is fast-becoming one of China’s major breakout stars; splitting her time between China and Korea as her fan base widens across the ocean. Dressed to a tee in the latest from Loewe, Victoria shared her looks on Weibo from Paris Fashion Week, and attracted a huge number of interactions – with nearly 790,000 engagements (made up by more than 630,000 shares, 120,000 likes and 30,000 comments).

Song Qian's post for Loewe helped to solidify the brand as most mentioned at PFW

When considering the most effective platform to communicate on as part of a brands social marketing strategy, we see that during Fashion Week a massive 98% of posts came from Weibo, versus merely 2% on WeChat. This phenomenon clearly demonstrates the public and open aspect of the Weibo platform in comparison to WeChat’s design as a private communication tool.

Celebrities & Influencers Rule the Fashion Week Buzz

Taking a look at the buzzword mentions on Weibo, KOLs took the vast majority of top positions, with reference to Chinese male actors Kris Wu and Li Yifeng dominating. The most frequently mentioned brands (top-placed Loewe and Burberry) fell below many KOLs, reiterating the need for brands to collaborate with top KOLs in order to get a larger reach.

Brands are increasingly recognizing the marketing power celebrity KOLs have across a broad range of industries. Sina Entertainment solidified their positioning as Weibo’s leading lifestyle media outlet, cleverly capturing and posting famed actress Fan BingBing kitted in black as she departs Beijing airport for Paris to attend Fashion Week. We saw FashionModels, a popular content aggregator that pulls fashion news from multiple sources, hit the nail on the head with their post proudly broadcasting the expertise of local Chinese fashion designer Heaven Gaia on the Paris Fashion Week runway. Both posts attracted around 30,000 engagements, the majority of interactions hailing from likes.

WeChat interactions marked significantly lower than Weibo, reiterating WeChat’s usage primarily as an internal communication tool. Although when comparing like-for-like on the WeChat platform, there was one KOL that deserves particular mention. Gogoboi’s article praising China’s wonderful actresses held more than 2,400 likes. His post received 140% more interactions than second-placed article from media aggregator “她刊” that accumulated 1,000 for their post about 45-year-old actress Faye Yu looking stunning in a simple, white shirt.

An Even Closer Relationship

This year we saw evidence of an even closer relationship between fashion brands and KOLs through the form of live broadcasting and entrusting Weibo account management.

Live broadcasting allows KOLs to truly let fans enter their world. Actresses Fan BingBing and Jin Chen welcomed audiences on their drive to Fashion Week, sharing insights on the stunning clothing they’d donned and their flawless makeup tips, before turning the camera to the runway for a “front row seat”. Use of live broadcasting platforms, such as 花椒直播(Huajiao Shenbo) and 一直播 (Yizhenbo), is becoming more and more popular, and the fight to become the number one application is a very real one.

Fan BingBing, ELLE and Yoka used live broadcasting applications to take audiences backstage at NYFW and PFW

Another newbie idea we saw was at Milan Fashion Week with brands handing over Weibo account reigns to KOLs. Giving the posts that added level of intimacy, Dolce & Gabanna gave Zhuang Huiwen the chance to interact with fans and write three articles, resulting in more than 50,000 interactions.

Zhuang Huiwen collaborates with Dolce & Gabanna to over their Weibo account at MFW and gains more than 50,000 interactions

Now. Now. Now.

One of the most exciting developments seen this Fashion Week was roll out of the concept “See now. Buy now.”

Traditionally, fashion-forwards have had to wait 6-months to see runway items on shop racks. Brands exhibit their fashion collections for future seasons bi-annually at Fashion Week events both to build hype and best calculate manufacturing volume based on forecast needs.

The spur for change is two-fold; seizing opportunity and countering competition. Enormous opportunity lies in capturing the impulses of potential consumers watching live Fashion Week coverage or interacting on social media. Similarly, competition from fast-fashion brands such as Zara and H&M; has increased significantly, delivering runway-inspired lines just a few weeks after Fashion Week and at a much cheaper price.

Heralded as a new era in fashion retail, “See Now. Buy Now.” was taken to a whole another level by Tommy Hilfiger at the New York Fashion Week. Not just a runway show, the event was an experience in itself. Hosted outdoor along New York’s Pier 16, renamed ‘Tommy Pier’, guests were invited to ride a ferris wheel, indulge in hot dogs and burgers from food stands and bide temptation of saying ‘yes’ to a real-life tattoo at Bert Krak’s tattoo parlour. The runway show featured along the length of the pier and the collection could be purchased immediately using interactive touch-screens at the Tommy X Gigi pop-up shops located throughout the venue.

Tommy Hilfiger and Gigi Hadid at end of the NYFW show that embraced the new “See Now. Buy Now.” trend

Locally, luxury retailer Lane Crawford sees potential with the “See Now. Buy Now.” concept, viewing it to coincide with, not diminish, their current calendar for its stores in China. What is an exciting time for both consumers and brands of the now generation, presents enormous challenge for smaller and newer fashion designers. Their ability to deliver on the “See Now. Buy Now.” shopping experience is extremely limited primarily due to unclear market demand and non-lean manufacturing turnaround. Furthermore, thoughtful consideration to fashion trends takes time and effort that will halt the complete elimination of a long runway-to-retail lead time.

VR. AR. Design-R.

The rise of virtual reality (VR) and augmented reality (AR) is loud and clear in fashion. First tasted in 2014 with Topshop recording its fall runway show to make available to in stores just three days after the event, VR was at the forefront this year at the New York and London Fashion Weeks.

Taking a few steps back, the preface for keen adoption of AR/VR in fashion rides primarily on the challenges experienced by today’s digitally-savvy consumer and a brand’s attempt to counter this with opportunity. Take, for example, the proliferation of e-commerce, which gives online shoppers the ability to purchase goods from across the globe but removes the ‘touch and feel’ shopping experience of traditional brick and mortar. This lack of sensual arousal is most felt in fashion. Fashionista’s are unable to try on garments for size and match, with studies suggesting between 20% and 40% of items returned. Not only a headache for consumers, subsuming expenses associated with return items is extremely costly for businesses.

Bringing this back to Fashion Week. The event is known for being extremely exclusive, targeting attendance only from top industry professionals, a-class celebrities and media representatives. This year Intel, Voke and Samsung partnered to combine their unique VR technologies and join the launch of New York Fashion Week with designer Tom Ford. Transporting audiences from their couches to the runway, the 360 degree experience was focused on providing wonderful aesthetics, thus giving fans unprecedented access to the exclusive event. In return, brands receive rich consumer insights to further develop and refine their marketing strategies.

Locally, Alibaba is investing heavily in these technological developments, recently combining VR and “See Now. Buy Now” tactics in the lead-up to this year’s 11.11 Singles’ Day. Just last week, Alibaba’s Tmall hosted an eight-hour live fashion show streamed via Tmall, Youku and Taobao, inviting viewers to pre-order items on show in real-time ahead of November 11th. Hosts coined the event as “fifth world fashion week”, with fans welcomed by appearances from fashion industry elite and live performances by popular singers like Mandopop star Khalil Fong. The company has also recently launched its Buy + VR service, where customers are carried into the virtual stores of select retail partners, such as Macy’s and Matsumoto Kiyoshi.

Last week, Tmall hosted the "fifth global fashion week" ahead of Singles' Day and leveraged VR such as the "See Now. Buy Now."tactics

So Now What?

SS 2017 International Fashion Week was a melting pot of the here and now for brands’ digital marketing strategies. The most successful campaigns were from brands that embraced KOLs in their marketing strategies, took their KOL-brand relationships to the next level and adapted technology advancements in e-commerce and VR/AR to the fashion industry.

It’s all good and well to partner with KOLs or adopt the newest technologies with the goal of increasing and brand or product’s exposure, but it’s imperative these tactics do not detract from ensuring the brand/product remain at the heart of the conversation. When choosing to work with a KOL, it’s important not only to consider how many other brands they are endorsing (e.g. are they promoting five other shows in a day, or only yours?), but also how these brands are reflected against your own. Are these brands classified as direct competition, on-the-fence or even complementary to your product?

The best way to overcome these hurdles is to build a close working relationship with KOLs. Involving KOLs in the marketing strategy development process, rather than just asking them to repost, increases likelihood of exciting and relevant perspectives that can be further leveraged through new technologies like VR and live broadcasting. At the end of the day, fashion brands know the age-old marketing concept still stands: quality versus quantity.

—————

If you liked this article, read more about the latest trends in digital and luxury fashion and China with “Coach’s Tmall Shop Closes as Luxury Brands Turn to WeChat Sales” and “4 Trends Defining the Industry of Chinese Outbound Tourism & Shopping”.

Partner and Managing Director, China, Luxury Society

Pablo Mauron is the Managing Director at Digital Luxury Group China. Based in Shanghai since 2012, his team successfully manages 360° digital and consulting projects for major luxury brands.