4 Trends Defining the Industry of Chinese Outbound Tourism & Shopping

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

It is no secret that the popularity of overseas travel is growing in China. All of the indicators, such as the growing number of passports and travel visas issued for Chinese tourists, have been in the green for some time. With a growing demand for experiences, wealthy Chinese and the growing middle class, are spending more and more on travels.

Fully aware of this trend, the travel and retail industries have been developing a whole range of strategies tapping into this growing interest. From honeymoon tours to graduation holidays, from intensive sightseeing programs, to personalized shopping trips, most of the destinations are now competing in order to influence both the travel and the purchase intentions of their target audience.

The Chinese National Holidays, also known as Golden Week, taking place now from October 1st to October 7th crystalize over 7 days all of the above and represent the most important milestone after the Chinese New Year in terms of number of Chinese travelers. With this in mind, Digital Luxury Group partnered with simplyBrand to analyze the online buzz on Sina Weibo, WeChat, and leading travel sites such as Ctrip, Qunar, and Tuniu to uncover what Chinese travelers are discussing. Based on an analysis of over 83,721 spontaneous messages posted online, we found some noteworthy insights:

South Korea and Japan In – Hong Kong Out

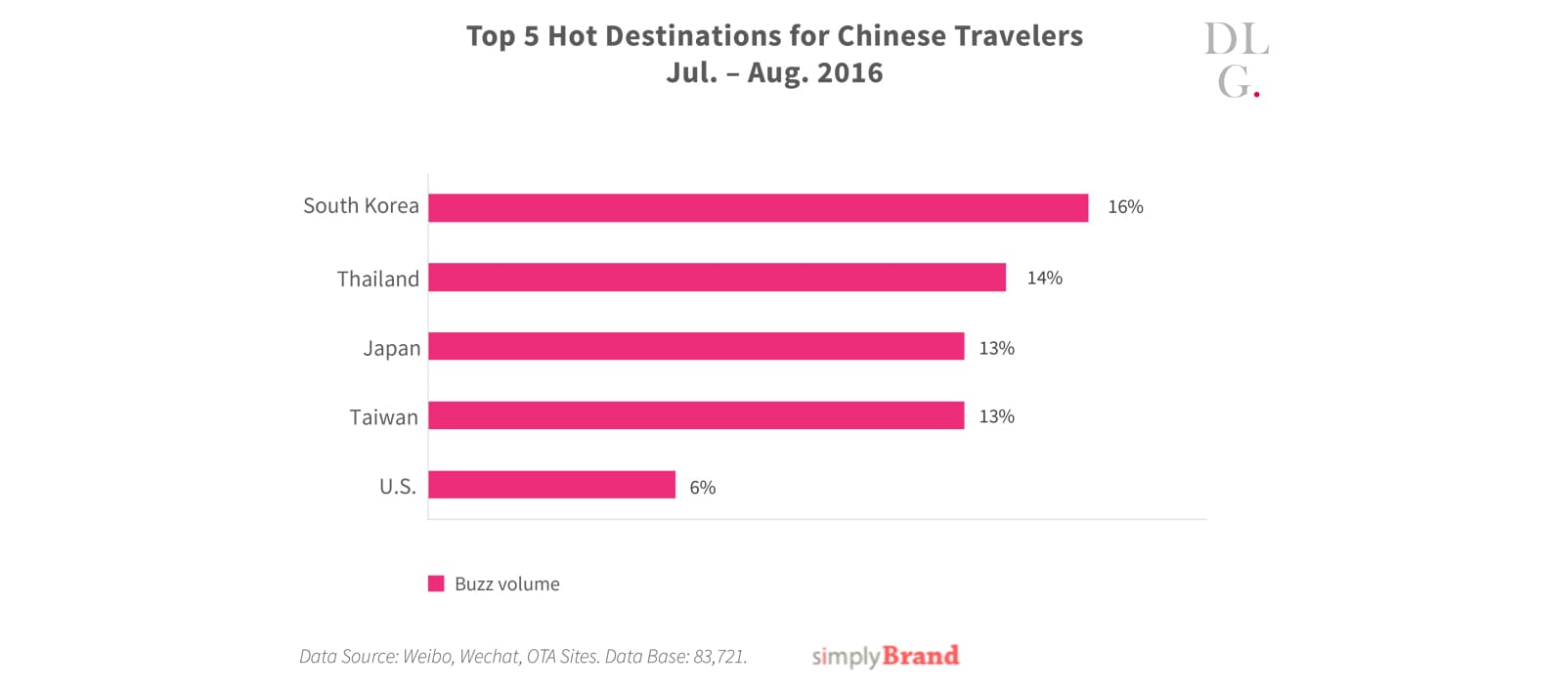

The trend that has been observed for some time is confirmed. Hong Kong didn’t even make it in the top 5 of the most discussed destinations:

South Korea and Japan are the big winners for short trips and remain favored destinations. It clearly appears that popular destinations are now winning over Hong Kong because they can offer more than just attractive retail prices. Japan with its rich history and culture, South Korea a go-to trendsetter for China when it comes to entertainment, beauty, and more, Thailand with its stunning beaches and temples, and Taiwan with its nature and notable street food are all close destination that have a lot to offer. Hong Kong’s reputation as a travel destination has become more associated to “outlet shopping” for Chinese consumers, a concern for Hong Kong’s tourist board if it wishes to keep Chinese tourists coming back.

Luxury Shopping Remains at the Center of Travel Activities

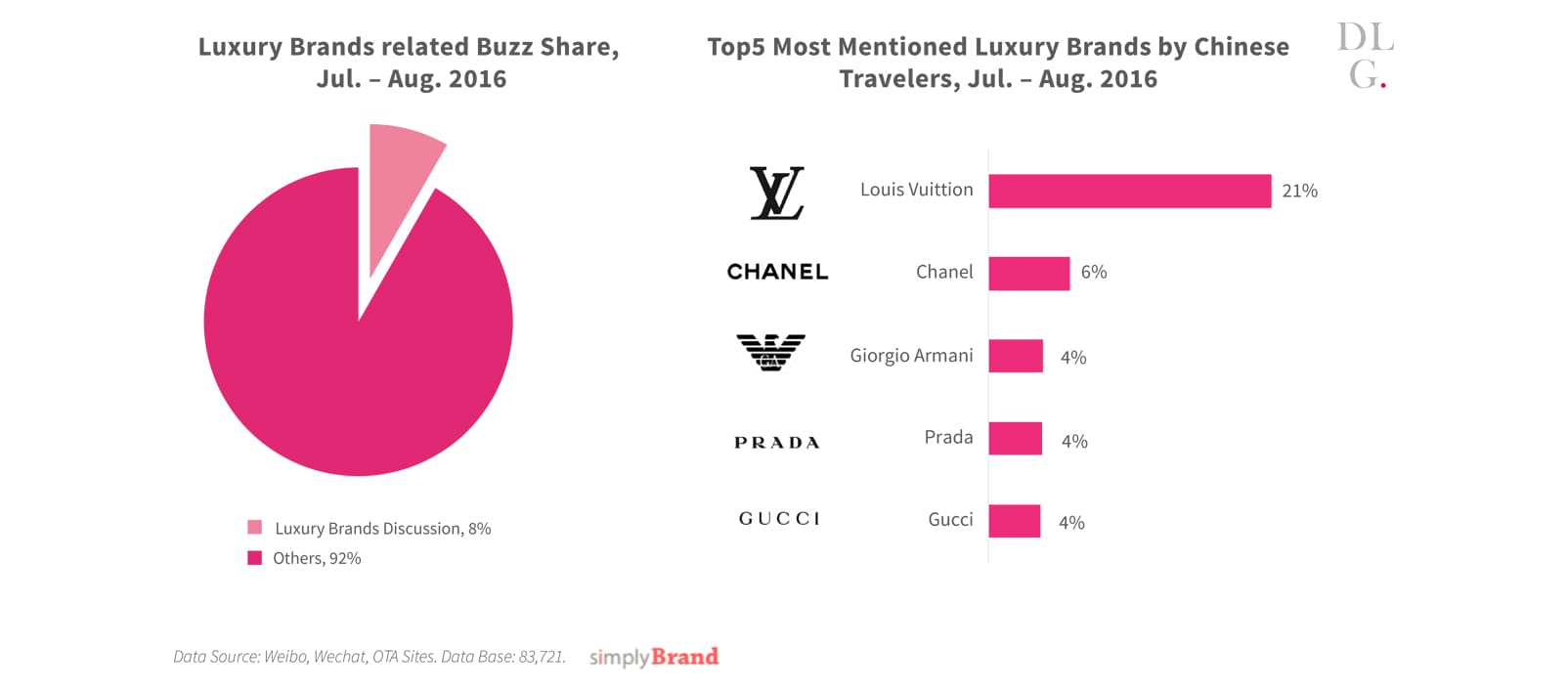

While the demand for experiential travel is growing, shopping remains a key draw, as evidenced by the monitoring of various travel discussions. In fact, 8% of the total buzz analyzed directly mentioned specific luxury brands. The most discussed brands are the grand “maisons” with Louis Vuitton (21%) coming first, followed by Chanel (6%), Giorgio Armani, Prada, and Gucci.

Analyzing more in detail the activity of these brands within that period of time, it appears that the winners were highly active during the summer months, even if that period is often considered as a “slow period” for retailers.

(Fan Bingbing spotted with Louis Vuitton luggage, generated significant buzz on Chinese social media)

As an example, Louis Vuitton collaborated with few highly popular celebrities (like Fan Bingbing and Jing Boran) to promote the LV travel suitcase, which in turn generated an enormous amount of social buzz.

Join Luxury Society to have more articles like this delivered directly to your inbox

First Tier Cities Key, But the Market Becomes More Fragmented

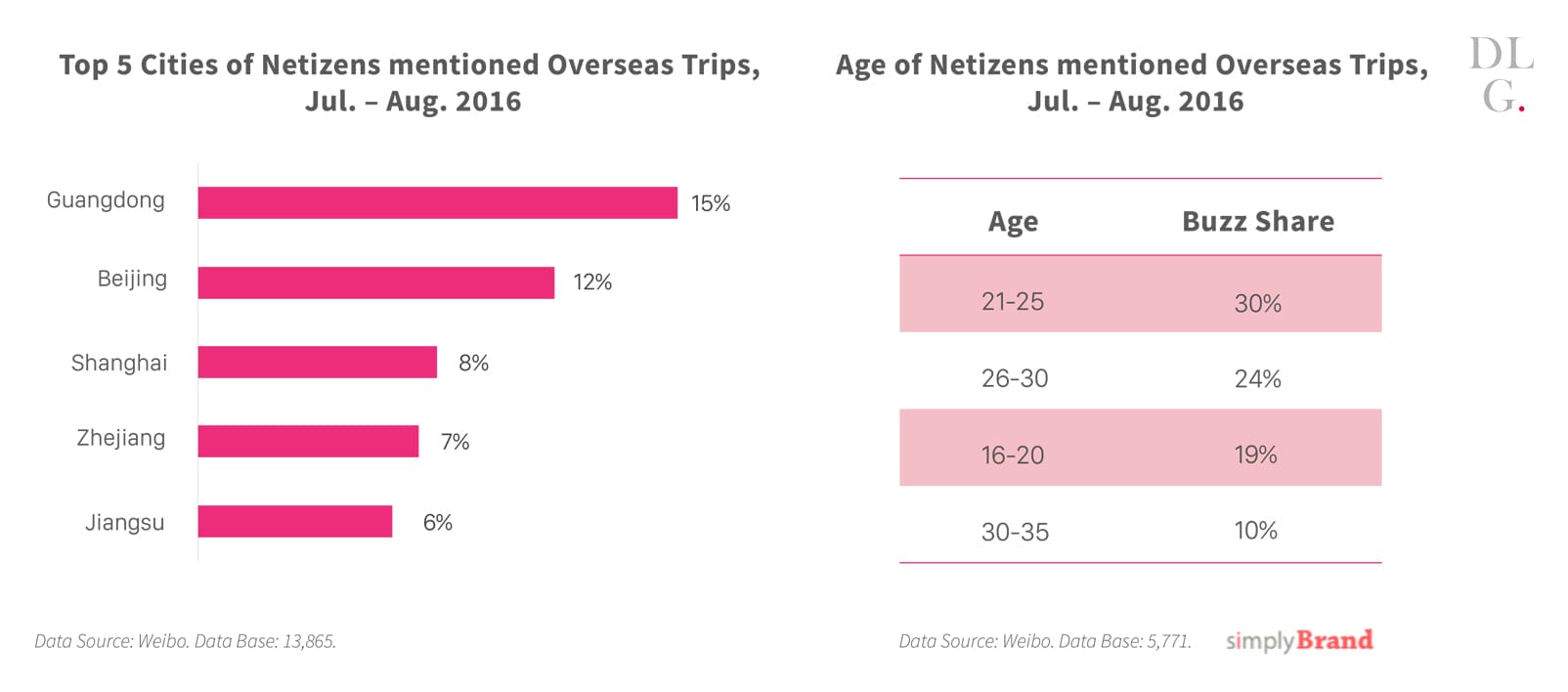

15% of the audience mentioning overseas trips were from Guangdong, which topped the city ranking, followed by Beijing, Shanghai, Zhejiang and Jiangsu. Additionally, more than half of the online users sharing online about their summer trips were between 21 and 30 years old. While it is not a surprise to see that active social media users are young, it also shows that overseas trip are not limited to a mature audience and that the spending power is already there.

Provinces like Zhejiang and Jiangsu represent a share close to their neighbor Shanghai which clearly illustrates the fact that provinces that have been considered for a long time as secondary are now playing a more important role.

Soft Luxury Over Hard Luxury

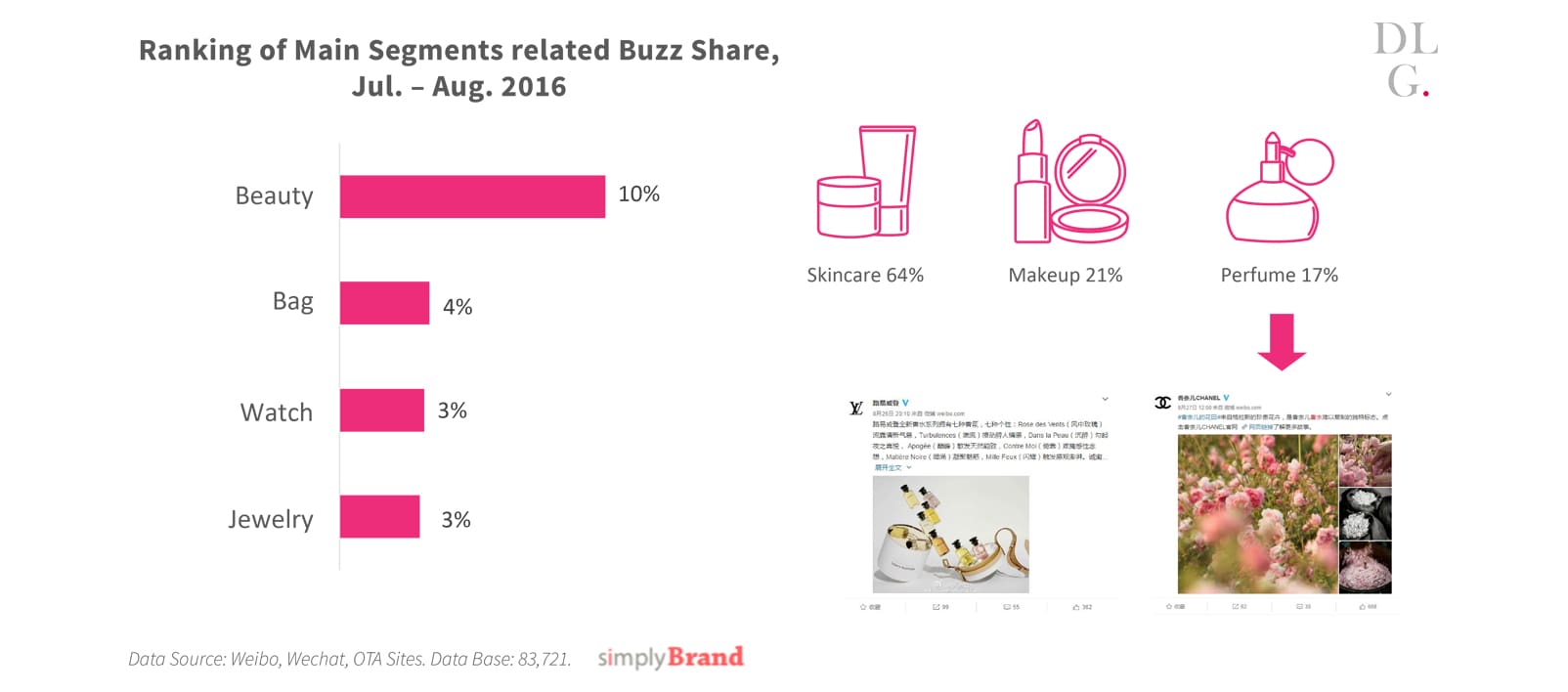

Beauty products were mentioned most, followed by handbags, watches, and then jewelry. Within the beauty category, 17% of discussions were about perfume, a segment that in the past did not particularly resonate in the Chinese market, illustrating clearly the growing “internationalization” of Chinese consumers but also the positive correlation with beauty brands communication.

Indicators are confirming the growing Westernization of Chinese travelers and this can be observed beyond the first tier cities. Travelers are now considering more destinations than in the past and their expectations have changed.

In a context where a brand’s marketing calendars are focused on supporting local retail, it clearly shows that the top places will be taken by the ones that are not afraid to invest in China to support their travel retail performance.

——

simplyBrand is a data-driven management company. simplyBrand provides solutions for the world's biggest brands and organizations looking to turn social data into insights, actions, and valuable results.

Partner and Managing Director, China, Luxury Society

Pablo Mauron is the Managing Director at Digital Luxury Group China. Based in Shanghai since 2012, his team successfully manages 360° digital and consulting projects for major luxury brands.